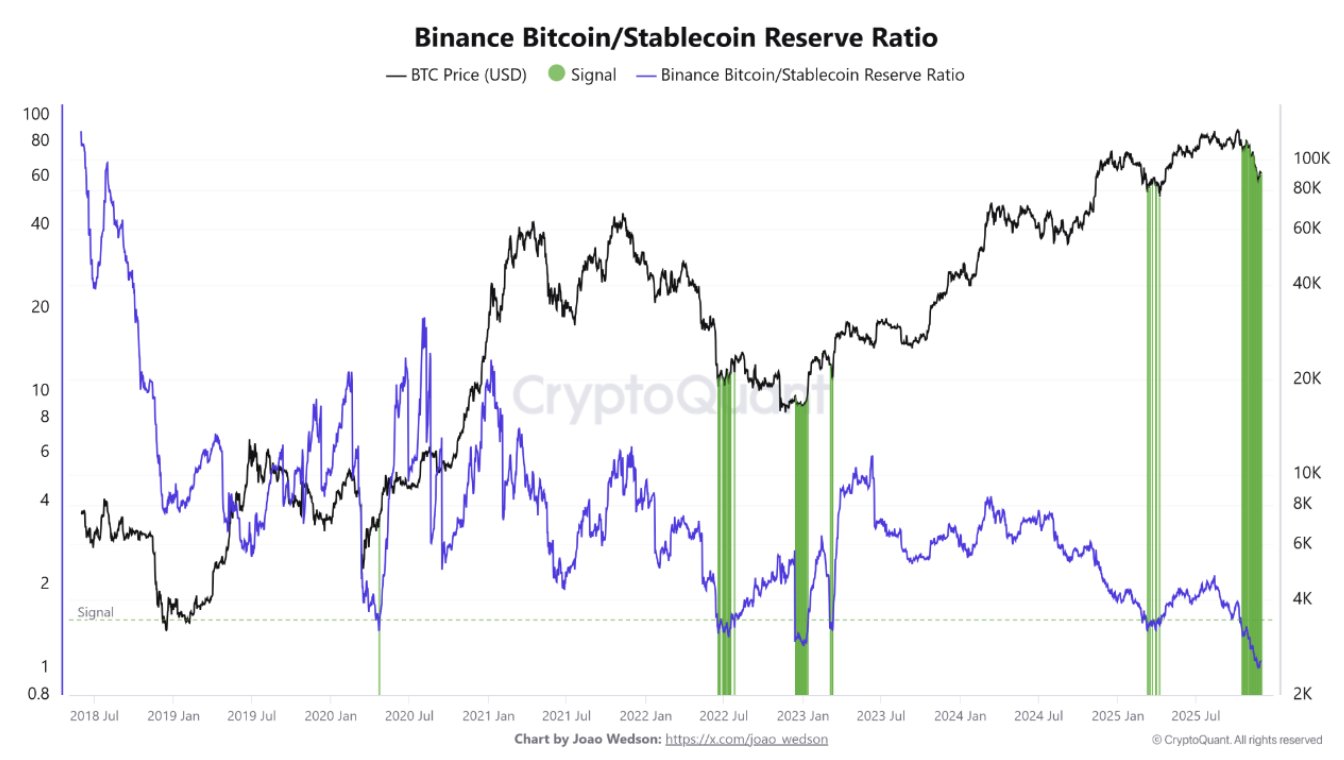

Binance’s reserve ratio has just fallen to its lowest point since 2018, setting off fresh conversations across the crypto market. The ratio, which compares the amount of Bitcoin the exchange holds to its holdings in stablecoins, has slipped to around 1.008, breaking below a level that analysts have been watching for years.

Binance Reserve Ratio Hits Lowest Level Since 2018

According to a recent report by on-chain analytics firm CryptoQuant, Binance’s Bitcoin to Stablecoin Reserve Ratio has hit its lowest level since 2018, slipping to 1.008. The firm revealed this information in an X post on December 1, 2025, bolstering market sentiment. Notably, the reserve ratio is essentially a gauge of trader sentiment.

When stablecoins accumulate and Bitcoin reserves decline, it typically means people are holding onto liquidity, waiting for the opportune moment to make a move. Binance’s BTC holdings have been declining, while stablecoin balances on the exchange have surged to new highs.

Meanwhile, this combination hasn’t appeared in such a dramatic way since 2018, and many traders see it as a sign that the market is preparing for something big. Interestingly, market experts seem to share the same sentiment as CryptoQuant.

For context, market expert CryptoOnchain speculated in an X post that Bitcoin could be gearing up for a decisive breakout. According to the platform, a steep decline in this ratio has historically been followed by a major Bitcoin rally, and the liquidity needed to spark this move is already on the exchange. Thus, if history repeats, Bitcoin could surge to much higher prices.

Bitcoin Market Outlook

While the dip in the Binance reserve ratio has sparked fresh optimism among investors, Bitcoin has yet to respond to the bullish sentiment, as it remains trapped below $90,000.

Further, in a bearish scenario, some investors warn that shrinking BTC reserves mean thinner liquidity on the exchange. When fewer coins sit on the order book, price swings can become more aggressive, making the market easier to push in either direction.

Additionally, similar setups in previous cycles have led to major trend reversals, but they have also preceded periods of increased volatility. In other news, Bitcoin ETFs are also struggling, recording almost $4 billion in outflows in November. The outflows also reflect the broader outlook for the crypto ETF market, which saw trading volume decline by over 26% to $1.59 trillion.