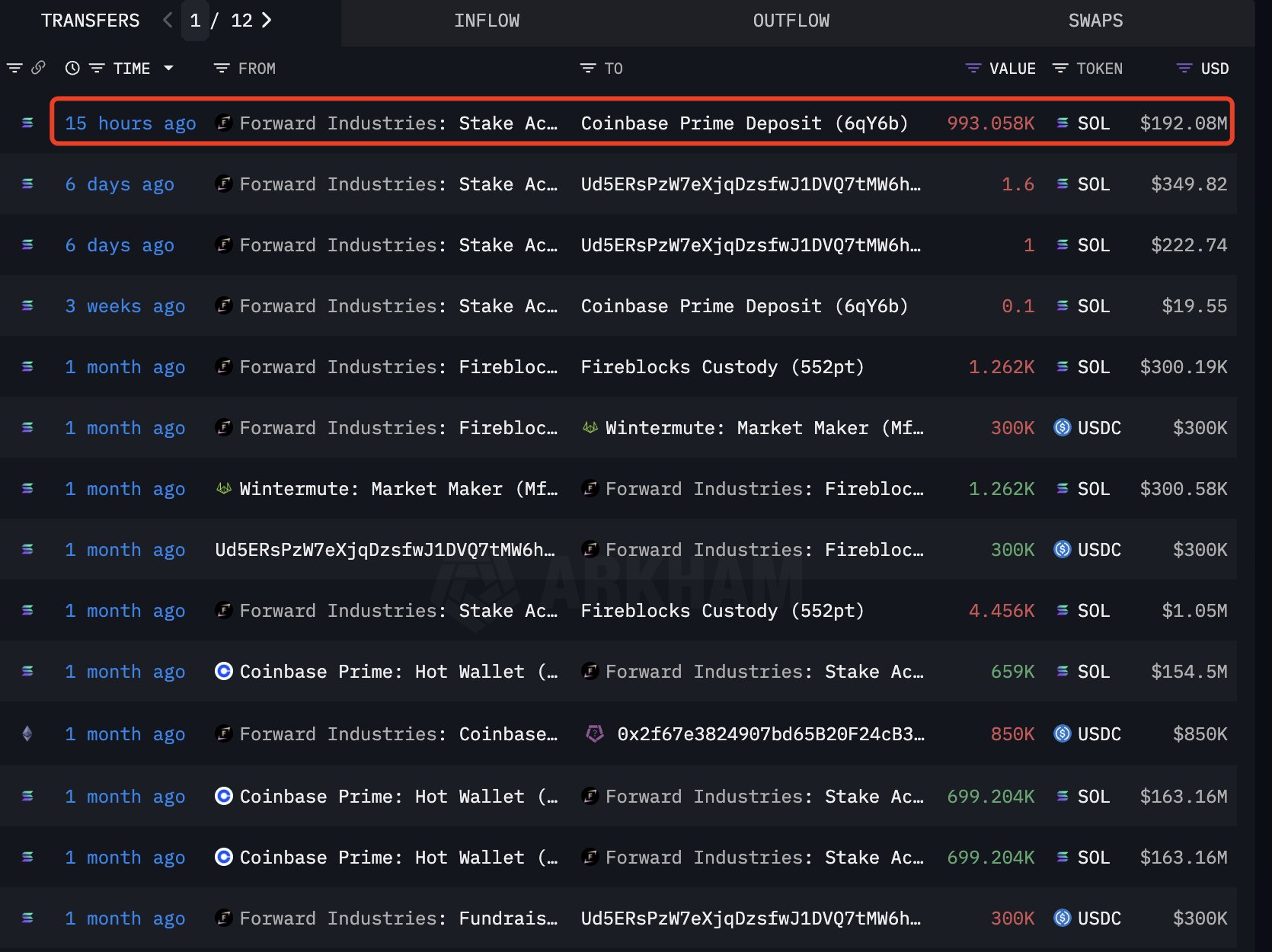

Solana (SOL) experienced large blockchain activity after Forward Industries transferred 993,058 SOL, valued at approximately $198 million, to Coinbase Prime. The large-scale movement, reported by data analytics platform Lookonchain, drew attention from market analysts monitoring institutional asset flows in the crypto market.

According to on-chain records, Forward Industries moved a total of 993,058 SOL to Coinbase Prime. Of the funds, the prominent US exchange moved 250,000 SOL ($50 million) in a separate transfer to Galaxy Digital, the investment firm founded by Mike Novogratz. Market observers have closely tracked these transactions due to their potential impact on Solana’s price and liquidity.

Notably, Forward Industries purchased 6.82 million SOL valued at $1.38 billion in September when the token traded near $232 per coin. Following the market downtrend, the firm has begun to move them at a lower price than its entry.

The loss remains unrealized at the time of writing, as it is unclear if the move was for potential sales. Meanwhile, analysts suggest the recent movements could also be related to portfolio adjustments or liquidity management, but remain speculative.

Solana Market Performance and Liquidity Conditions

As of the latest market data, Solana traded at $198.96, marking a 1.58% increase in the past 24 hours. The token’s 24-hour trading volume stood at $10.88 billion, representing a 13.59% decline compared to the previous session. Solana maintains a market capitalization of $108.77 billion, ranking sixth globally, with a circulating supply of 546.7 million SOL.

Market analysts noted that while Solana’s trading volume remains lower than average, any increase in activity could support higher price movements. Analysts view Forward Industries’ recent transactions as key indicators of institutional behavior in the market.

SEC Decision Could Shape Solana’s Next Move

The timing of Forward Industries’ transactions aligns with an expected decision by the US Securities and Exchange Commission (SEC) on pending Solana exchange-traded fund (ETF) applications. The SEC is expected to issue a ruling within 48 hours that could influence institutional participation in the token’s market.

Analysts continue to track on-chain activity to determine whether Forward Industries’ deposits represent strategic positioning ahead of regulatory developments or an adjustment of its existing Solana exposure.