Bitcoin slipped to $89,000 amid shaky market conditions driven by escalating US–EU geopolitical tensions and rising macro uncertainty ahead of the Bank of Japan’s expected rate increase. Despite the turbulence, new data shows that large investors, often referred to as whales, are aggressively accumulating, signaling renewed confidence during the downturn.

Whale Wallets Expand Holdings as BTC Slides

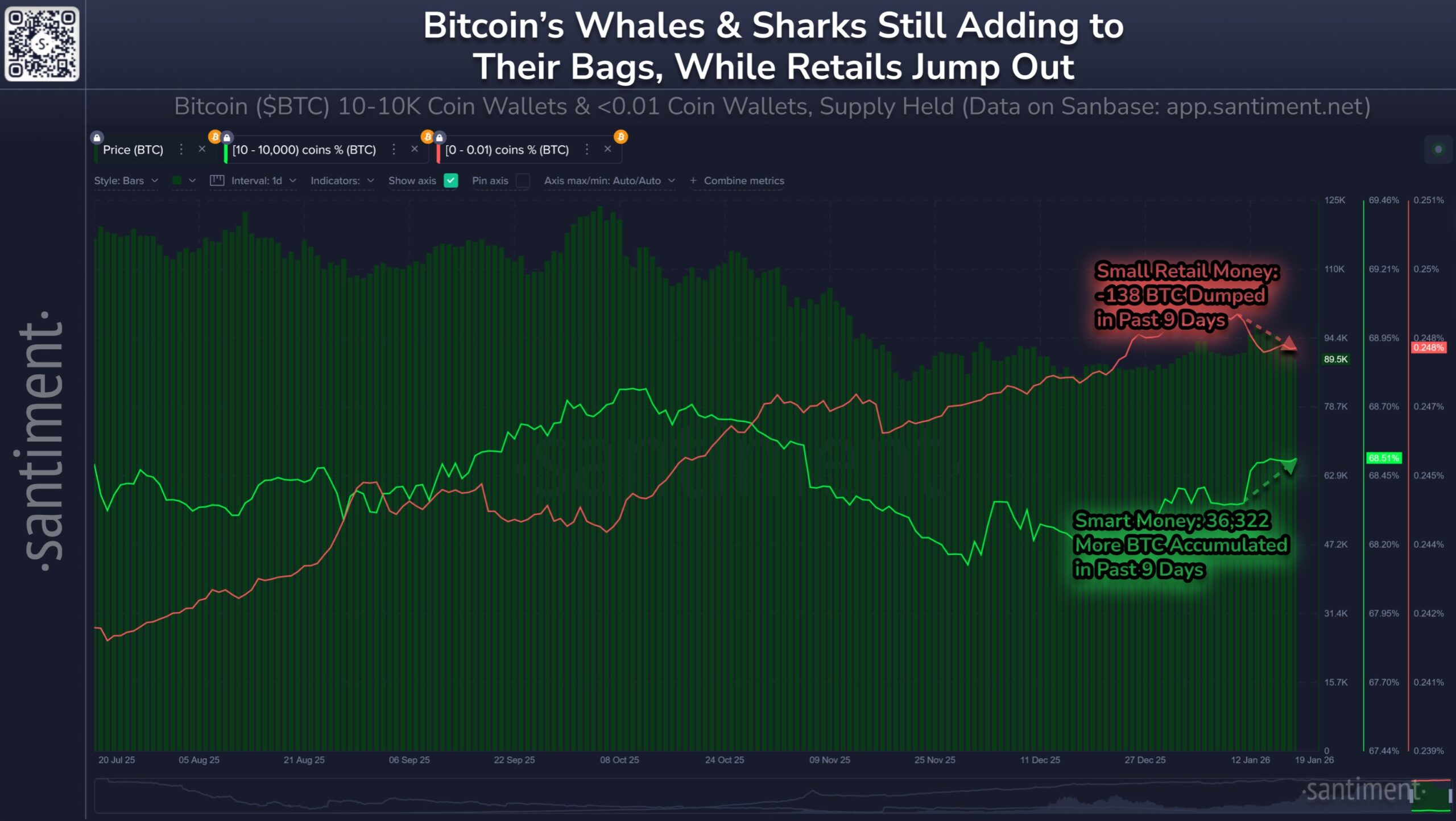

In a recent X post, analytics firm Santiment revealed a sharp contrast in behavior between large holders and retail wallets. According to Santiment, wallets holding between 10 and 10,000 BTC have accumulated 36,322 BTC, worth $3.2 billion, over the past nine days, an increase of 0.27%. Meanwhile, smaller wallets holding less than 0.01 BTC have dumped 132 BTC over the same period, marking a 0.28% decline.

This divergence highlights a familiar pattern: whales and sharks are accumulating while retail investors offload their holdings. Santiment suggested that such conditions often create a prime setup for a bullish crypto breakout.

Meanwhile, it’s worth noting that whales routinely accumulate during fear-driven sell-offs, mirroring previous cycles where they positioned themselves ahead of major market recoveries. Thus, despite the ongoing geopolitical tensions, Santiment believes this pattern is shaping up into a long-term bullish signal.

Institutional Sentiment Strengthens as Major Players Lead Massive BTC Accumulation

Meanwhile, institutions continue to buy Bitcoin in large quantities, reinforcing broader bullish sentiment despite macroeconomic turbulence. One standout example is Michael Saylor’s aggressive accumulation strategy.

According to Lookonchain, Saylor’s firm, Strategy, purchased 22,305 BTC last week, spending $2.13 billion to grow its holdings. The company now controls 709,715 BTC, valued at roughly $64.5 billion.

Institutional appetite is also reflected in ETF activity. Lookonchain reported that spot Bitcoin ETFs saw $1.34 billion in net inflows over the past seven days as of January 20, 2026. This steady institutional participation through ETFs, structured products, and derivatives continues to cushion Bitcoin against macro headwinds.

Bitcoin Price Action: $89K Becomes Critical as Analysts Issue Stark Warnings

Bitcoin’s dip to $89,000 has intensified focus on this level as a critical short-term support zone. Crypto market expert Ted Pillows warned in a recent X post that BTC must hold the $89,000 level, noting that losing this zone could “end its short-term uptrend” and open the door to deeper corrections.

Adding to the caution, veteran trader Peter Brandt recently speculated that Bitcoin could be “on the road to $58,000,” highlighting several breakout attempts on the BTC price chart. Over the past 24 hours, BTC has hovered tightly around the $89,000–$90,000 range, struggling to reclaim higher levels amid elevated volatility.

However, long-term sentiment remains far more optimistic. Several top market executives predicted throughout 2025 that Bitcoin would set a new all-time high in 2026. Bitmine chairman Tom Lee projected that BTC could surge to $250,000 by the end of 2026, citing accelerating institutional adoption.

Meanwhile, BSTR President Katherine Dowling forecasted that Bitcoin would reach $150,000 in 2026, mainly driven by expanding Wall Street participation and growing demand for regulated BTC investment products.