The broader crypto market has slumped sharply recently as renewed tariff threats from the Trump administration triggered a wave of panic selling across major digital assets. Bitcoin, Ethereum, and XRP all tumbled as investors reassessed global risk conditions and braced for potential economic fallout linked to escalating geopolitical tensions.

Bitcoin Leads Market Decline After Trump Unveils Aggressive Tariff Plan

Bitcoin plunged after President Trump announced plans to impose a 10% tariff on all goods exported from eight European countries. The affected countries include Denmark, Sweden, Germany, France, the United Kingdom, Finland, the Netherlands, and Norway, with the tariff set to take effect on February 1, 2026. Further, the tariff will escalate to 25% by June 1, 2026.

Trump described the move as a retaliatory strike against European nations opposing U.S. efforts to take over Greenland, a campaign he claims is essential for the survival of the planet. He further asserted that the U.S. has been attempting to acquire Greenland for the past 150 years, but Denmark has refused to cooperate.

Thus, the tariffs will remain in effect until a consensus is reached regarding Greenland’s total purchase. However, he noted that the U.S. remains open to negotiations with Denmark and any of the listed countries. Notably, this development comes ahead of a pending U.S. Supreme Court ruling that will determine whether the president has the authority to impose such tariffs under the 1977 International Emergency Economic Powers Act.

The looming legal showdown added additional tension to global markets, amplifying Bitcoin’s downside pressure. According to CoinMarketCap, Bitcoin has slumped to the $92,000 region, down 2.4% over the past 24 hours.

Ethereum and Altcoins Enter Risk-Off Mode as Volatility Surges

Ethereum, following Bitcoin’s lead, slumped below $3,300 and, according to CoinMarketCap, is currently trading around $3,200, a 2.8% decrease over the past 24 hours. Meanwhile, XRP also slipped sharply, tracking the broader altcoin retreat. CoinMarketCap data shows that XRP has fallen 3.9% over the past 24 hours, slipping from fourth to fifth place. Further, XRP now trades below $2, losing a crucial support level.

Interestingly, analysts noted that high-cap assets tend to respond quickly to geopolitical shocks, and Saturday’s tariff announcement triggered immediate repricing across multiple trading pairs.

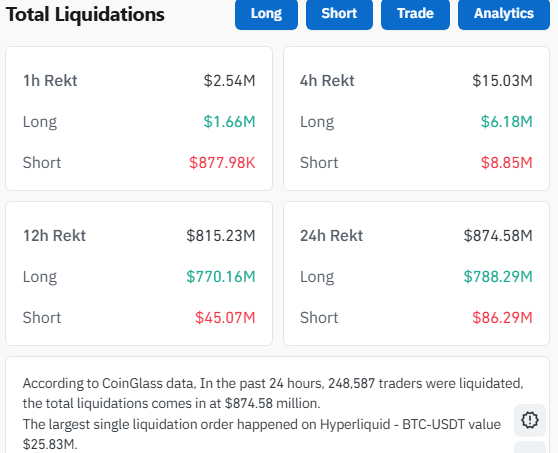

Following the downturn, the market saw approximately $874 million in leveraged liquidations over the past 24 hours. Long traders absorbed the majority of the losses, surrendering $788.29 million, while short traders accounted for the remaining $86 million. In total, 248,587 traders were impacted, with the largest single liquidation recorded on Hyperliquid.

Markets Brace For Turbulence

Market strategists warn that digital assets may remain highly sensitive to political headlines in the coming weeks, particularly as the Supreme Court prepares to deliver its ruling on the Trump tariffs. A confirmation of presidential authority could pave the way for broader, more frequent tariff actions, a scenario that could introduce persistent volatility into both traditional and crypto markets.

Meanwhile, the European Union, in response to Trump’s tariff sanctions, is looking to fight back with a package of counter-tariffs that would take effect on February 6, 2026, adding to the panic. So for now, traders are adopting a defensive stance as the market braces for turbulence amid geopolitical escalation on the horizon.