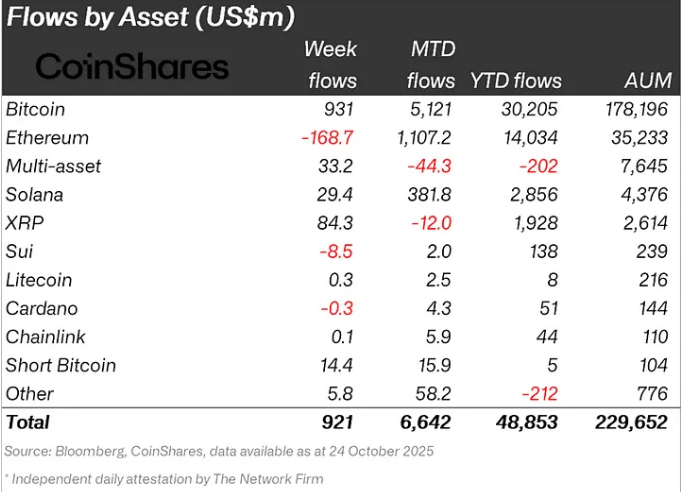

Crypto investment products witnessed a strong surge over the past week, with total net inflows reaching $921 million, according to CoinShares’ latest report for the week ending October 26, 2025. The report highlighted continued investor confidence in Bitcoin, which led with $931 million in inflows. In contrast, Ethereum recorded its first outflows in five weeks, totaling $168.7 million, signaling a shift in market sentiment.

Source: CoinShares

Bitcoin Leads Institutional Demand

Bitcoin once again took center stage, drawing nearly all of the week’s inflows into digital asset investment products. The surge indicates that institutional and retail investors continue to view Bitcoin as the primary store of value in the cryptocurrency sector. Its dominance reinforces the idea that, during market uncertainty, Bitcoin remains the go-to asset for exposure to digital markets.

The inflows also reflect broader investor optimism amid expectations of favorable macroeconomic conditions. Many traders see the current rally as part of a “risk-on” sentiment across global markets. As equity markets strengthen, investors appear to be using Bitcoin to diversify their portfolios. The rise in inflows, combined with elevated trading activity, highlights sustained institutional interest despite ongoing market volatility.

Ethereum Outflows and Altcoin Slowdown as Trading Volume Hits $39B

While Bitcoin saw strong demand, Ethereum’s $169 million outflow marks a notable reversal after five consecutive weeks of inflows. Analysts suggest this could signal a temporary pause in investor enthusiasm or a rotation toward more stable assets like Bitcoin.

Among altcoins, Solana and XRP continued to attract capital but at reduced levels. Solana recorded $29.4 million in inflows, while XRP gained $84.3 million. It is noteworthy that XRP and Solana’s latest inflows are lower compared to previous weeks. This cooling flow suggests a cautious stance among investors as they reassess their exposure to high-risk assets.

Other assets also saw modest inflows, with Litecoin at $0.3 million and Chainlink at $0.1 million. Multi-asset funds also saw $33.2 million in inflows. Meanwhile, Sui and Cardano posted outflows of $8.5 million and $0.3 million, respectively. Overall, the data reflects a strong institutional focus on Bitcoin and select altcoins, while Ethereum faced a temporary pullback.

Trading activity in digital asset exchange-traded products (ETPs) over the past week surged to $39 billion, surpassing the yearly average of $28 billion and signaling renewed market confidence. Analysts link this rise to growing institutional participation and stronger interest in crypto as a diversification asset.

The slowing altcoin momentum suggests a potential consolidation phase ahead, likely driven by broader macroeconomic factors, including the trade war between the U.S. and China.