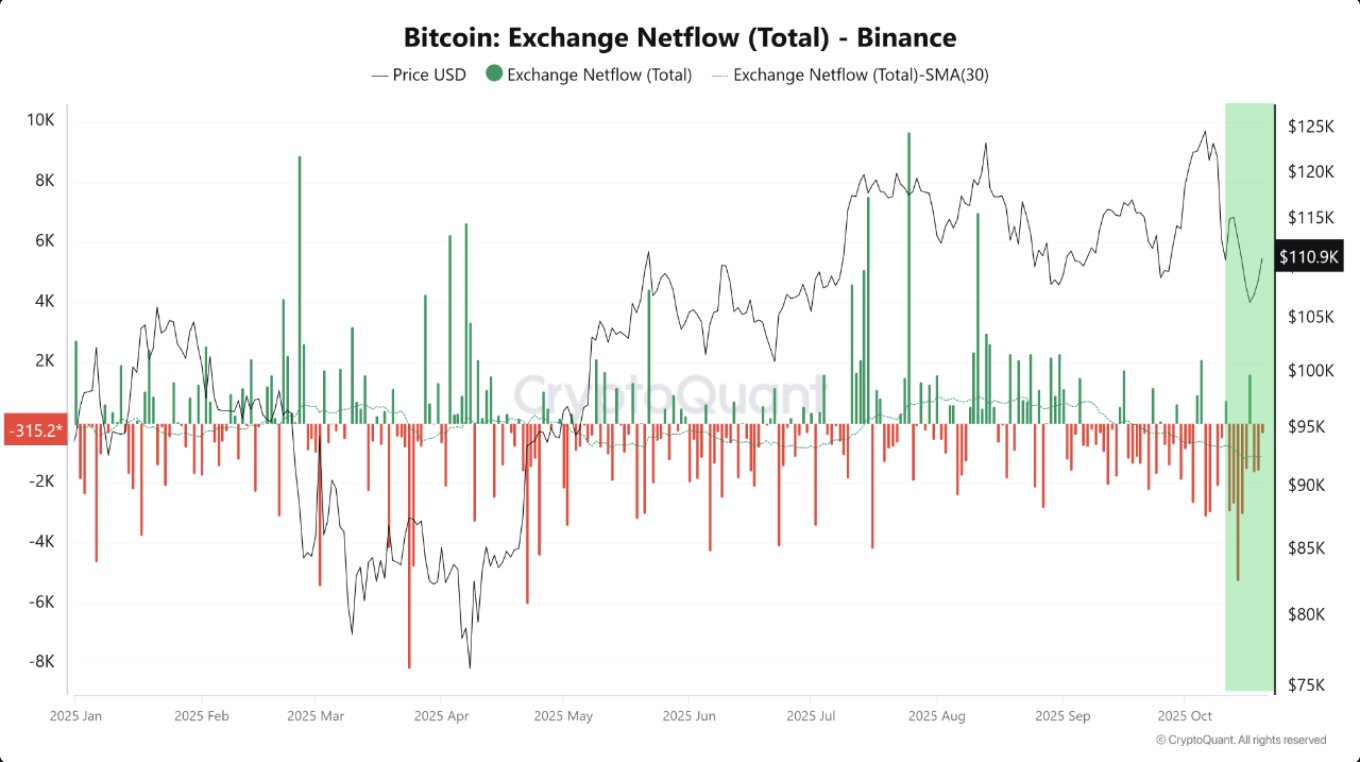

The Binance Bitcoin Netflow metric is signaling a clear shift in investor behavior. The chart from CryptoQuant shows that more Bitcoin is leaving Binance than entering, with the 30-day moving average (SMA30) turning sharply negative. While daily inflows and outflows can fluctuate, the longer-term trend reveals that investors are moving their assets off exchanges, reducing selling pressure and showing confidence in Bitcoin’s future.

Bitcoin Outflows Hint at Accumulation and Market Strength

Recent data shows a strong negative netflow of about -315.2 BTC, meaning more coins are being withdrawn than deposited. This pattern suggests investors are transferring Bitcoin to private wallets for safekeeping, indicating that they are choosing to hold rather than sell BTC. Such movements often appear during accumulation phases, typically preceding periods of price recovery or long-term growth.

Analysts note that this consistent outflow trend points to strengthening market confidence. When large holders or institutional investors begin withdrawing funds from exchanges, it usually reflects an expectation of higher future prices. In simple terms, fewer coins on exchanges means fewer assets available for immediate sale, reducing short-term market pressure.

Bitcoin Price Steadies as Outflows Increase

The CryptoQuant chart shows Bitcoin’s price, represented by the black line, stabilizing during periods of high outflows. This correlation reinforces that declining exchange balances often coincide with reduced selling and improving investor sentiment. Toward October 2025, the green-highlighted section indicates intensified outflows alongside a modest price rebound, a combination that usually signals the early stages of accumulation.

Despite market volatility, Bitcoin recently hit a three-year low in net exchange inflows, further confirming the trend of reduced selling activity. The 30-day moving average smooths out daily noise and highlights this broader shift toward accumulation.

Bitcoin is trading at $107,755 at press time, down 2.73% in the last 24 hours. The price has declined from around $111,000 earlier in the day, showing a short-term pullback after recent gains. Despite the drop, Bitcoin remains near the $107,000 level, suggesting stability as investors await the next market move.

If the current pattern continues, the market could be entering a new consolidation phase, potentially setting the stage for the next bullish cycle, as analyst Burak Kesmeci observed.