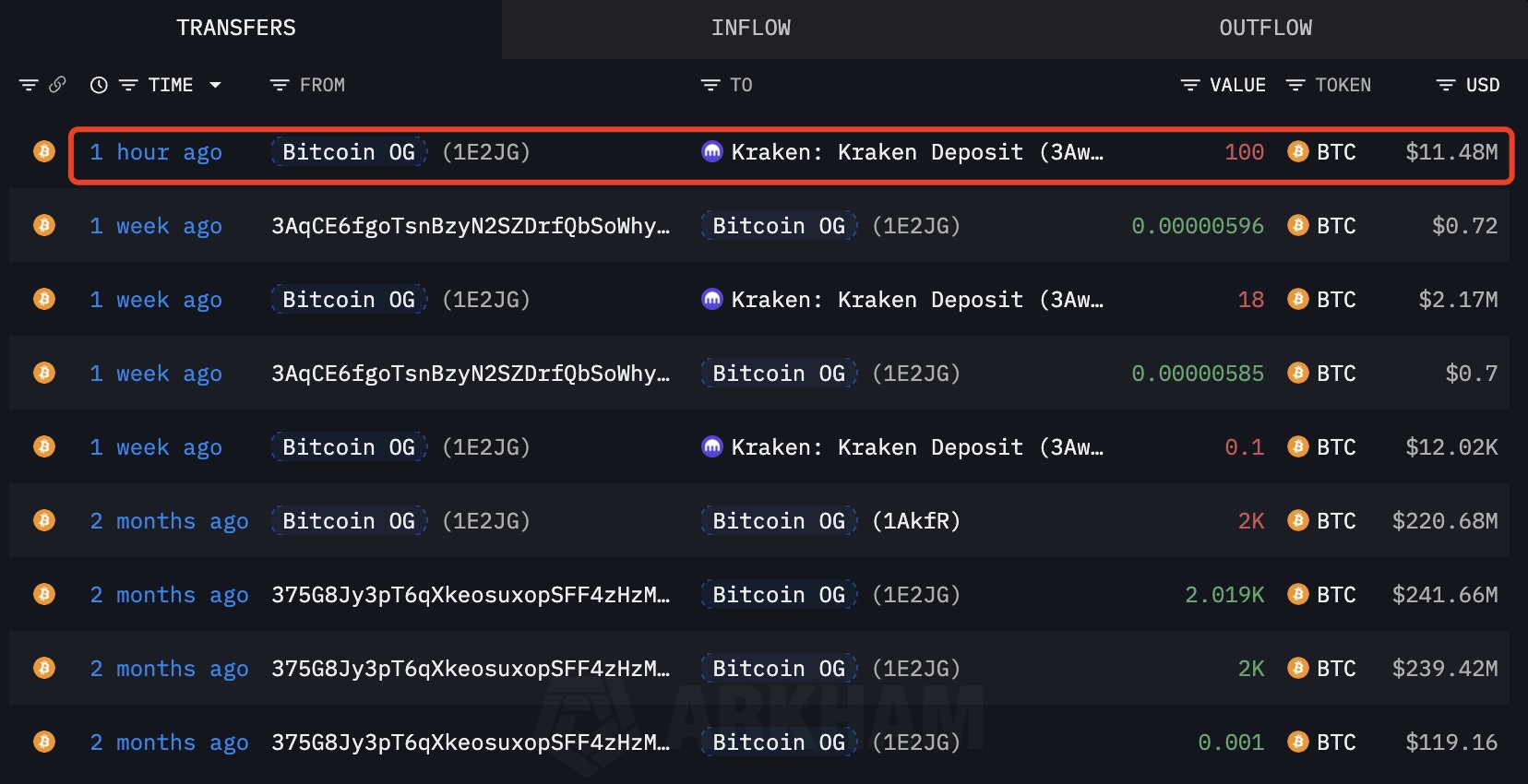

In a startling development, a mysterious crypto whale trader, known by the pseudonym Bitcoin OG, has just deposited 100 BTC into the Kraken exchange.

The Bitcoin OG caught the attention of the broader crypto market after earning an astonishing $160 million in just 30 hours by shorting BTC and ETH right before the market downturn.

When prices plunged following Donald Trump’s announcement of an additional 100% tariff hike on China, the trader closed most of their short positions, securing a massive profit of around $160 million. However, they still maintained an open 10x short position of 821.6 BTC, valued at approximately $92 million.

As prices rebound, Bitcoin OG has deposited 100 BTC, worth approximately $11.48 million, into the Kraken exchange. According to Lookonchain, the trader appears to be adding more funds to his short position to avoid liquidation.

Trader Increases Short Position to $210M

Data from Onchain Lens reveals that the trader has expanded their short position on Bitcoin, increasing both the position size and leverage.

Notably, the position is now valued at around $210 million, with the leverage ratio doubled from 10x to 20x. Currently, Bitcoin OG holds a total short position of 1,823 BTC, entered at $116,812, with a liquidation price set at $120,990.

Bitcoin Price Rebound

In the meantime, cryptocurrency prices, including that of Bitcoin, have rebounded significantly from their October 10 lows. Bitcoin, which dropped to around $104,000 on Friday, is now trading above $114,000.

Interestingly, market observers remain optimistic that the leading crypto asset will sustain its upward momentum, particularly after Donald Trump eased concerns about a potential renewed tariff war.

On Sunday, Trump reassured the public “not to worry about China,” suggesting that both nations may be engaging in talks to prevent further escalation.

If Bitcoin continues its upward trajectory, the leveraged trader may need to add more BTC to their short position to avoid liquidation. At present, the whale holds approximately 1,901 BTC, valued at around $218.9 million.

Dump Incoming?

Following the success of their previous trade, market observers are keeping a close watch, with some speculating that another broader market correction could be imminent.

Meanwhile, Bitcoin is trading at $114,109, reflecting a 2.83% gain over the past 24 hours. The broader crypto market has also advanced during the same period by 4.2%, lifting the global market capitalization to $3.93 trillion.