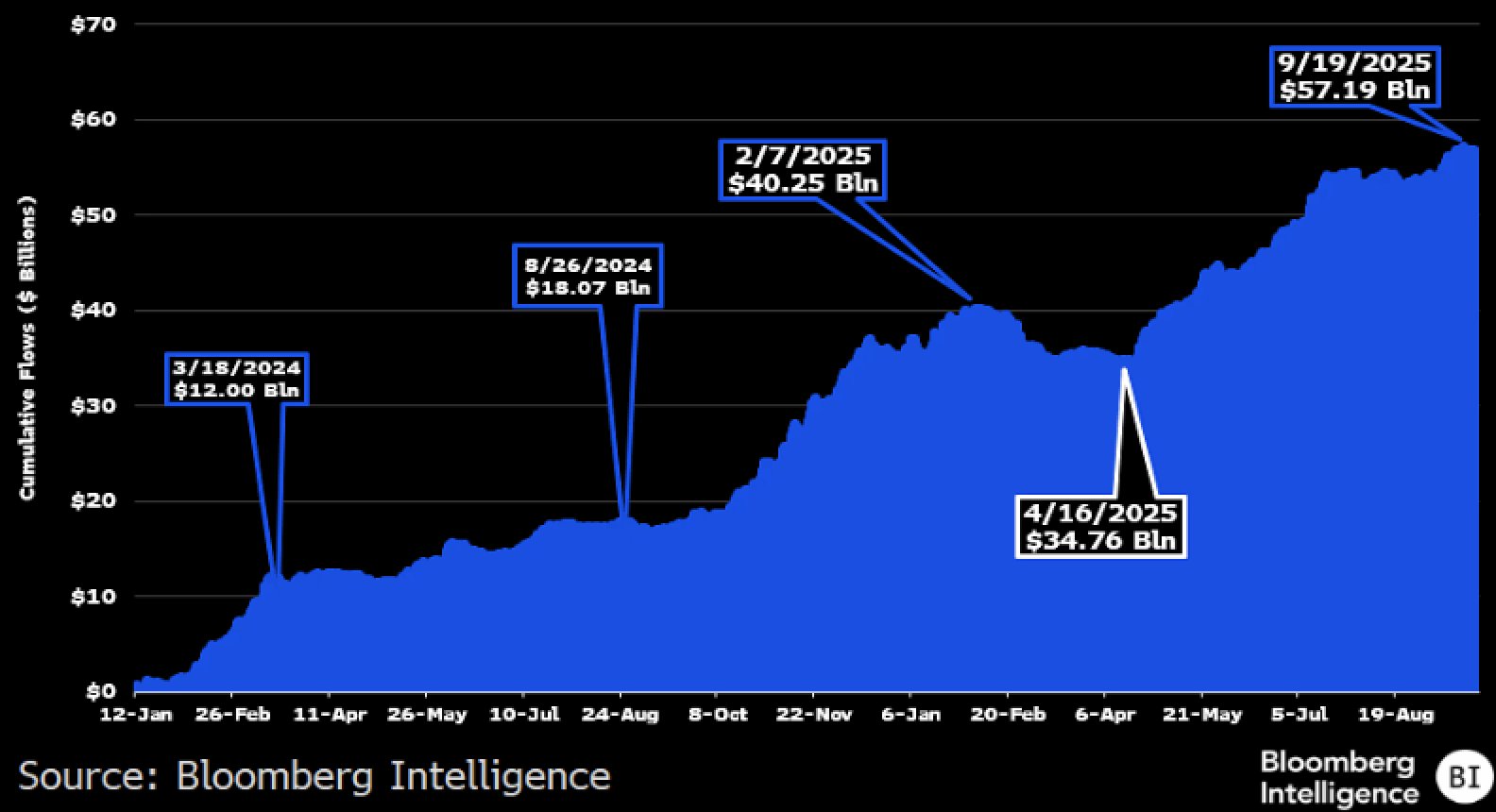

U.S. spot Bitcoin exchange-traded funds (ETFs) continued their steady expansion in the third quarter of 2025, attracting $7.8 billion in net inflows. Bloomberg senior ETF analyst Eric Balchunas highlighted this in a Tuesday post, citing data from Bloomberg Intelligence.

Bitcoin ETFs Extend Outstanding Form

Meanwhile, the impressive quarterly addition follows a stellar outing between July and September, amid increased institutional and retail interest. The month of July was Q3’s best-performing month as the 11 ETFs attracted a monthly net inflow of $6.02 billion.

The performance dipped in August, mirroring broader turbulence in the crypto market. The investment funds saw a net outflow of $751 million before the September recovery. This month, the funds have recorded a net inflow of $3.1 billion, led by the BlackRock iShares Bitcoin Trust (IBIT).

Remarkably, the total $7.8 billion for Q3 2025 brings the year-to-date (YTD) total to $21.5 billion. It also extends the U.S. Bitcoin spot ETFs’ overall inflows since inception to an impressive $57 billion.

The figures mark another sign of resilience in the maturing crypto investment landscape. Bitcoin ETFs, first introduced in the U.S. less than two years ago, have become a cornerstone for institutional and retail investors seeking regulated exposure to digital assets. Their gradual but consistent inflows suggest that, despite volatility in Bitcoin’s spot price, investor appetite remains strong.

Bitcoin’s Growth Gradual but Steady

Meanwhile, Balchunas notes that while the quarterly addition may not appear earth-shattering in comparison to Bitcoin’s trillion-dollar expectations, the steady trajectory underscores its continued adoption by traditional finance. For many investors, ETFs offer a lower-barrier, familiar way to hold Bitcoin without dealing with the complexities of private keys, custody, or direct exchange risks.

Still, enthusiasm within parts of the crypto community has been tempered by unrealistic expectations. Some critics point to voices in online forums who imagined ETF launches would bring daily inflows in the trillions. Instead, Balchunas pointed out that the reality is a more gradual pattern: two steps forward, one step back, as adoption grows in tandem with investor confidence and broader market conditions.

For now, the consistent pace of ETF inflows adds a layer of credibility to Bitcoin’s long-term investment case. Analysts suggest that as regulatory clarity improves and financial institutions deepen their integration of crypto products, the role of spot Bitcoin ETFs could expand even further.