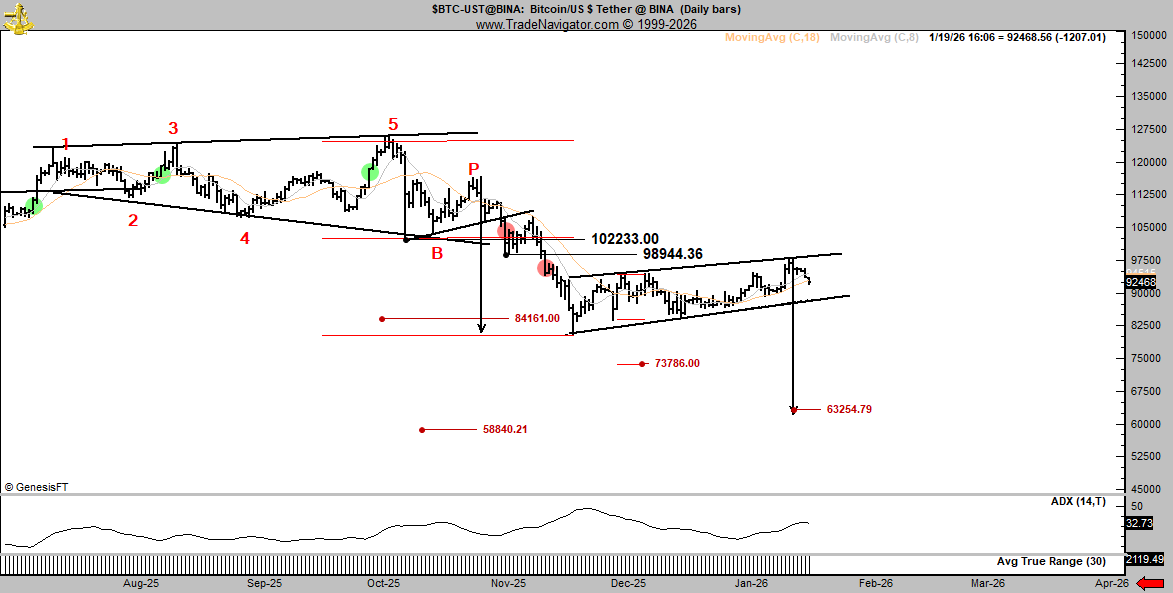

Veteran trader Peter Brandt has once again stirred debate across the crypto market after warning that Bitcoin could be headed for a sharp correction, with downside targets stretching as low as $62,000. The prediction, shared alongside a technical chart on X, has drawn mixed reactions from traders, with some urging caution while others argue the broader trend remains intact.

Brandt’s Chart Signals Rising Bitcoin Downside Risk

Brandt’s latest Bitcoin outlook is rooted in a classic chart pattern that, in his view, points to a deeper corrective move still ahead. In his analysis, Brandt highlights a multi-month distribution structure at Bitcoin’s recent highs, marked by several failed breakout attempts before the price finally broke lower.

The critical moment in Brandt’s framework occurs when Bitcoin decisively falls below the lower boundary of this range, a level he labels as the breakdown point. Once that support gave way, Brandt interprets subsequent price action not as the start of a new uptrend, but as a corrective rally within a broader bearish move.

Using measured-move projections, he identifies the $58,000 to $62,000 zone as the most likely downside target if the pattern completes. This area aligns with both historical support and the technical distance of the prior range projected downward from the breakdown. In his view, a move into this region would represent a textbook resolution of the structure rather than an abnormal market collapse.

Brandt’s bearish outlook is not entirely isolated. Some analysts have pointed to lower highs, fading momentum, and weakening short-term support zones as signs that Bitcoin may be vulnerable to a broader correction. Elevated leverage across derivatives markets has also raised concerns that a sharp move lower could trigger cascading liquidations if key levels are broken.

Why the Market Takes Brandt Seriously

Brandt is widely respected for his decades-long experience in traditional markets and his disciplined, pattern-based approach to trading. While he is known for making both bullish and bearish calls, Brandt has repeatedly stressed that his focus is on risk management, not predicting outcomes with absolute confidence.

His reputation for transparency, often admitting when he is wrong, has paradoxically strengthened his credibility among traders. Whenever Brandt highlights potential downside risks, many market participants view it as a signal to reassess exposure rather than panic.

What Traders Are Watching Next

Despite the bearish technical setup, several factors could limit the extent of a downside move. Bitcoin continues to benefit from strong institutional participation, relatively tight exchange supply, and ongoing interest from spot ETFs. These structural supports have historically helped absorb selling pressure during pullbacks.

Even Brandt himself framed the analysis as a scenario rather than a prediction, acknowledging that Bitcoin could invalidate the pattern if it regains strength above recent resistance levels.

As the debate unfolds, traders are closely monitoring critical price zones. A sustained break below near-term support could strengthen the case for a move toward $62,000, while a decisive rebound would undermine the bearish thesis altogether.