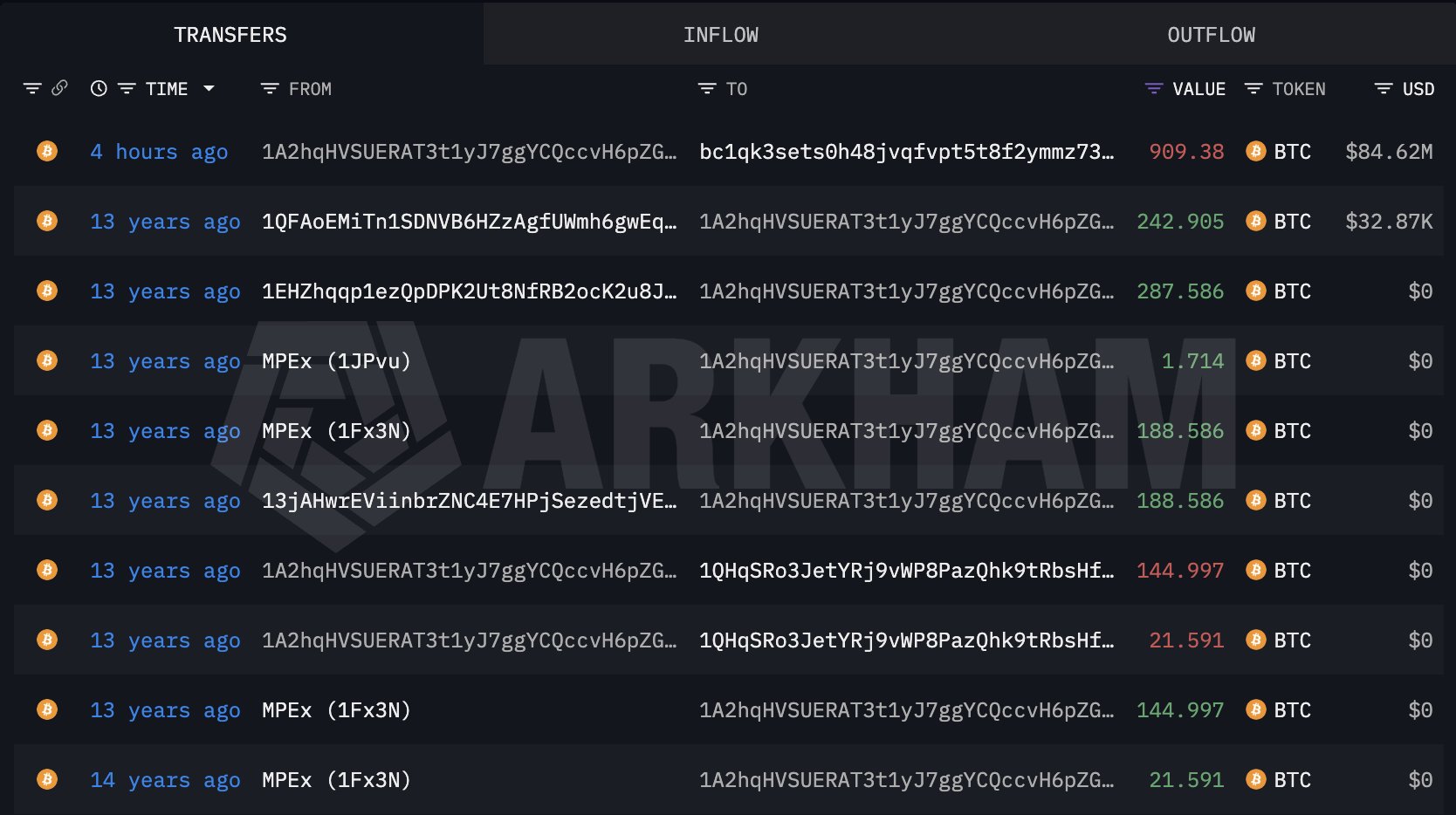

A long-dormant Bitcoin wallet has suddenly come back to life after more than 13 years of inactivity, transferring its entire balance of 909.38 BTC, now worth approximately $84.62 million, into a newly created wallet. The rare on-chain movement has quickly drawn attention from traders and blockchain analysts, given both the size of the transfer and the wallet’s early origins in Bitcoin’s history.

On-Chain Data Shows Full Bitcoin Balance Relocated

The transaction involved moving all 909.38 BTC into a fresh wallet address, with no evidence of partial withdrawals or distribution across multiple destinations. The transfer totals $84.62 million at Bitcoin’s current price. This type of move often suggests wallet restructuring or custody upgrades, rather than an immediate intention to sell. Analysts note that if liquidation were imminent, funds would typically be routed directly to known exchange wallets.

According to blockchain data, the wallet had remained untouched since Bitcoin’s earliest years, before executing a single, consolidated transfer that moved the full balance at once.

So far, there are no signs that the BTC has been deposited onto centralized trading platforms, reducing concerns of short-term selling pressure. Currently, the entire 909 million BTC are held in the recipient wallet address. However, market participants continue to monitor the new wallet closely for any follow-up transactions.

From Under $7 to $84 Million: A 13,900x Return

What makes the transaction particularly striking is its historical context. When this unknown Bitcoin OG first received the BTC more than 13 years ago, Bitcoin was trading below $7. At that time, the entire holding would have been worth less than $6,400.

Today, that same position is valued at over $84 million, representing an approximate 13,900x return. It’s a powerful reminder of Bitcoin’s long-term appreciation and the extraordinary gains achieved by early adopters who held through multiple market cycles.

Sell-Off Risk or Strategic Repositioning?

Dormant wallet reactivations are closely watched because they can signal a change in behavior from early investors who control significant amounts of supply. Historically, large transfers from long-inactive wallets have sometimes preceded periods of increased volatility, especially if the funds move toward exchanges.

Similarly, not every reactivation leads to a sale. Many early holders are moving funds for security upgrades or custody transitions as Bitcoin’s value grows and wallet technology evolves.

At this stage, the transfer remains neutral from a market-impact perspective. Without exchange deposits, the move does not indicate immediate selling pressure. Some analysts interpret this as a precautionary step, possibly moving coins from an older wallet format to a more secure or modern setup.

Others caution that while no selling has occurred yet, the size of the holding means any future liquidation could influence market sentiment, particularly if executed during periods of lower liquidity.