An Aster whale has captured the attention of community members after depositing a significant amount of ASTER tokens into a centralized exchange, raising concerns about potential sell pressure.

On-chain data from Arkham shows the whale moved 1.92 million ASTER to a centralized exchange at a time when the token remains under notable bearish pressure, sparking speculation that the investor may be preparing to exit at a loss.

Aster Whale’s Exchange Deposit Sparks Sell-Off Concerns

Blockchain tracker ChainCatcher has flagged a transaction by an Aster whale that moved 1.92 million ASTER to OKX. Highlighting an image from Arkham Intelligence, the on-chain sleuth revealed that the Aster whale had transferred this token from a Binance hot wallet two months ago, when it was worth $2.01 million.

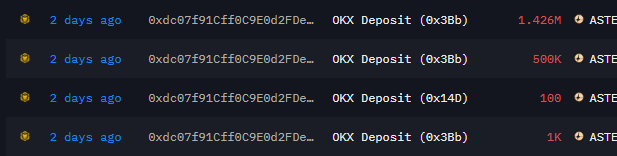

According to Arkham intelligence data, the Aster whale initially moved the ASTER tokens in batches, first depositing 1,000 tokens worth $710 to OKX and then making two other transactions before depositing 500,000 tokens worth over $354,000 in a single transaction.

The whale then made the largest single transfer of 1.426 million ASTER, worth $1.01 million, to cap off the entire transaction. Interestingly, Arkham data shows that this whale made the transactions in a single day on December 27, 2025, spending over $1.35 million on the purchase.

At the current price, the Aster tokens are worth a little over $1.34 million, indicating that the whale is already sitting on unrealized losses. Thus, if the Aster whales choose to offload the tokens, they will have a total loss of over $656,000.

Not New

It is worth noting that this whale transaction is one of many involving Aster that have been flagged by blockchain trackers this month. Interestingly, on-chain sleuth Lookonchain had earlier in December revealed that an Aster whale whose strategy is to sell Aster at a loss suffered a $1.37 million loss.

On-chain data from December 18, 2025, flagged a transaction by another Aster whale who sat on over $64 million in losses from trading Aster, indicating an uptick in whale activity.

However, aside from the increased whale interest, this recent whale activity comes shortly after the Aster team announced the commencement of stage 5 of its ongoing token buyback program.

In addition, trading powerhouse SIA launches Aster trading agent for one-click copy trading

ASTER Price Struggles Amid Rising Uncertainty

Meanwhile, ASTER continues to battle bearish pressure as the broader market remains unstable due to macroeconomic concerns. This includes the recent BOJ rate hike and regulatory uncertainties in the United States. In addition, the BOJ has again hinted at further rate increases in the coming months, with its policy makers calling for a steady rate increase every few months.

According to CoinMarketCap, ASTER now trades around the $0.70 mark, representing a 2.5% dip over the past 24 hours. Technical indicators suggest that ASTER is hovering near a key support zone, with downside risk increasing if selling pressure intensifies.

If the 1.92 million ASTER deposit results in a full or partial sell-off, analysts warn the token could test lower support levels in the short term. Conversely, a hold above current levels could signal resilience and open the door for a relief bounce, particularly if broader market conditions improve.