Leading crypto exchange Coinbase recorded a strong third quarter marked by rising trading activity and an increase in Ethereum holdings. The U.S.-based cryptocurrency exchange added nearly 12,000 ETH to its balance sheet during the period, boosting its Ethereum position by roughly 9% from the previous quarter.

Coinbase added nearly 12,000 $ETH to its balance sheet in Q3, increasing its holding by ~9% from the prior quarter👇 pic.twitter.com/s5NP9ZMrS5

— Etheraider (@etheraider) October 31, 2025

Ethereum Is a Store of Value Asset

Reacting to Coinbase’s growing Ethereum holdings, BitMine asserted that the development reinforces Ethereum’s status as a store-of-value asset, adding that ETH now serves as a treasury asset for the San Francisco–based exchange.

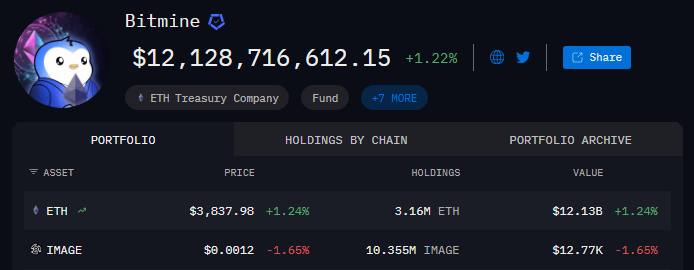

Like Coinbase, BitMine has been purchasing huge amounts of Ethereum weekly. The firm, which aims to acquire 5% of Ethereum’s total supply, now holds around 3.16 million ETH (2.61% of the supply).

Ethereum Represents 22% of Coinbase Q3 Trading Activity

Meanwhile, according to the firm’s Q3 financial report, Ethereum trading accounted for a larger portion of Coinbase’s overall activity. ETH represented 22% of total trading volume, up from 15% in the prior quarter.

Transaction revenue linked to Ethereum also rose to 17%, compared with 12% previously. While Bitcoin remained the most traded cryptocurrency, its share of total trading volume and revenue both declined as Ethereum’s activity increased.

Financial Performance and Market Breakdown

Coinbase reported total revenue of $1.9 billion for the quarter, a 58% increase from $1.2 billion recorded in the same period a year earlier. Transaction revenues alone reached $1 billion, representing a 37% quarter-on-quarter rise and nearly double last year’s figure. The company pointed out the improvement to higher trading volumes and growing engagement among advanced traders driven by new token listings and favorable market pricing in select assets.

Total trading volume climbed to $295 billion, up from $185 billion in the corresponding quarter of the previous year. The increase signals a recovery from the prior quarter, when Coinbase experienced declines across both trading and revenue categories. Despite the overall gains, net income for Q3 stood at $433 million, higher than last year but lower than the previous quarter’s performance.

Bitcoin and Workforce Updates

Coinbase continued to expand its Bitcoin holdings alongside its Ethereum accumulation. The company added 2,772 BTC during the quarter, valued at approximately $299 million. In a statement on X, CEO Brian Armstrong confirmed the firm’s continued Bitcoin purchases, following its addition of 2,772 BTC.

Coinbase is long bitcoin.

Our holding increased by 2,772 BTC in Q3. And we keep buying more.

— Brian Armstrong (@brian_armstrong) October 30, 2025

The company also reported a 12% increase in its workforce quarter-on-quarter, reflecting operational expansion amid stronger market participation. Last quarter, Coinbase disclosed the purchase of 2,509 BTC, with CEO Brian Armstrong stating on X that “Coinbase is long bitcoin” and that the company continues to add to its holdings.