XRP’s on-chain utility is gaining momentum as Flare’s FXRP supply approaches 100 million tokens, with the majority already locked in decentralized finance applications. Flare Networks shared the news and accompanying data in a recent X post.

FXRP Supply Climbs as DeFi Participation Accelerates

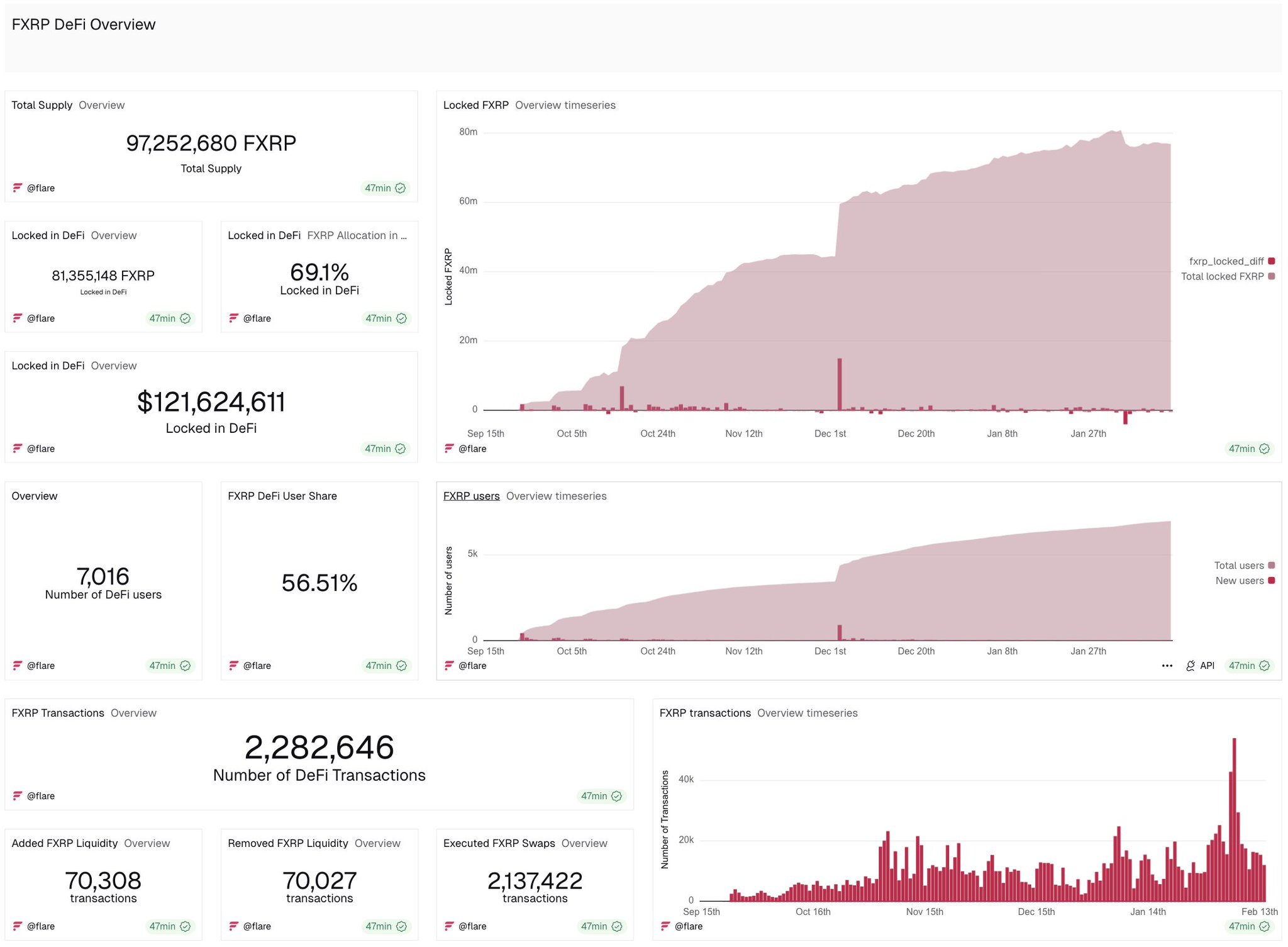

Flare’s dashboard reveals that over 81 million FXRP, representing 69.1% of the roughly 97.25 million tokens in circulation, are now locked in DeFi contracts, translating to about $121 million in total value locked across the ecosystem. Meanwhile, user adoption continues to rise, with the number of DeFi participants surpassing 7,000, and network activity accelerating, as total transactions have climbed beyond 2.28 million.

The supply growth chart shows a steady upward trajectory over recent months, with periodic jumps that suggest new capital entering the system. Liquidity activity remains balanced, with over 70,000 FXRP liquidity additions and removals recorded, alongside more than 2.1 million FXRP swaps executed.

The XRP community has responded favorably to these developments as they took to the comment section of the Flare Network post to express their bullish outlook. As many have implied, a high lock ratio at this scale signals large-scale structural engagement. Locked tokens are generally used in lending markets, liquidity provisioning, or structured yield products.

That utility can reduce freely circulating supply and strengthen protocol usage. The development also reflects XRP’s evolution from a payment vehicle to full-fledged financial infrastructure.

XRP Sees Over $2 Billion In DAT Investment Despite Weak Performance

XRP Extends On-Chain Utility

FXRP is an initiative from Flare that allows users to bridge their XRP tokens to Flare’s DeFi ecosystem, granting them access to the evolving world of decentralized finance (DeFi). For years, XRP’s primary narrative centered around cross-border payments and settlement efficiency. FXRP changes that dynamic by enabling XRP holders to bring their assets into smart contract environments without relinquishing exposure to XRP itself.

This unlocks use cases that were previously unavailable on the XRP Ledger natively. XRP holders can now participate in borrowing, lending, liquidity provision, and other programmable financial activities. As more XRP enters these environments, the asset transitions from being purely transactional to becoming an integrated financial infrastructure.

Flare’s post also emphasized scaling these use cases “from retail usage today to institutional workflows over time.” Thus, the DeFi strategies that retail traders are currently experimenting with, and the infrastructure being built, could eventually support larger-scale participation from institutions, who tend to require reliable collateral frameworks, predictable yield mechanisms, and transparent liquidity pools.

XRP News: Ripple Expands Custody Services to Ethereum and Solana Staking