Mt. Gox triggered renewed uncertainty on Tuesday after moving more than 10,608 BTC to a new blockchain wallet. Traders reacted sharply as the transfer coincided with one of the steepest market sell-offs of the year, with Bitcoin falling below $90,000 and major altcoins sliding deeper into bearish territories.

The defunct exchange shifted 10,423 BTC worth $936 million to a fresh wallet following eight months of inactivity, according to Lookonchain. A few minutes later, another 185.2 BTC worth $16.8 million was moved to one of Kraken’s hot wallets, adding pressure during a turbulent session for Bitcoin, Ethereum, XRP, BNB, Solana, and Cardano.

For context, the last time the wallet moved funds was eight months ago, when it transferred 893 Bitcoin to prominent crypto exchange Kraken. Ever since, the wallet has been dormant and recently came out of hibernation today to move 10,423 BTC to a newly created blockchain address.

After 8 months of inactivity, Mt. Gox just transferred 10,423 $BTC($936M) to a new wallet.https://t.co/wKkooF4WWR pic.twitter.com/FtMCnDXcm2

— Lookonchain (@lookonchain) November 18, 2025

The latest transactions surfaced only weeks after trustee Nobuaki Kobayashi extended the repayment deadline from October 2025 to October 2026, as many creditors had not completed the required documentation. The timing raised questions about whether the movements reflected internal restructuring or preparations for eventual distributions. In the meantime, the trustee has not issued a statement on the purpose of Tuesday’s transfers.

Mt. Gox maintains roughly 34,689 BTC valued at over $3 billion after distributing more than 107,000 BTC since July 2024. More than 19,500 creditors received BTC or BCH by March 2025, according to official disclosures.

Analysts Split on Motives Behind Transfers

Although some traders speculated that the latest transfers could be signs of incoming selling pressure, some analysts urged caution. Market commentator Ted suggested on X that the movements resembled standard wallet reshuffling, especially given the extended repayment window. Earlier activity supports that argument.

Mt. Gox has transferred $970,460,000 in $BTC to a new address today.

A few weeks ago, it was reported that Mt. Gox has delayed its repayments to Q4 2026.

It seems like this is just wallet reshuffling and nothing else. pic.twitter.com/J3NRW0zC0j

— Ted (@TedPillows) November 18, 2025

When Mt. Gox moved 893 BTC in March 2025, Glassnode noted that transfers often represent administrative handling within the repayment process rather than active selling.

Whales Accumulate As Smaller Holders Exit

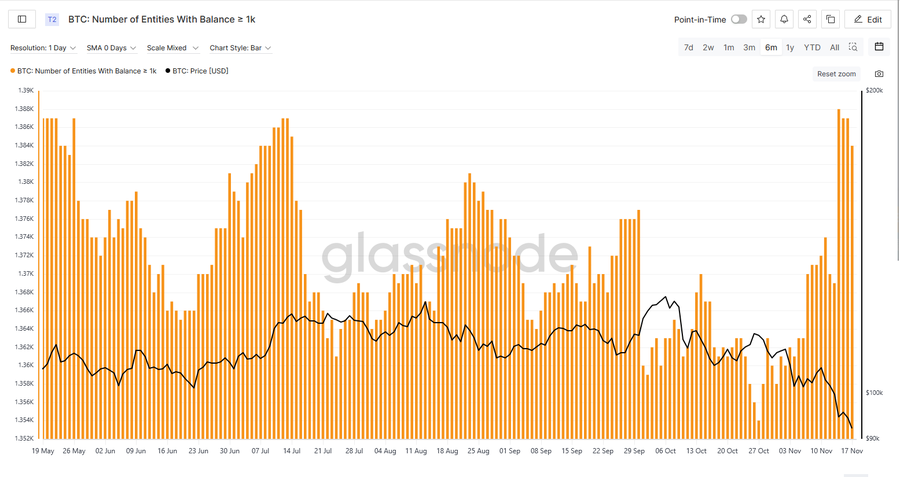

Despite the downturn, larger investors increased their exposure. Glassnode data shows whale wallets holding more than 1,000 BTC climbed from a yearly low of 1,354 on Oct. 27 to 1,384 on Monday, marking a 2.21% rise. The metric reached its highest level in four months, suggesting high-value accounts viewed the correction as an opportunity.

Conversely, wallets holding at least 1 BTC dropped to 977,420 by Nov. 17, the lowest level this year. Many smaller holders appear to be retreating after accumulating during the $102,000 to $107,000 range.