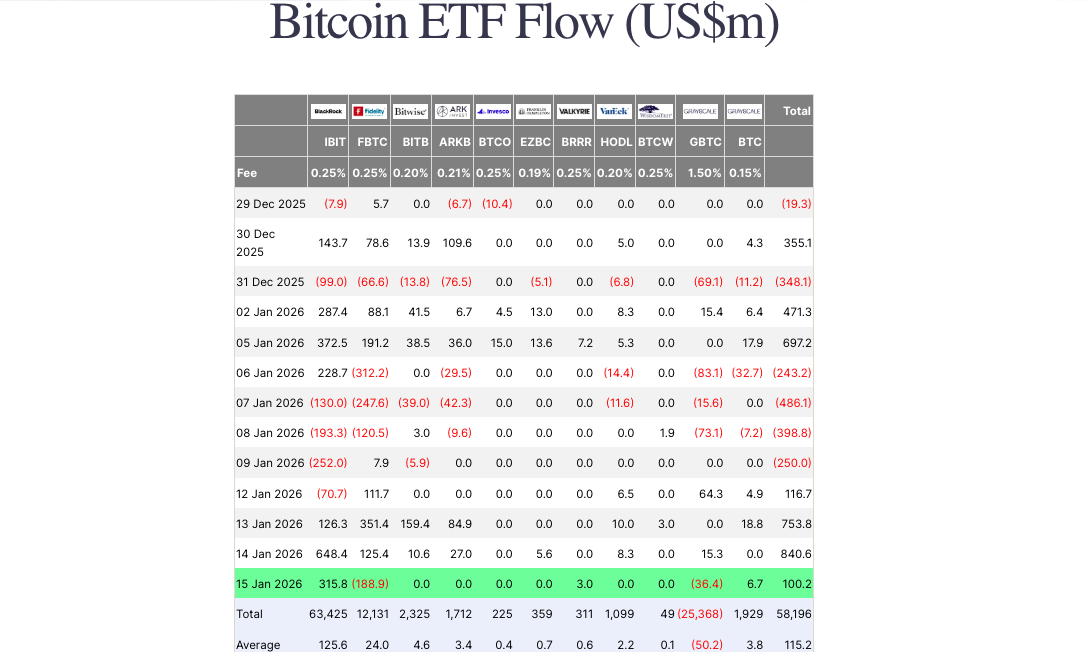

Bitcoin exchange-traded funds (ETFs) recorded another strong week of accumulation, absorbing 17,700 BTC, worth approximately $1.68 billion. The figure underscores continued institutional demand for Bitcoin exposure, even as the broader market navigates periods of consolidation and volatility.

Bitcoin ETFs Add 17,700 BTC in One Week

According to aggregated ETF flow data, spot Bitcoin ETFs collectively added 17,700 BTC to their holdings since this week. At current prices, this accumulation translates to roughly $1.68 billion worth of Bitcoin, while total net inflows into the products reached $1.81 billion, reflecting both BTC purchases and cash-based inflows across multiple issuers.

This level of weekly accumulation is notable when compared to Bitcoin’s newly mined supply, which currently averages around 3,150 BTC per week. ETF demand this week alone has therefore absorbed several times the amount of Bitcoin entering circulation, reinforcing the narrative of tightening supply dynamics.

What’s Driving the Strong ETF Demand?

The surge in ETF inflows appears to be driven by a combination of price stability and renewed confidence among institutional investors. Bitcoin’s ability to hold key technical levels has reduced downside anxiety, encouraging capital to flow into regulated investment products rather than direct spot markets.

Additionally, ETFs provide a familiar and compliant avenue for traditional investors seeking exposure to Bitcoin without the complexities of custody, private keys, or exchanges. As market participants anticipate potential upside in the coming months, ETFs remain a preferred gateway.

Impact on Bitcoin’s Supply and Market Structure

Sustained ETF accumulation could potentially benefit Bitcoin’s market structure. As ETFs move Bitcoin into long-term custodial storage, the circulating supply available on exchanges continues to shrink. This reduces immediate sell-side pressure and increases the market’s sensitivity to demand shocks.

Historically, periods of strong ETF inflows have coincided with price stabilization or gradual upward movement, rather than abrupt sell-offs. While inflows alone do not guarantee price appreciation, they create a supportive backdrop that can amplify bullish catalysts when they emerge.

Meanwhile, Bitcoin’s price action has remained relatively measured, suggesting that the market is in a consolidation phase. In the near term, traders will be watching whether ETF inflows remain elevated or begin to taper. Continued accumulation at this pace could reinforce Bitcoin’s recent support levels and increase the likelihood of a renewed push higher.