Ripple’s XRP sales remain a recurring point of debate in the market. However, new on-chain and derivatives data suggest the token’s recent performance comes from broader demand trends rather than company distribution practices.

Legal analyst Bill Morgan dismissed the idea that Ripple’s sales explain current correlations, saying the argument has “no explanatory relevance.” Notably, market data appears to support that view.

Imagine thinking Ripple selling XRP has a jot of explanatory relevance in analysing this correlation. pic.twitter.com/vNLSQ8dL74

— bill morgan (@Belisarius2020) November 12, 2025

A shared chart shows that XRP followed Bitcoin’s drop on Wednesday, indicating a close price relationship between the two assets. This strengthened his argument that Ripple sales are not a factor driving XRP’s price struggle in any way.

XRP Exchange Balances Fall as Network Activity Rises

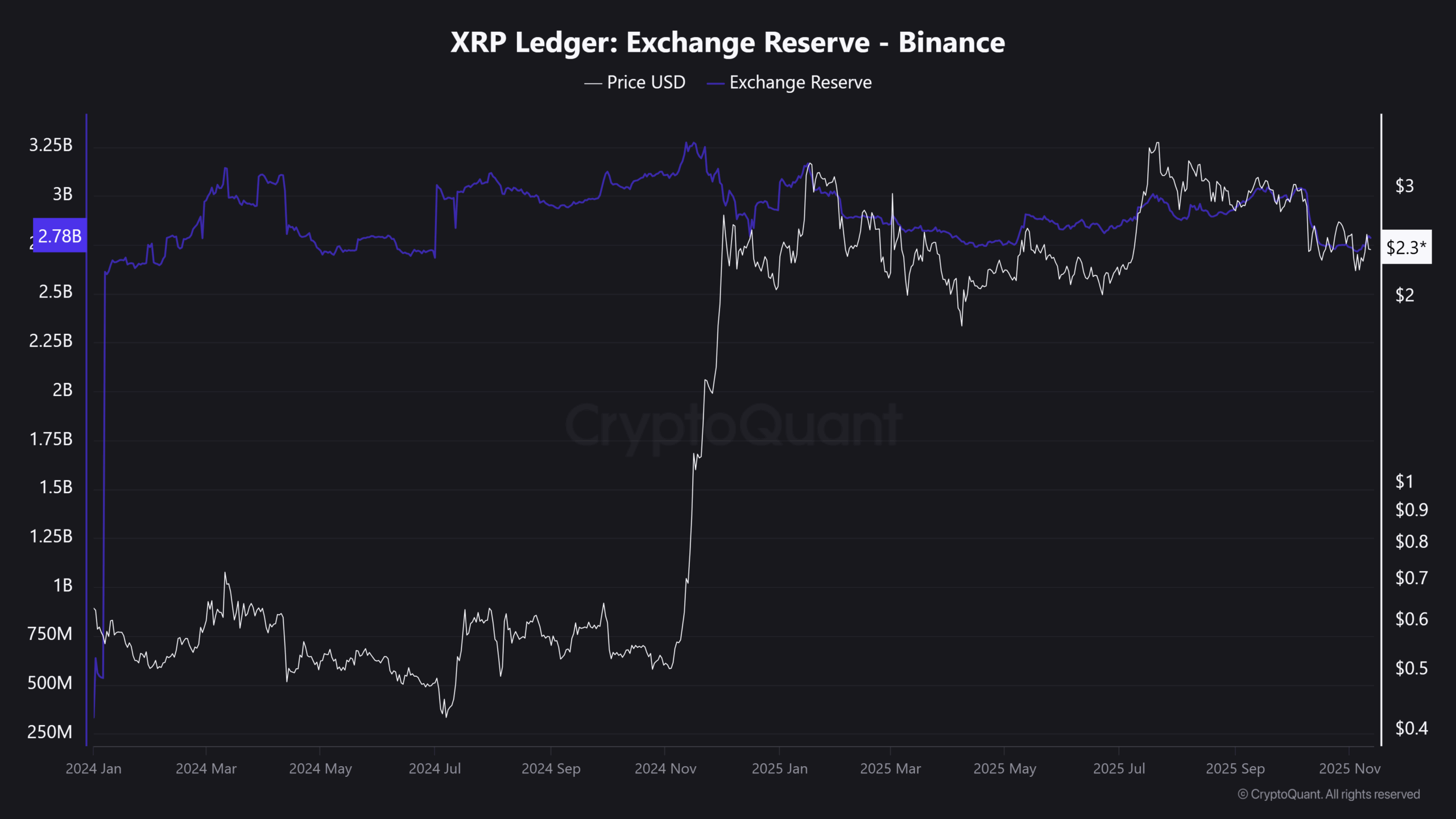

XRP balances on Binance have declined sharply since late 2024, according to CryptoQuant data. The drop in reserves coincided with a period of price appreciation, indicating that exchange supply tightened even as XRP moved higher. The trend contrasts with claims that Ripple’s quarterly sales place consistent downward pressure on the token.

Meanwhile, network activity on the XRP Ledger has strengthened at the same time. The total number of addresses has increased to approximately 7.7 million, extending a steady rise in wallet growth observed over the past two years. Messari reported that XRP ended the third quarter at $2.85, up 27% from the previous quarter, while market value climbed 29% to $170.3 billion.

The increase exceeded the combined growth of Bitcoin, Ethereum, and Solana. Average daily transactions also increased, indicating stronger user engagement across the network.

Technical indicators show improving relative strength. XRP’s RSI and MACD against Bitcoin have turned higher, suggesting a shift in momentum as XRP begins to break from its earlier pattern of underperformance versus BTC.

Derivatives Positioning and ETF Steps Gain Influence

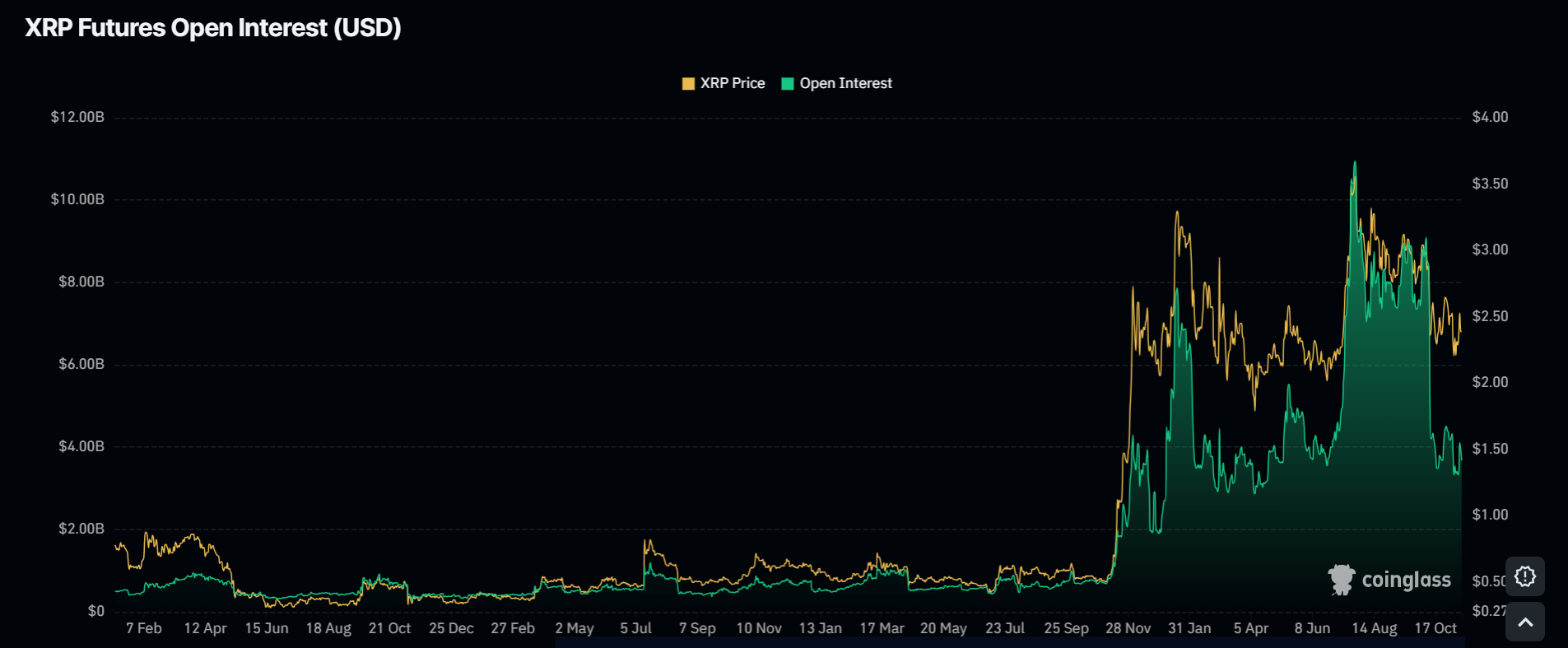

Futures positioning has emerged as a major driver of XRP’s price action. Open interest in XRP derivatives rose to around $10 billion during periods of heightened volatility over the past year, according to CoinGlass data. Price movements have closely tracked these shifts, underscoring the influence of leveraged trading rather than Ripple’s controlled and largely OTC-based token distributions.

Liquidation patterns reinforce the trend. Large long and short wipeouts aligned with swings in futures positioning, not with Ripple’s escrow events. Institutional interest has continued to build. Nasdaq certified the listing of Canary Funds’ XRP exchange-traded fund this week, clearing the product for trading once its SEC registration becomes effective. The issuer stated that it expects the fund to begin trading on November 13.