Economist Peter Schiff has once again challenged Bitcoin’s legitimacy, arguing that its value rests entirely on the “belief of fools.” In a post on X, Schiff claimed that Bitcoin’s price stability depends on continuous investor confidence. He warned that once belief fades, the market collapses under its own weight, a position he has maintained throughout Bitcoin’s rise to prominence.

Meanwhile, Binance founder Changpeng Zhao (CZ) quickly countered, asserting that belief sustains all monetary systems, including gold. “Gold’s price is not derived from its industrial or utility value,” he wrote. “Just a pure belief system.”

Bitcoin vs. Gold: A Debate for the Ages

The online sparring has evolved into a formal debate. In a post on X earlier this week, Schiff invited the Binance founder to a live debate on Bitcoin versus tokenized gold.

The event, set for Binance Blockchain Week in Dubai this December, will examine which asset best fulfills the fundamental roles of money: a medium of exchange, a unit of account, and a store of value.

CZ confirmed his participation, joking that he “might lose the debate,” but added that he will stand up for Bitcoin. He acknowledged that Schiff’s new gold-tokenization venture might gain exposure from the exchange, yet welcomed the opportunity for open discussion on monetary philosophy.

Market Shifts Reinforce Contrasting Narratives

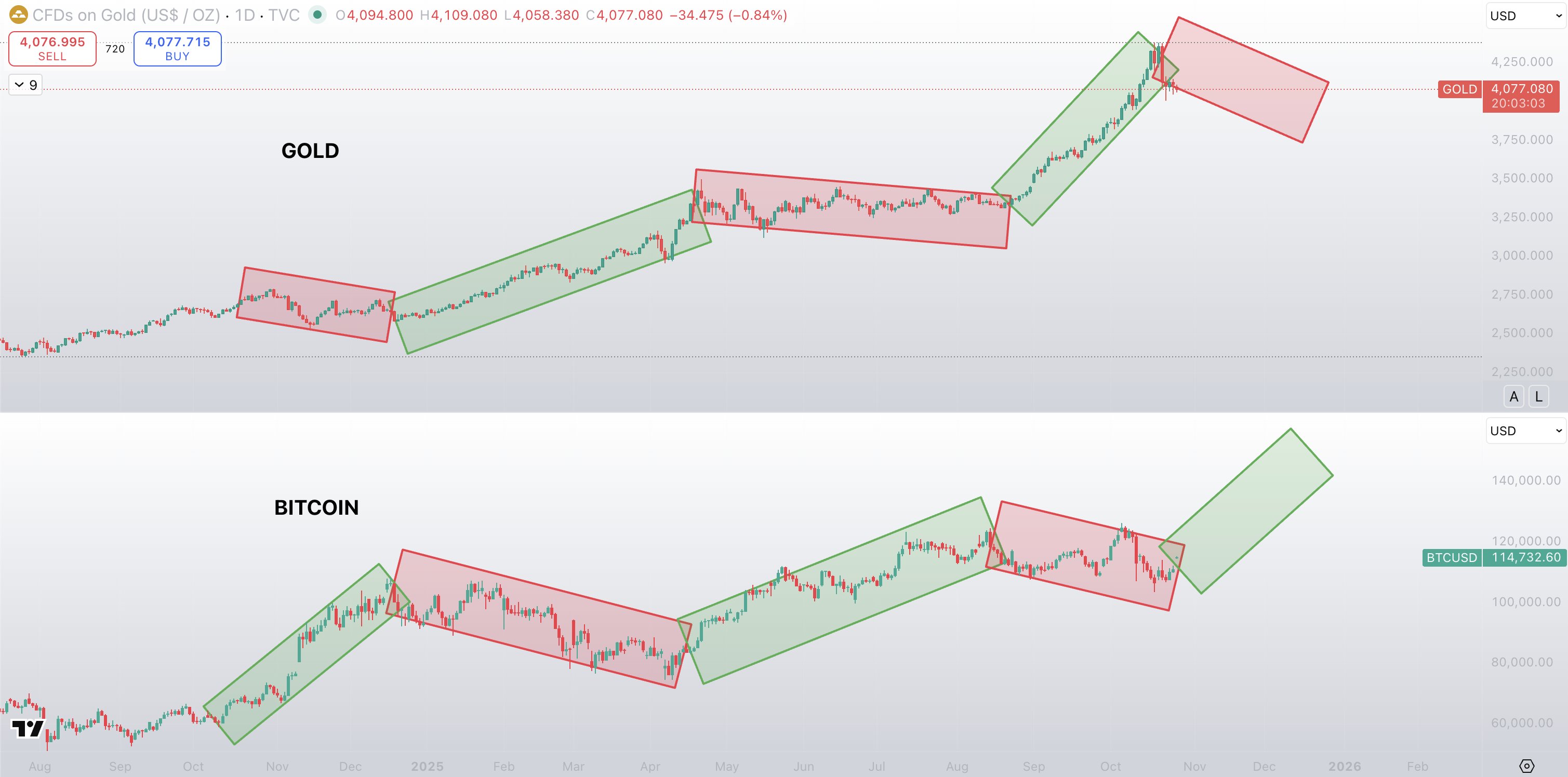

The debate comes following a striking divergence between gold and Bitcoin prices. Earlier this month, gold broke a historic barrier, surpassing $4,000 per ounce before reaching a peak of $4,342. Shortly after, it fell nearly 10% to $3,930, signaling a cooling phase following its parabolic rally. At the same time, Bitcoin rebounded to around $114,000, marking a 6% weekly gain after a dip to $101,000.

Crypto analyst Sykodelic highlighted a recurring inverse correlation between the two assets that has persisted for roughly 18 months. When gold peaks, Bitcoin often initiates a new bullish phase. He noted, “Looking as bullish as ever with GOLD having at minimum local topped, and the Crypto getting ready to leg up massively.”