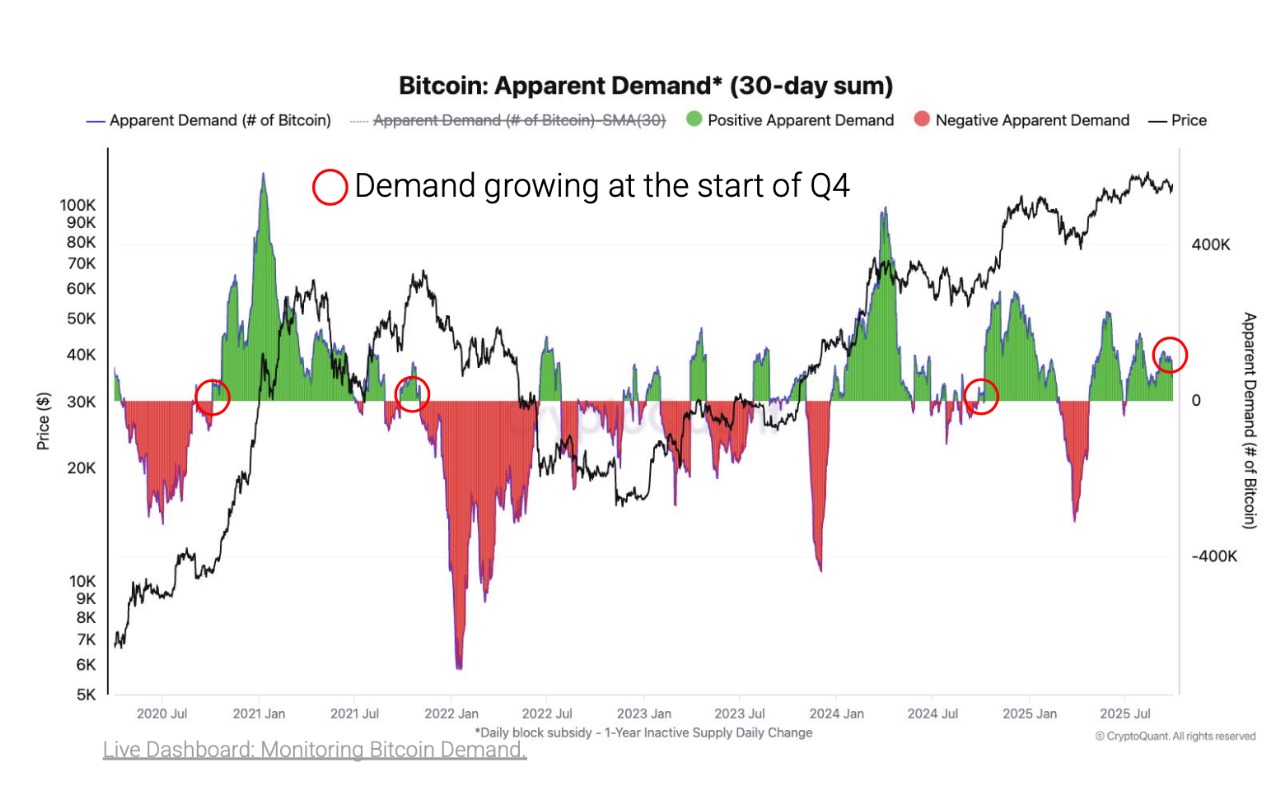

Bitcoin has entered the final quarter of 2025 under conditions that suggest another strong rally may be ahead. On-chain data from CryptoQuant shows demand has been rising steadily since July, with monthly growth exceeding 62,000 BTC.

This growth trajectory mirrors patterns seen in previous bull cycles, including the late 2020, 2021, and 2024. With sustained demand acting as a critical driver of higher valuations, the market now appears well-positioned for a potential upward surge.

Bitcoin Apparent Demand | CryptoQuant

Whales are also playing a crucial role in shaping the current market environment. Their holdings are expanding at an annual rate of 331,000 BTC, surpassing the 255,000 BTC growth recorded in Q4 2024. For context, Q1 2020 saw growth of 238,000 BTC, while 2021 even recorded a contraction. These figures highlight that large investors remain confident in Bitcoin’s long-term prospects.

Bitcoin Price Momentum Still Needed for Breakout

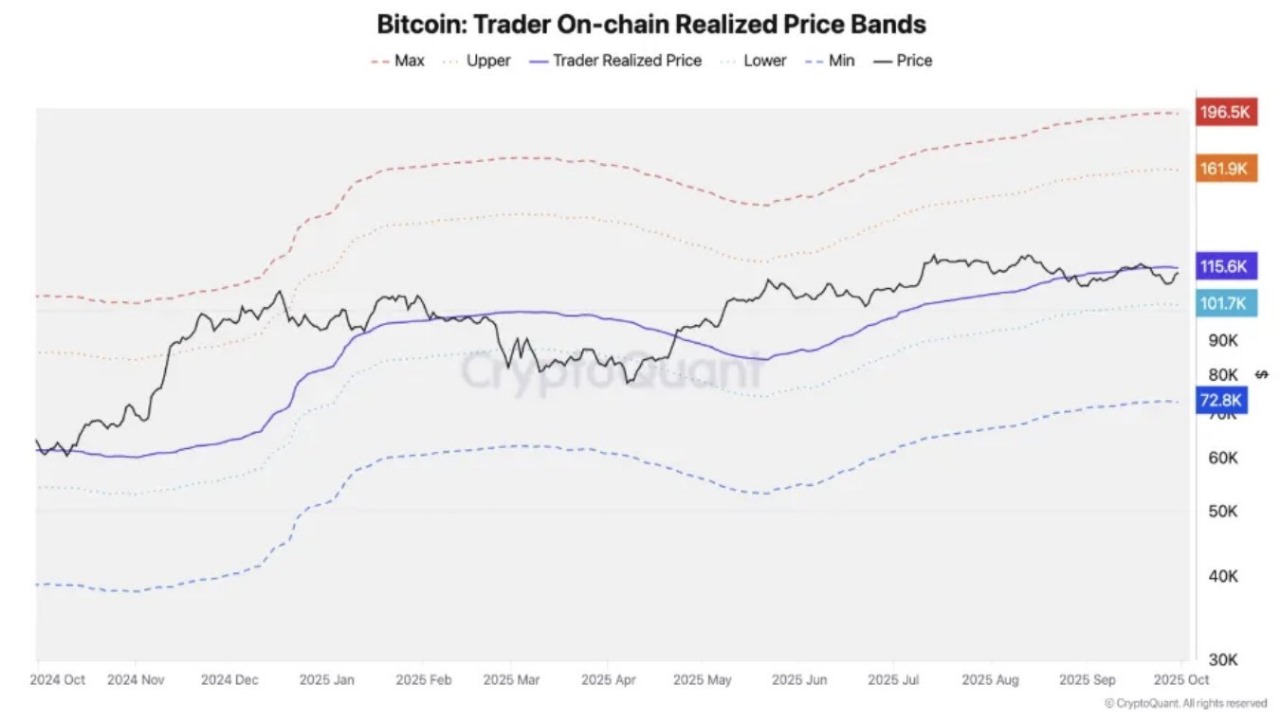

CryptoQuant emphasizes that momentum is key to fueling the next major rally. The trader’s on-chain realized price sits at $116,000, a level historically marking the transition into the “bull phase” of the market cycle. With Bitcoin now trading near $117,530, this threshold has been surpassed—signaling that conditions are in place for significant price acceleration.

In addition, historical data reinforces this setup. U.S.-listed ETFs acquired 213,000 BTC in Q4 2024, representing a 71% increase in holdings. A similar wave of activity this quarter could further fuel demand and potentially drive Bitcoin into the projected $160,000 to $200,000 range.

Indicators Point to Bullish Conditions

CryptoQuant’s Bitcoin Bull Score Index climbed to the 40–50 range by the end of Q3 2025, a level last seen before last year’s major rally. Notably, when the index surpassed 50 in late 2024, Bitcoin surged from roughly $70,000 to nearly $100,000.

Several factors underpin this bullish outlook. Expanding stablecoin liquidity could inject fresh capital into the market, while reduced unrealized trader gains are easing selling pressure. At the same time, rising spot demand continues to strengthen momentum. Collectively, these conditions position the market for a potentially explosive Q4.