A viral post on X has reignited discussions around crypto’s volatile potential after claiming that a trader turned just $108 into $420,700 in 10 days, representing a staggering 3,900x return. The eye-catching figures quickly captured the attention of the crypto community, fueling excitement, skepticism, and renewed discussions around risk-taking in highly volatile markets.

Inside a $108 to $420,700 Crypto Trade

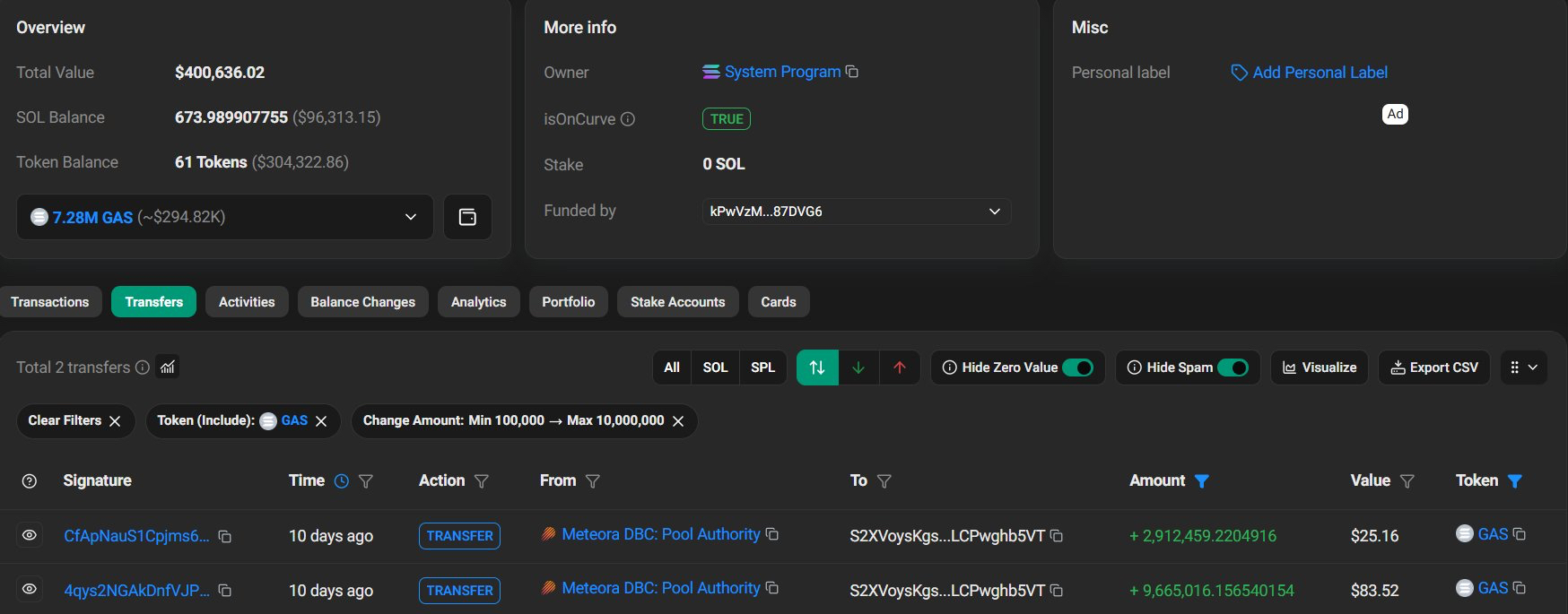

On-chain data from the Solana blockchain appears to validate the viral claim, revealing two key transfers totaling approximately 12.5 million GAS tokens ($108). Both transfers originated from a Meteora pool authority and were executed within minutes of each other, roughly 10 days ago. Meanwhile, the trader’s holdings have since ballooned to a peak valuation above $400,000.

These transactions marked the wallet’s initial exposure to the token and aligned precisely with the timeline shared on X, offering insight into how the trader captured a near 3,900x return in under two weeks.

Such gains are extremely rare, even in crypto markets known for volatility, and typically occur in low-liquidity or newly launched tokens that experience explosive price movements. The returns were from the trader’s GAS token purchase, confirming the speculation that the uptick likely came from a high-risk memecoin or micro-cap token.

The trade has sparked mixed reactions across X, with some users celebrating the trade as proof of crypto’s unmatched upside, while others caution against chasing similar outcomes. Many seasoned traders emphasize that focusing on consistency and risk management is more sustainable than pursuing viral wins.

What Could Drive a 3,900x Return?

Returns of this magnitude are usually the result of a perfect storm: early positioning, rapid viral momentum, and aggressive risk exposure. In many cases, traders who achieve such outsized gains enter before broader attention arrives and exit before liquidity dries up.

While stories like this tend to dominate social media, they represent extreme outliers rather than typical outcomes. This phenomenon, known as survivorship bias, skews perception by highlighting only the winners while ignoring the majority who fail. Thus, viral success stories can create unrealistic expectations, particularly for newer market participants. Nevertheless, the same volatility that enables exponential upside can just as easily wipe out capital, especially for traders who enter late or fail to exit in time.

Although skill and market awareness matter, no strategy reliably produces returns of this magnitude on demand. For every trader who captures a 3,900x return, countless others experience losses attempting to replicate similar strategies.