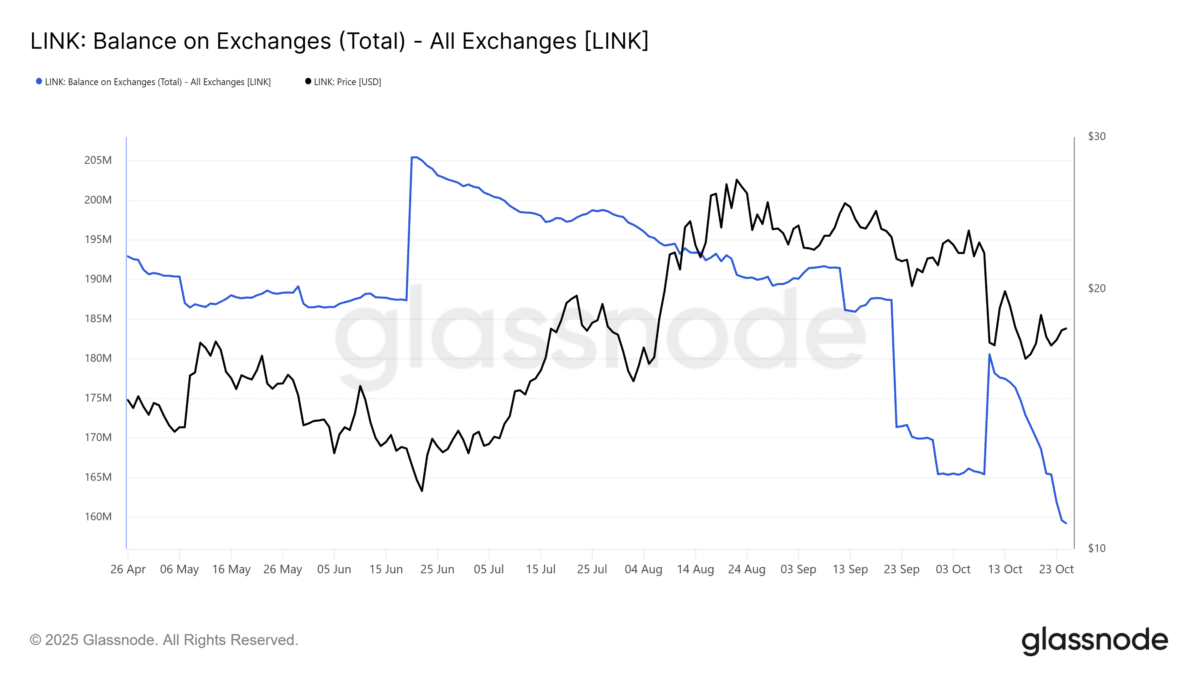

Chainlink’s (LINK) on-chain activity shows a major reduction in exchange-held tokens as large holders continue to move assets into private custody. Data from Glassnode and Lookonchain highlight a decline in LINK’s exchange balances and an increase in whale accumulation since early October, pointing to a tightening liquidity supply environment.

According to Glassnode data, the total LINK balance held on centralized exchanges dropped from about 185 million tokens in early October to nearly 160 million by October 23, marking a decline of 25 million.

Despite the decline in exchange supply, LINK’s price has remained stable between $15 and $20, reflecting investors’ preference to move their holdings into private wallets rather than sell. This accumulation shows growing assurance among long-term holders, who appear to be positioning for future gains rather than short-term profit.

The tightening supply on exchanges implies reduced selling pressure, which could create favorable conditions for a sustained price recovery. According to crypto analyst Tom Tacker’s post on X, if this trend continues, LINK could be on track for a large move upward, possibly reaching the $46 level as liquidity dries up and market demand strengthens.

Whale Activity Surges After Market Volatility

Following the October 11 market downturn, blockchain tracker Lookonchain recorded heightened accumulation by major investors. Approximately 9.94 million LINK, valued at around $188 million, were withdrawn from Binance by 39 newly activated wallets. Additional data showed 30 wallets withdrew 6.25 million LINK worth $116.7 million within several hours of the same period.

Whales keep accumulating $LINK.

39 new wallets have withdrawn 9.94M $LINK($188M) from #Binance since the 1011 market crash.https://t.co/N4RfX2npyl pic.twitter.com/aZcl3uYlZJ

— Lookonchain (@lookonchain) October 27, 2025

Among the largest accumulators, wallet 0xbBF5….2451E added 1.61 million LINK valued at $30.6 million, while wallet 0x068A2…B65daB withdrew 998,592 LINK worth $18.9 million. Other addresses, including 0x11ab0…F34, each secured hundreds of thousands of tokens in separate transactions.

Long-Term Holders Dominate Market Composition

Glassnode’s Holder Accumulation Ratio, which tracks net accumulation among LINK addresses, recently reached 98.9%, indicating that nearly all tracked holders are increasing their balances. This pattern aligns with declining exchange reserves, pointing to reduced short-term liquidity and growing long-term positioning.

The accumulation coincides with expanding adoption of Chainlink’s Cross-Chain Interoperability Protocol (CCIP), which has driven renewed institutional interest in the project’s infrastructure. Analysts monitoring the on-chain data predict that if these storage and withdrawal patterns persist, LINK’s circulating supply on exchanges could continue to contract, possibly influencing short-term market dynamics.

Overall, the decline in exchange reserves and surge in whale accumulation mark a measured shift in investor behavior, highlighting a transition toward self-custody and reduced sell-side activity within the Chainlink network.