XRP investment activity increased across major platforms as new ETFs, including Grayscale ETF, attracted strong inflows. Meanwhile, market access to XRP has widened through these funds, with daily demand now surpassing 10 million tokens.

Grayscale Adds Nearly 30 Million XRP as ETF Interest Rises

Notably, Grayscale increased its XRP holdings this week after adding nearly 30 million tokens to its GXRP trust. The XRP spot ETF now holds more than 64 million XRP and manages over $138 million in assets. Each share represents 19.40 XRP, and Coinbase Custody stores the assets.

Grayscale Updates GXRP

Adds nearly 30Million XRP into AUM👀⬇️ https://t.co/xs2be9fXFa pic.twitter.com/YHx9KsNuyM

— Chad Steingraber (@ChadSteingraber) December 3, 2025

The addition came as XRP ETFs recorded almost $824 million in net inflows since their late November launch. Franklin Templeton’s ETF holds more than 53 million XRP, though its net asset value has moved with market conditions. Some participants said this kind of deposit may be driving unseen increases that appear later in public filings.

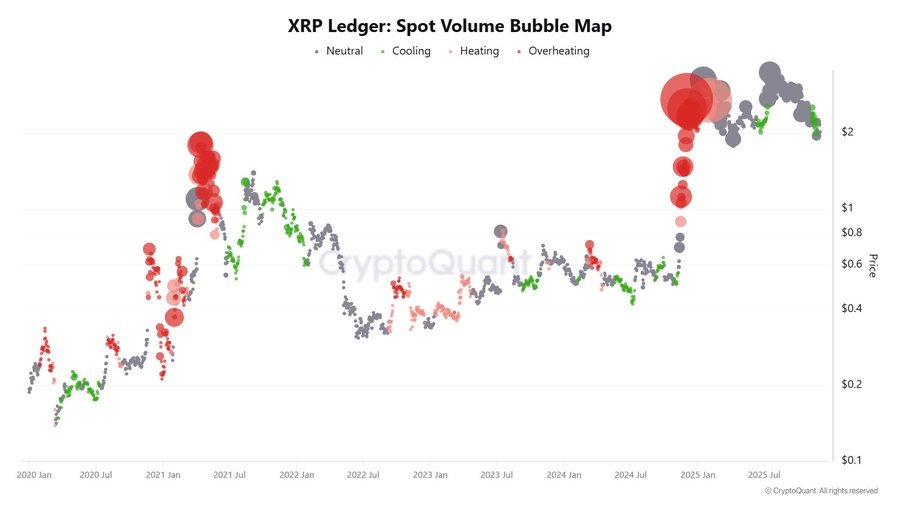

XRP stayed above $2 during this activity, and analysts noted that daily ETF accumulation may reach 10 million tokens if current demand continues. XRP remains the fourth-largest asset by market value as activity grows across regulated markets.

Regulatory Actions Shape ETF Activity as New Access Expands

This follows a previous report where the US SEC pushed back on 3x and 5x leveraged ETF proposals and told issuers to revise filings that failed to meet Rule 18f-4. The agency said some filings included language that did not comply with the rule’s leverage limits and required risk procedures.

In addition, new products entered the market, with Grayscale launching its Chainlink Trust ETF on NYSE Arca, which raised more than $17 million in assets. The firm has introduced ETFs tied to XRP, Dogecoin, and Solana, and recently filed for approval of a Zcash product as crypto access widened.

Meanwhile, Vanguard opened its platform to third-party crypto ETFs, including funds linked to XRP, Bitcoin, Ethereum, Solana, and HBAR. This offered wider access for mainstream investors and added new channels for XRP inflows. CW8900 stated that XRP’s spot volume bubble map shows a cooling phase, which it said often appears near oversold conditions and may not last long as new ETF listings increase liquidity.