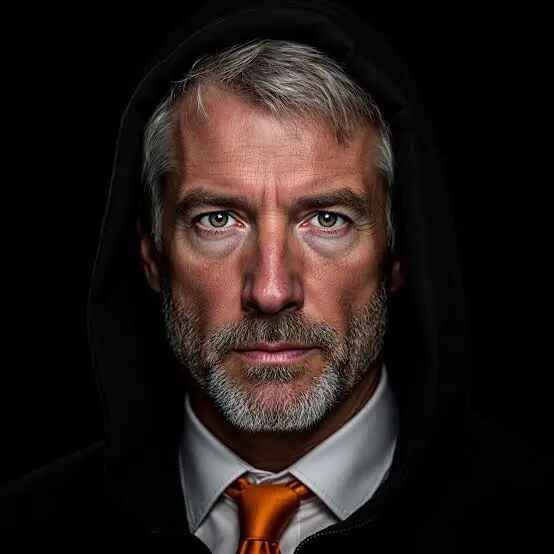

Michael Saylor, Executive Chairman of Strategy (formerly MicroStrategy), has hinted that his company may soon purchase more Bitcoin.

In a recent post on X, Saylor shared a chart titled “Saylor Bitcoin Tracker.” He captioned it, “The most important orange dot is always the next,” sparking speculation about another imminent Bitcoin acquisition.

Similar Message, New Bitcoin Purchase

Meanwhile, the statement mirrors his past cryptic posts that often preceded actual Bitcoin purchases. Saylor’s posts typically serve as subtle signals for upcoming corporate moves in cryptocurrency markets.

The most important orange dot is always the next. pic.twitter.com/N5GQOdqr6y

— Michael Saylor (@saylor) October 19, 2025

The post quickly attracted attention from the crypto community. Analysts noted that Saylor’s language echoed similar remarks before previous large acquisitions.

Notably, those announcements have historically triggered short-term optimism in Bitcoin’s price performance. Market watchers now expect Strategy to announce an increase in its holdings tomorrow, further establishing its place as the largest corporation holding Bitcoin in reserve.

Massive Strategy’s Bitcoin Holding

According to the company’s latest disclosure, Strategy holds 640,250 BTC as of October 2025. The firm’s Bitcoin stash amounts to approximately $69 million at the current market price of $107,718.

Meanwhile, the average purchase price for the company’s holdings stands at $74,000 per coin. The entry means that Strategy remains in massive profit despite the recent market volatility.

Saylor has repeatedly expressed his belief that Bitcoin is “digital gold” and the ultimate long-term store of value. He maintains that holding Bitcoin provides stronger financial security than traditional assets.

Market analysts suggest that another major purchase could further reinforce corporate confidence in Bitcoin. The firm’s continued accumulation strategy demonstrates faith in the cryptocurrency’s long-term appreciation.