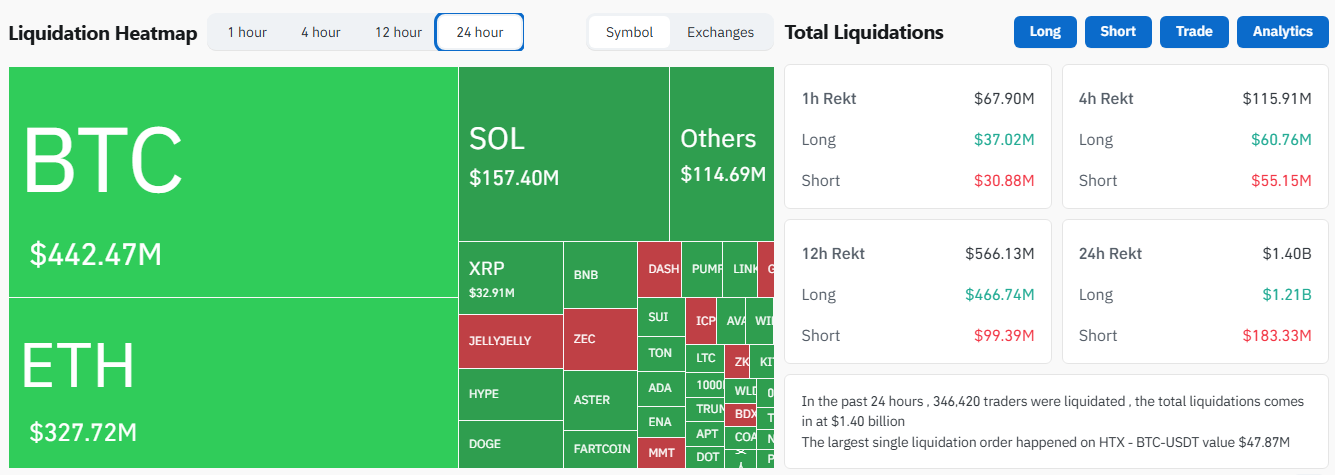

Crypto markets experienced heavy liquidations over the past 24 hours, erasing approximately $1.40 billion in leveraged positions, according to data from CoinGlass. Long traders bore the brunt of the selloff, losing roughly $1.21 billion, while shorts accounted for about $183.33 million.

Bitcoin led the market-wide liquidation wave, with $442.47 million in positions closed out over the past day as prices fell below $105,000. Ethereum followed with $327.72 million in liquidations, mainly from long bets, while Solana saw $157.4 million. Notably, XRP leveraged traders also suffered losses of around $32.91 million.

More than 346,000 leveraged traders were liquidated in the selloff, which also featured one of the largest single orders on record $47.87 million on HTX’s BTC-USDT pair.

ETF Outflows and Fed Comments Pressure Sentiment

The development comes as spot Bitcoin exchange-traded funds logged a fourth straight day of withdrawals, draining $187 million from the market on Nov. 3. Ether ETFs saw $136 million in outflows, while Solana products drew $70 million in inflows.

Open interest in Bitcoin futures declined 4% across major exchanges, with CME’s institutional contracts dropping 9% over the same period. A decline in open interest typically signals that traders are reducing their exposure as volatility rises. Similar decreases in September preceded an 8% correction in Bitcoin’s price.

The selloff followed the Federal Reserve’s latest policy decision, which cut rates for the second time this year but signaled a pause in further easing through 2025. That stance dampened expectations for additional liquidity, weighing on risk assets from equities to cryptocurrencies.

Bitcoin Tests Critical $100,000 Support

Bitcoin dropped under $105,000 at the time of writing, raising concerns that the next key support near $100,000 could soon be tested. The Crypto Fear & Greed Index fell to 21, signaling deep caution among investors.

Trader Jelle said on X that Bitcoin must “reclaim $105,000, $107,000 quickly” to prevent a deeper slide. AlphaBTC, another widely followed analyst, warned that a daily close below $105,300 could accelerate losses toward five-figure territory. Bitfinex analysts echoed the sentiment, noting that continued ETF outflows or weak institutional demand could push Bitcoin lower.

Getting closer to the 20-22% pullback area we saw at the start of the cycle.

20-22% of downside would put prices in the $100k region.

A 32% pullback from the highs, as seen in recent corrections, would take #Bitcoin as low as $85,000.

In any case, BTC always bounces back. pic.twitter.com/H2hfnlGvGQ

— Jelle (@CryptoJelleNL) November 4, 2025

In the meantime, altcoins tracked Bitcoin’s move over the 24-hour timeframe. Ether fell 4% to $3,539, XRP dropped 5.5% to $2.28, and Solana slid 7% to $164.