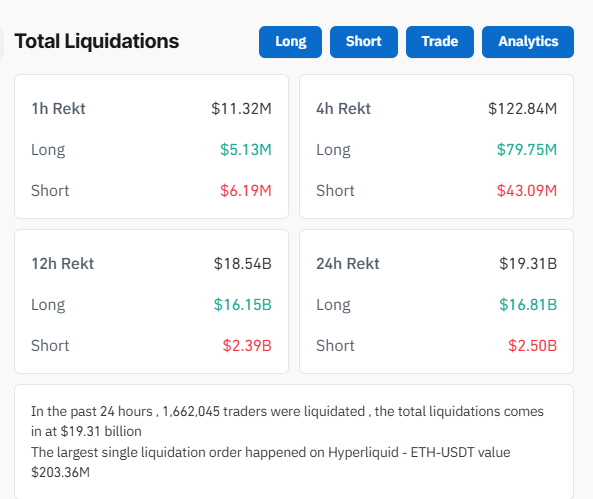

The cryptocurrency market has just suffered its largest liquidation event in history, with more than $19.31 billion in leveraged positions erased in the past 24 hours. Data from Coinglass shows that around $16.81 billion came from long positions, while $2.50 billion were shorts—a rare and brutal double-sided flush that has shaken traders across the globe.

Meanwhile, a Hyperliquid whale took a strong hit, losing a staggering $203.36 million on its Ethereum long trade. This was the largest single position liquidation recorded. In total, the wipeout affected over 1.66 million traders.

The massive liquidation came after President Donald Trump announced plans to impose an additional 100% tariff on all Chinese imports, set to take effect on November 1. The move, which effectively reignites the U.S.–China trade war, sent shockwaves through global markets and immediately sparked a rush to safety. Risk assets, including cryptocurrencies, took the most brutal hit as investors scrambled to unwind exposure in anticipation of broader economic fallout.

Traders Reeling as Bitcoin and Ethereum Volatility Surges

Bitcoin and Ethereum both plunged within hours of the news, dragging the broader crypto market deep into the red. BTC dropped to $104,000 before rebounding to $112,000, while Ethereum capsized to $3,500 and then bounced to $3,700.

Meanwhile, exchanges struggled to keep up with the torrent of forced liquidations as cascading margin calls amplified the sell-off. The broader financial markets didn’t escape unscathed either.

Equities tumbled, commodity prices swung wildly, and investors piled into cash and short-term bonds. While some traders see the liquidation as a painful but necessary reset after months of speculative excess, others fear it could mark the start of a deeper correction if trade tensions continue to escalate.

As markets digest the policy shock, all eyes are on Washington and Beijing—and on how the crypto market, still licking its wounds, will rebuild from one of the most violent unwinds in its history.