A large Chainlink whale has withdrawn a total of 531,671 LINK from Binance in recent weeks, hinting at long-term holding behavior. The move has further sparked fresh speculation in the market about what smart money is planning for Chainlink and where the price may go from here.

Whale Withdraws $2.36M Worth of LINK Off Binance

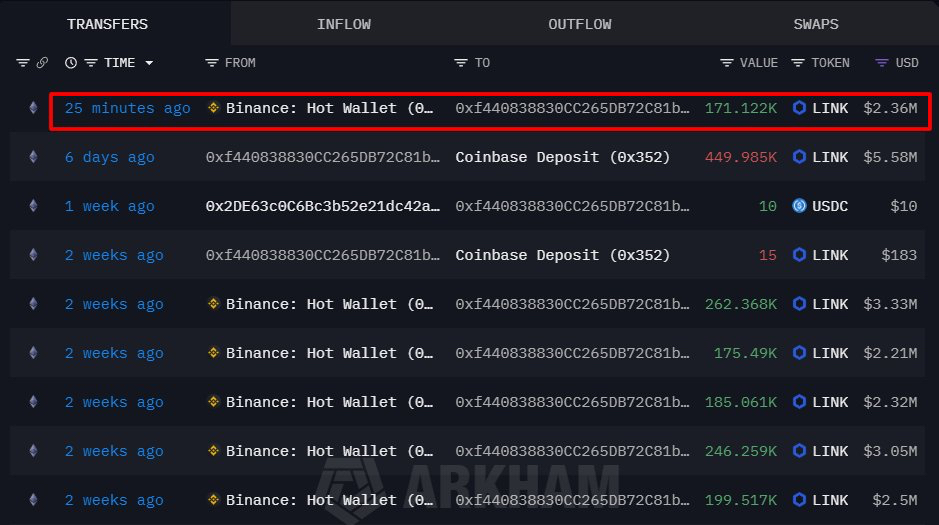

On-chain analytics platform OnchainLens reported that a major LINK whale executed a significant withdrawal from Binance. The large investor moved 171,122 LINK, worth roughly $2.36 million, off the exchange and into a private wallet.

Interestingly, this follows a series of LINK accumulations from this whale. Onchain Lens earlier reported on December 22, 2025, that this same whale had withdrawn $4.53 million in LINK from Binance.

As of then, the Onchain sleuth revealed that this whale wallet now holds over 806,327 LINK worth $10.17 million. However, this most recent transaction has now brought the whale’s wallet balance to just over 789,000 LINK, worth approximately $10.89 million at current prices.

Meanwhile, this kind of behavior is attracting a lot of attention since large withdrawals like this effectively reduce the number of tokens readily available to exchanges. Notably, the move to a private wallet indicates strong confidence rather than a massive sell-off.

Could This Impact LINK’s Price?

While a single whale move won’t send LINK to the moon overnight, it can still influence market psychology. Traders monitor metrics such as exchange reserves and large wallet activity to gauge sentiment. If more whales begin to mirror this behavior and Binance’s LINK balance keeps shrinking, basic supply-and-demand logic suggests that prices could respond positively.

In this case, over half a million LINK disappearing from circulation represents a reduction in immediate selling pressure. LINK is currently trading at $13.86, up 2.4% over the last 24 hours and 11% over the past week.

The Bigger Picture for Chainlink

Chainlink is fast becoming the backbone of price data for many DeFi applications, providing oracle services to thousands of smart contracts. Most notably, BitMEX, the exchange widely credited with inventing crypto-perpetual futures, recently announced that Chainlink’s oracle infrastructure will power its new Equity Perpetuals. Chainlink’s fast, reliable, low-latency price data will power on-chain price data for stocks, ETFs, and more directly on BitMEX.

Many other platforms are also adopting Chainlink’s Data Streams to power tokenized equities and DeFi derivatives, demonstrating growing demand for its institutional-grade oracle services. These strengthen the narrative that Chainlink is one of the most critical infrastructures in crypto today. Thus, the waves of this increased adoption are bound to spill over into LINK’s market positioning.

Perhaps this is why the LINK whale has chosen to accumulate and hold such large amounts of the token. They would thus be well-positioned to benefit from future rallies. In any case, the move signals strong confidence in the token and could drive positive price action if more whales follow suit.