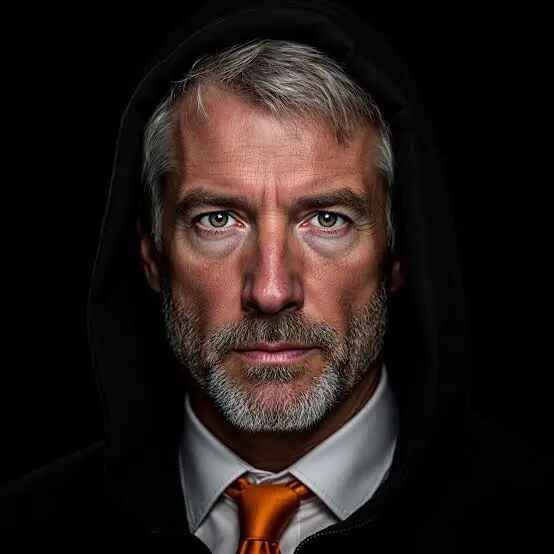

Michael Saylor, Executive Chairman of Strategy, has publicly urged Saudi Arabia’s $3 trillion sovereign wealth fund to invest in Bitcoin. Speaking in an interview, Saylor highlighted Bitcoin’s scarcity and unmatched long-term potential.

According to him, investing in Bitcoin could enable Saudi Arabia to multiply its wealth significantly over time. He boldly claimed that Bitcoin offers a path to potentially “1,000x your money.”

🇺🇸 MICHAEL SAYLOR URGES SAUDI ARABIA'S $3 TRILLION SOVEREIGN WEALTH FUND TO BUY "ALL THE #BITCOIN"

THAT’S HOW YOU “1,000X YOUR MONEY” pic.twitter.com/HLhB5uMj4t

— Vivek Sen (@Vivek4real_) October 21, 2025

Saylor’s argument centers on Bitcoin’s fixed supply and rising global demand. By acquiring Bitcoin early, he believes, Saudi Arabia could secure a strategic edge in digital finance. He sees this as a future-proofing tactic—transforming oil-based wealth into decentralized digital value.

He highlighted that sovereign investments would not only legitimize Bitcoin on the global stage but could also drastically shift supply dynamics, paving the way for broader adoption.

Bitcoin Is Unstoppable

In his view, Bitcoin’s momentum is “pretty unstoppable,” highlighting what he sees as a major milestone in its path toward full global legitimacy.

According to him, the White House’s recognition of Bitcoin as the sole digital commodity marks a defining moment for the asset. He suggested that with the “most powerful man,” President Trump, signaling confidence in Bitcoin, the final barrier to mainstream acceptance has effectively been cleared.

Strategy Adds 168 BTC

Saylor’s commentary aligns closely with his company’s continued investment in Bitcoin. Yesterday, Strategy announced it had purchased 168 BTC between October 13 and 19, 2025. The acquisition, totaling $18.8 million, was funded through the sale of perpetual preferred stock. The company paid an average price of $112,051 per Bitcoin and eventually grew its Bitcoin holdings to 640,418.

This latest purchase follows subtle hints from Saylor himself. According to Coin Remark, just days earlier, he posted a chart on X titled “Saylor Bitcoin Tracker” with the caption, “The most important orange dot is always the next.” Such cryptic messages have previously signaled incoming Bitcoin buys from MicroStrategy.

Michael Saylor Sees Governments as Bitcoin’s Next Big Buyers

Saylor’s call to action suggests that the next primary demand wave could come from governments, not just institutions. If Saudi Arabia were to invest even a portion of its $3 trillion sovereign wealth fund in Bitcoin, it might encourage other nations to follow.

Sovereign adoption could transform Bitcoin from a speculative asset into a core component of global financial strategy. It is worth mentioning that the United States has also indicated plans to establish a Bitcoin-only Strategic Reserve (SBR), with several nations also considering following suit.

As traditional finance continues to evolve, Saylor’s message stands out: Bitcoin is not just a hedge, it’s a long-term opportunity for nations to preserve and grow wealth in a digital age.