Bitcoin’s recent market behavior has sparked concern among traders, with nearly $20 billion in short liquidations sitting between $110,000 and $126,000. The market has entered a phase of “bear euphoria,” according to analyst Max Crypto, as high price volatility persists despite positive statements from political figures like President Donald Trump.

Liquidation Risks as Bitcoin Fluctuates

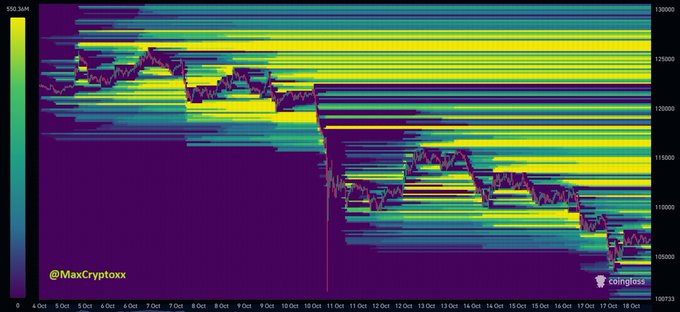

The Bitcoin market has shown a remarkable range of fluctuations in October 2025, the Bitcoin price action heatmap discloses. Traders observed heightened market movement across varying price points, especially during the early and mid-October period.

For context, price action showed major upward movements around October 5, but retracements followed subsequently, most notably between October 10 and 18. These declines may point to large-scale sell-offs or major shifts in market sentiment, as indicated by changes in the volume of trades at these levels.

The heatmap further highlighted price accumulation and distribution zones, where significant buying and selling occurred. These key levels could act as potential support and resistance in the near future, providing traders with a better understanding of market sentiment.

Meanwhile, Bitcoin trades at $107,026, up nearly 2% in the past 24 hours. With prices showing strength, a staggering $20 billion in unclaimed liquidity sits between $110,000 and $126,000.

Notably, Max Crypto emphasized that whales might hunt these price levels to claim this liquidity, potentially wiping out billions of bears. From the current market price, a rally to $110,000 and $126,000 represents a 2.8% and 18% increase, respectively.

Coinbase Premium Gap Shifts Negative

Another key indicator of Bitcoin’s market sentiment is the Coinbase Premium Gap. This metric tracks the price difference of Bitcoin between Coinbase and other exchanges, providing insights into demand.

Between October 14 and 16, the gap remained positive, showing strong demand on Coinbase relative to other platforms, with Bitcoin hovering around $114,000. However, on October 17, the premium gap turned negative, coinciding with a drop in Bitcoin’s price below $107,000.

This shift in the Coinbase Premium Gap points to a possible correction in the market, as the demand that previously existed on Coinbase weakened. The reversal from a positive to a negative gap reveals a change in trading behavior, meaning that market participants, both retail and institutional, may be pulling back, leading to downward pressure on Bitcoin prices.

While this signals bearish sentiment in the short term, there is reason to believe that Bitcoin could gradually recover. Matt Hougan stated that despite recent fluctuations, Bitcoin’s underlying fundamentals remain strong, and the market may refocus on these long-term drivers, which could support a slow recovery.