The crypto market has experienced a major shift, with over $640 million in leveraged positions liquidated in the last 24 hours. The turmoil, which has affected multiple digital assets, is part of a broader trend of market volatility driven by rising global trade tensions. The data show the major risks that leveraged trading can pose, especially during periods of heightened uncertainty.

Liquidation Breakdown and Key Market Figures

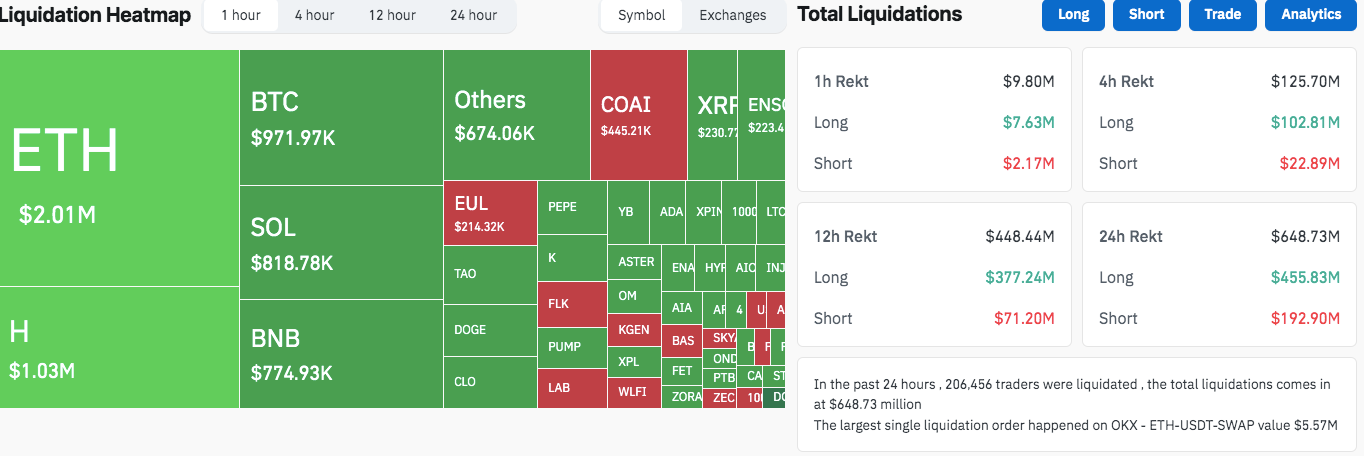

Ethereum (ETH) topped the liquidation charts with $2.01 million in liquidations over the past hour, followed by Bitcoin (BTC), which saw $971,970 in liquidations. Other cryptocurrencies, such as Solana (SOL) and Binance Coin (BNB), were also affected, with $818,780 and $774,930 in liquidations over the past hour, respectively.

In total, the crypto market recorded $648.73 million in liquidations over the past 24 hours, with long positions making up the majority of the losses. Long positions accounted for $455.83 million of the total liquidations, while short positions contributed $192.90 million. The largest single liquidation occurred on the OKX exchange, where the ETH-USDT-SWAP pair was liquidated for $5.57 million.

U.S.-China Trade Tensions and Their Impact

The recent market downturn coincided with heightened geopolitical tensions, particularly between the U.S. and China. On Friday, President Donald Trump escalated the trade conflict by threatening a 100% tariff on Chinese imports, effective November 1. While some analysts initially attributed the market crash to a price oracle malfunction, the timing of the liquidation event closely coincided with Trump’s announcement, showing a possible link between the two.

The intensification of the trade war sent shockwaves through global markets, and the crypto market followed suit. On Friday, over $19 billion in liquidations were recorded across both centralized and decentralized exchanges, making it the largest single-day liquidation event in crypto history. This massive sell-off was triggered by excessive leverage and cross-margined collateral on many exchanges, resulting in price drops for uncertain altcoins.

Signs of Recovery Amid Ongoing Market Stress

Despite the liquidation event, the crypto market has shown signs of recovery. At the time of writing, Bitcoin and Ethereum had rebounded from their Friday lows, trading at $110,150 and $3,900, respectively. However, funding rates across the market have dropped to their lowest levels since the 2022 bear market, indicating that the market is undergoing a major leverage reset.

While the market shows signs of recovery, some analysts believe the path to a full recovery depends mainly on the resolution of the U.S.-China trade tensions. If an agreement is reached, many expect the market to regain momentum, possibly setting the stage for new all-time highs.