Crypto investment products continue to face mounting pressure as investors sharply retreat from major digital assets. The latest weekly data reflects a deepening risk-off environment, with Bitcoin, Ethereum, and XRP investment products experiencing their heaviest withdrawals in months.

Massive Outflows Hit Crypto Funds Amid Market Caution

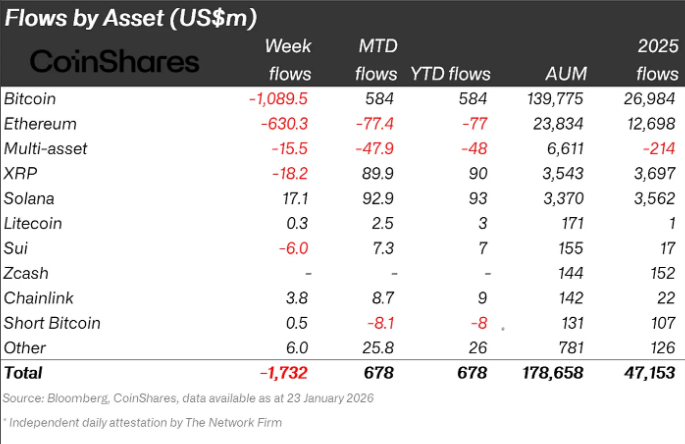

A recent CoinShares report shows that digital asset investment products witnessed massive outflows last week, the largest since mid-November 2025. Total withdrawals surged to $1.73 billion, marking one of the strongest bearish waves the sector has seen in more than a year.

Bitcoin led the downturn with $1.09 billion in outflows, its largest since mid-November 2025. Ethereum followed with $630 million, while XRP recorded $18.2 million in outflows. Analysts note that this broad-based retreat underscores a bearish sentiment that has persisted since the October 10, 2025, market crash, with market confidence yet to fully recover.

Meanwhile, it’s worth noting that Solana bucked the trend, attracting a notable $17.1 million in inflows, signaling sustained investor confidence in its ecosystem. Chainlink also posted a modest $3.8 million inflow, highlighting selective accumulation despite broader market weakness.

Investor Behavior Shifts as US Regulatory Uncertainty Intensifies

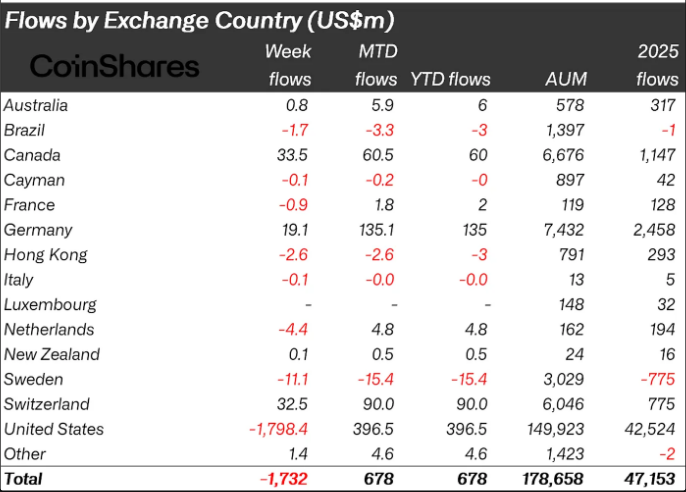

CoinShares reported that the United States accounted for nearly $1.8 billion in outflows, making it the primary destination of last week’s global retreat. Analysts attribute this to mounting regulatory uncertainty and a growing list of political and economic concerns.

The long-delayed Crypto Clarity Bill remains stalled as the U.S. Banking and Agriculture Senate Committees continue to postpone crucial markup meetings. Meanwhile, aside from that, the US is now threatening to impose a 100% tariff on Canada, following claims that Canada is participating in a new trade deal with China. This development has added to the strain on North American market sentiment.

At the same time, fears of another U.S. government shutdown are intensifying. Funding legislation required to keep federal agencies operating has yet to be passed, raising alarm bells across financial markets. The looming risk of disrupted government services is contributing to elevated anxiety for investors already navigating volatile economic conditions.

Meanwhile, other regions displayed more resilience. Germany, Switzerland, and Canada recorded modest inflows of $19.1M, $32.5M, and $33.5M, respectively. Conversely, Sweden and the Netherlands mirrored the US trend, posting outflows of $11.1M and $4.4M, respectively. This divergence highlights how political clarity and regulatory stability heavily influence capital flows.

BTC, ETH, and XRP Price Action Reflect Growing Investor Anxiety

The price performance of major cryptocurrencies now mirrors the heavy outflows. According to CoinMarketCap, Bitcoin trades around $87,000, down 0.8% over the past 24 hours.

Ethereum has slipped below the critical $3,000 threshold, falling 1.5% over the same period. XRP, trading near $1.89, has dipped 0.5% and is now the fifth-largest cryptocurrency by market cap. Analysts caution that continued outflows, combined with macroeconomic uncertainty, could keep BTC, ETH, and XRP locked in subdued momentum unless investor confidence meaningfully rebounds.