A recent analysis from a crypto pundit suggests that ASTER could see significant upside if it successfully attains the market cap of HYPE or BNB. Under bullish conditions, price projections indicate a 9-fold increase in the short term and about 100-fold in the long term.

Comparing ASTER with HYPE and BNB

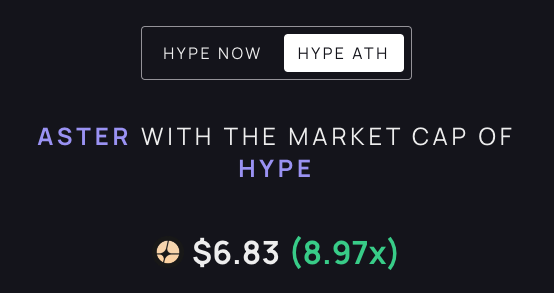

Popular crypto analyst and commentator, DC Crypt, provided insight into the discourse about ASTER’s future valuation. He suggested that the token’s price could reach $6.83 per token if it captures the market cap of HYPE.

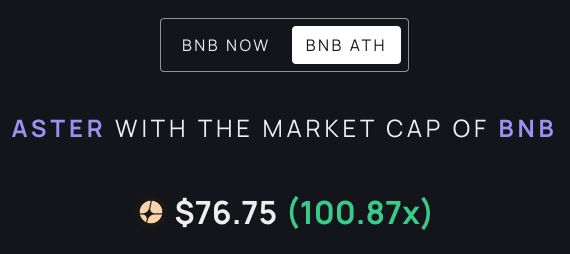

He further compared ASTER to BNB, a token frequently cited by the community as a benchmark for ASTER’s long-term price potential. BNB’s evolution shows how exchange-native tokens can grow into globally recognized crypto assets. If ASTER achieves a comparable level of adoption and utility—and captures a similar market capitalization—its price could climb to $76.75, implying an extraordinary 100.87× upside from current levels.

The analyst noted that catching up with HYPE could be achievable within months if momentum continues, while reaching BNB’s level would be extremely difficult, likely requiring years and depending heavily on the broader future of decentralized exchanges.

Understanding the Real Competition

Although traders frequently benchmark ASTER against HYPE, the analyst clarified that AsterDex is designed to compete less with other DEX tokens and more with centralized exchanges. Its ecosystem is built around a perpetual derivatives platform that seeks to attract professional traders migrating away from traditional exchange models. As a result, its valuation path may not mirror HYPE’s revenue-support mechanics. Instead, its success will hinge on its ability to challenge CEX dominance and onboard a global user base that prefers self-custody.

This distinction is crucial. HYPE benefits from tighter tokenomics and demand directly linked to fees. ASTER, meanwhile, carries a larger supply and focuses on adoption incentives, meaning its price appreciation is more speculative and growth-dependent.

The Growing Trend Toward DEXs

A key theme in DC Crypt’s commentary was the observable shift in trader behavior. More users are choosing decentralized exchanges over centralized ones to retain control of their tokens in personal wallets. This migration trend toward self-custody aligns directly with ASTER’s mission.

Yet the analyst warned that increased DEX adoption could invite regulatory scrutiny. Governments may attempt to impose new rules on decentralized exchanges, potentially creating operational challenges for all DeFi protocols. How this tension plays out could influence ASTER’s long-term valuation more than any single product upgrade.