Ethereum whales have gone on a buying spree, acquiring $127.7 million worth of ETH in just 24 hours as the token rebounded past $4,100. Data from Lookonchain shows that two newly created wallets accrued a staggering 30,354 ETH late Monday, coinciding with a broader market recovery.

New Whales Buy Millions of Ethereum

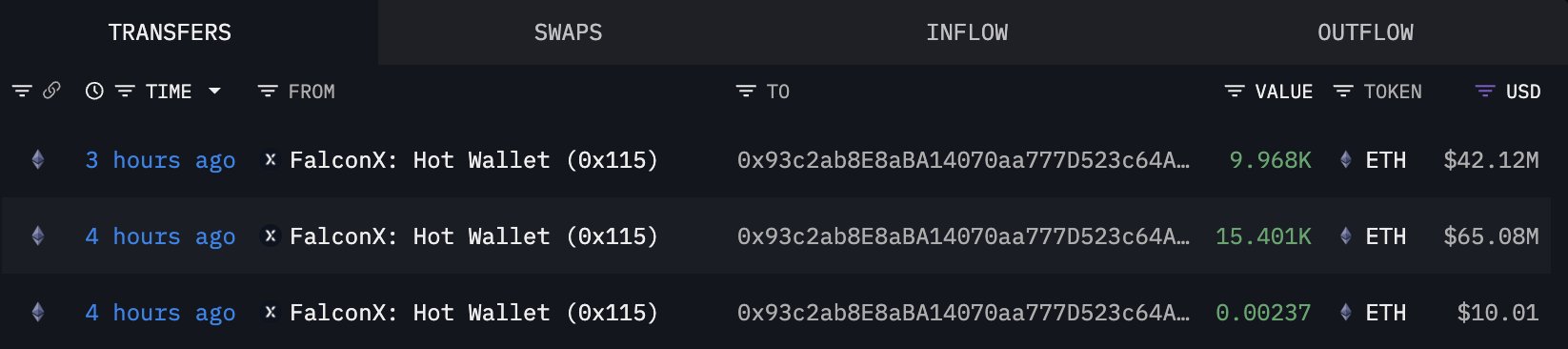

Specifically, the newly created wallet address “0x93c2” received 25,369 ETH ($106.74 million) from the crypto exchange FalconX on Monday at around 21:54 (UTC). The wallet withdrew the funds over three transactions, receiving a test transaction of 0.00237 ETH ($10) before 15,401 ETH and 9,968 ETH.

Meanwhile, Lookonchahin highlighted that the wallet likely belonged to Ethereum treasury firm Bitime Immersion. For the uninitiated, the firm is the largest corporate holder of Ethereum and has Tom Lee as its executive chairman.

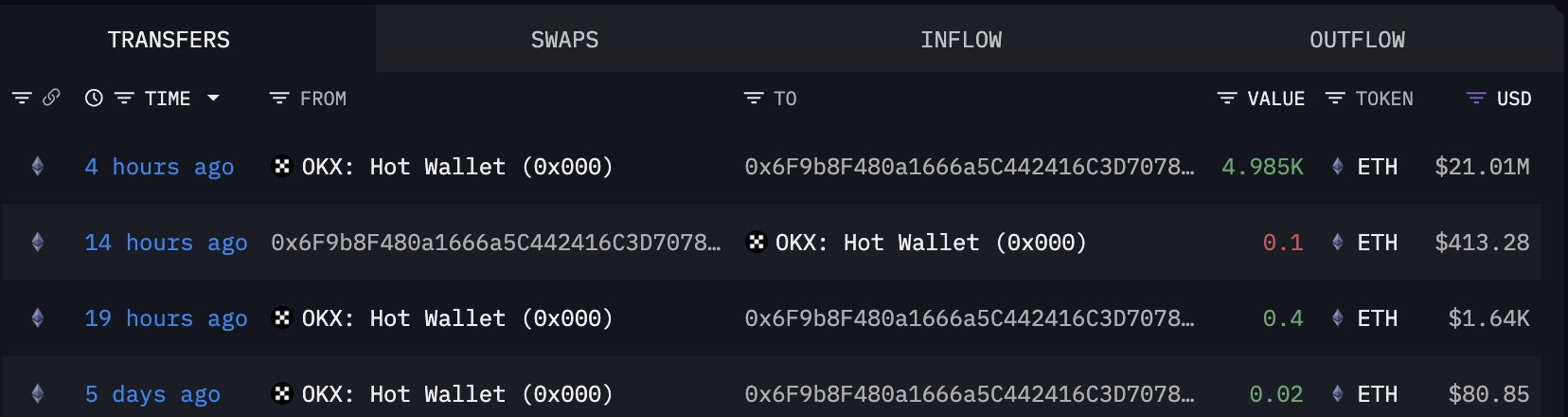

Furthermore, another newly created wallet also bought millions of Ethereum yesterday. The wallet address “0x6F9b” withdrew 4,985 ETH ($21 million) from the top offshore exchange platform OKX. This indicates a renewed interest in Ethereum as the asset continues to show signs of life.

Massive Buy Activity Pushes Ethereum Past $4,100

Remarkably, this comes against a backdrop of heightened volatility. Ethereum fell below $4,000 last week, spurred by negative macroeconomic trends. However, the altcoin king has recovered considerably, surging past $4,100 at the time of writing.

The recovery has sparked bullish momentum within the Ethereum ecosystem, with analysts predicting further upside. For context, pundit Lark Davis noted that ETH has entered its most oversold RSI zone since April, following a 20% decline over the past two weeks.

Historically, such levels have preceded explosive rallies. As such, Davis reminded followers that ETH surged 134% the last time it was this oversold.

Michaël van de Poppe, in a recent tweet on X, reinforced the bullish outlook. He noted that September “is always a terrible month” for crypto, but Q4 and Q1 have historically delivered substantial gains. The analyst projected Ethereum could outperform BTC in a promising Q4.

Meanwhile, Bitmine’s executive chairman, Tom Lee, took an even more aggressive stance, predicting ETH will climb to the $10,000–$12,000 range before year-end.

Ethereum Whale Buying Outpaces Founders’ Sell Pressure

While whales accumulate billions, Ethereum co-founder Jeffrey Wilcke has been quietly moving ETH to exchanges. On September 26, Lookonchain revealed that he transferred 1,500 ETH ($6 million) to Kraken, following similar moves earlier this year.

Still, Wilcke’s movements pale in comparison to whale activity. Over the past three days, 16 wallets have absorbed 431,018 ETH ($1.73 billion) from platforms such as Kraken, Galaxy Digital, BitGo, and FalconX. At least 15 wallets have purchased 406,000 ETH ($1.6 billion) in the last 48 hours, dwarfing Wilcke’s sales.

Furthermore, analyst Zyn noted that 10 wallets purchased 201,000 ETH ($855 million) on September 25, calling it a classic bottoming signal. “This often happens when ETH is getting closer to a bottom,” analyst Zyn emphasized.

With growing momentum, Ethereum’s next moves will determine whether the $4,100 serves as a springboard to new all-time highs.