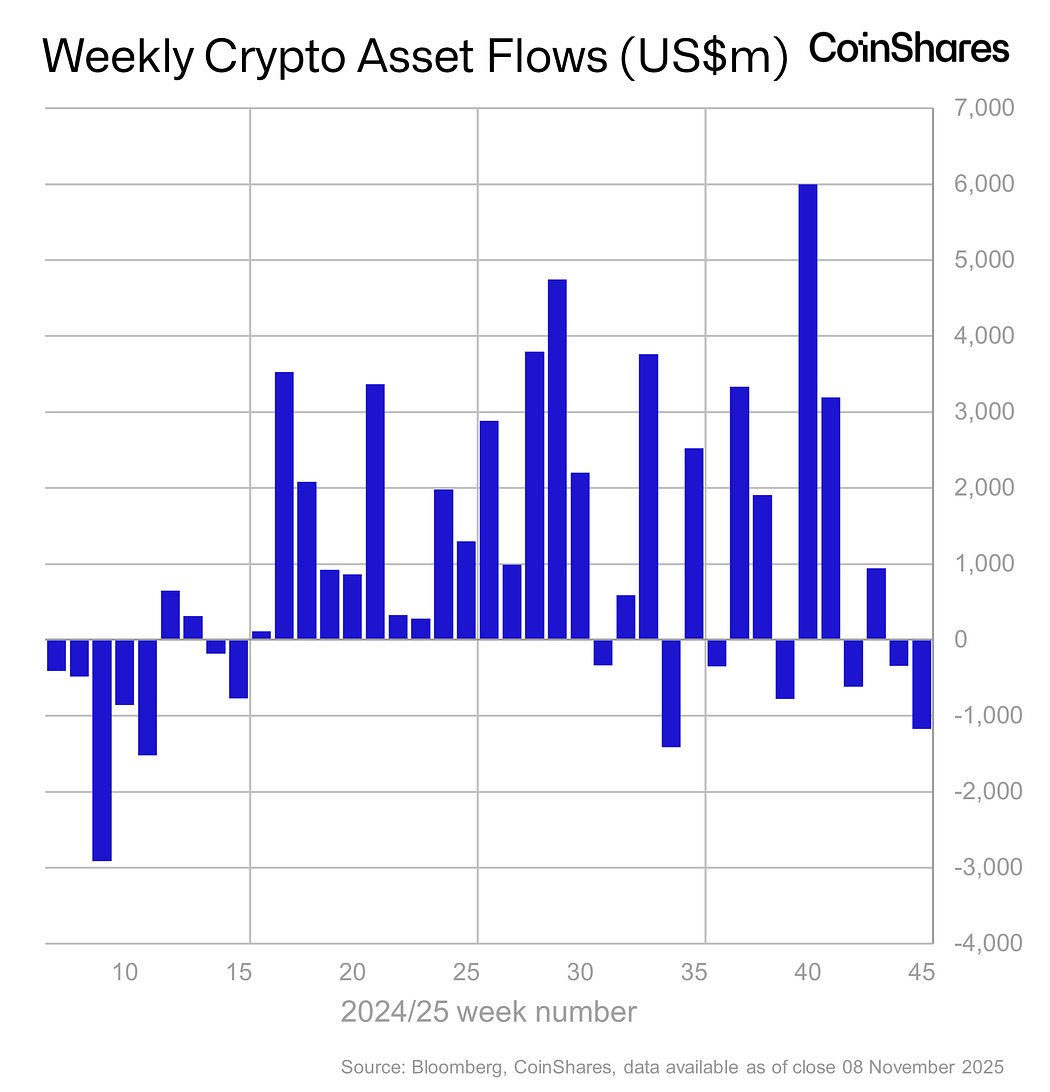

Crypto investment products faced another week of heavy outflows, with market-wide uncertainty fueling a second consecutive billion-dollar exodus. According to CoinShares, digital asset funds saw $1.17 billion in outflows last week, following a $1.4 billion drain the previous week.

The two-week retreat marks one of the worst periods of 2025 and highlights investor anxiety over the prolonged U.S. government shutdown, as well as uncertainty surrounding the Federal Reserve’s next policy move.

Bitcoin investment products incurred the heaviest losses, with $932 million in withdrawals, while Ethereum funds suffered a loss of $438 million. Together, they accounted for nearly the entire decline crypto investment products experienced the previous week.

CoinShares noted that despite heavy selling, exchange-traded product (ETP) volumes reached $43 billion over the past week. This indicates that trading activity remains elevated but sentiment is fragile. Short Bitcoin funds, however, were among the few winners posting $11.8 million in inflows, the largest since May 2025.

Fed Faces ‘Blind’ Decision-Making

The extended U.S. government shutdown has halted the release of key economic data, including inflation and employment figures, leaving policymakers without the usual reference points for the December interest rate decision.

Amid the turbulence, Solana stood out as a rare outperformer. SOL investment products attracted $118 million in inflows, extending their nine-week streak to over $2.1 billion. Other altcoins also saw minor inflows; Hedera investment products added $26.8 million, while Hyperliquid gained $4.2 million.

Regional differences were stark: the United States recorded $1.22 billion in outflows, while Germany and Switzerland registered $41 million and $49 million in inflows, respectively.

Liquidations Mount as Traders Adjust

Meanwhile, the broader crypto market saw $341.85 million in liquidations over the weekend, according to CoinGlass. Short traders bore the bulk of the losses, with 117,978 positions wiped out within 24 hours. Bitcoin accounted for $115.98 million in liquidations, while Ethereum followed with $92.01 million.

Despite the turbulence, prices showed early signs of stabilization. Bitcoin rallied above $106,000, and Ethereum regained $3,650, fueled by optimism that Washington’s budget deal and a proposed $2,000 stimulus plan from President Donald Trump could restore liquidity and lift investor confidence.