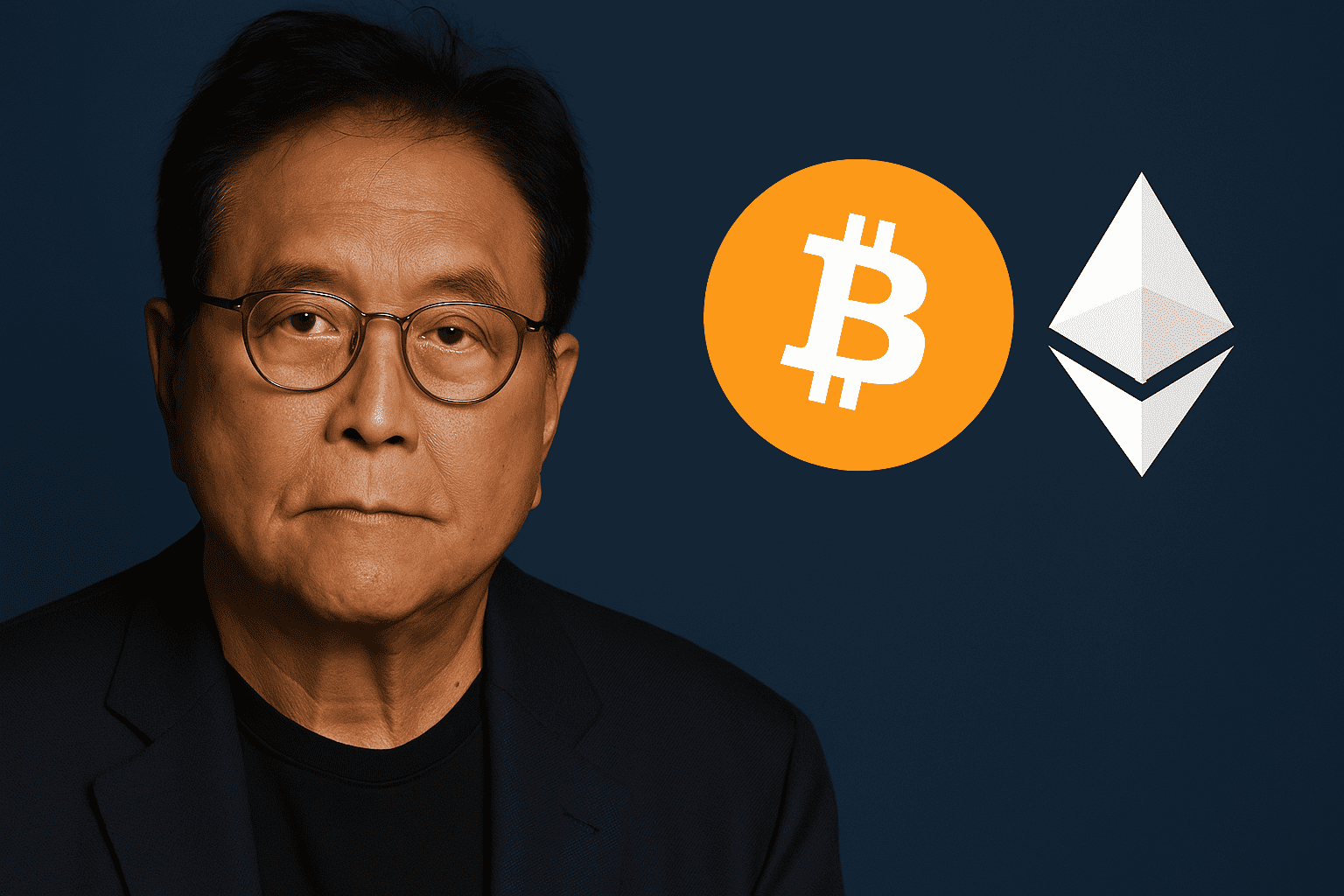

Robert Kiyosaki, the author of financial literacy book ‘Rich Dad, Poor Dad,’ has sounded an alarm over the future of the U.S. dollar, urging investors to seek refuge in Bitcoin and Ethereum.

The financial literacy author expressed this view in a recent X post, where he wrote, “End of U.S. Dollar?” suggesting a possible decline in the currency’s long-standing dominance within the global financial system.

Only Losers Save in Dollars

This view aligns with his long-held belief that the U.S. dollar is steadily losing its purchasing power due to unchecked government spending, excessive money printing by the Federal Reserve, and soaring national debt.

Believing that global confidence in the dollar has eroded, Kiyosaki has repeatedly warned that holding the currency is becoming increasingly risky. He reaffirmed this stance today, bluntly referring to those saving in dollars as “losers.”

Kiyosaki Is Buying More Bitcoin and Ethereum

Consequently, he disclosed that he is increasing his investments in Bitcoin and Ethereum, the world’s two largest cryptocurrencies by market capitalization. In addition to Bitcoin and Ethereum, Kiyosaki also mentioned that he would acquire more gold.

It is worth noting that all three assets are viewed as hedges against economic uncertainties and the debasement of fiat currencies. In particular, Kiyosaki has consistently praised Bitcoin, referring to it as the future of money.

Meanwhile, the financial literacy author encouraged his more than 2.8 million followers to be winners, suggesting that they should protect their wealth by diversifying their assets into Bitcoin, Ethereum, or even gold.

END of US Dollar?

Adding to my gold, silver, Bitcoin, and Ethereum stack.

Savers of US dollars are losers.

Be a winner.

Take care.

— Robert Kiyosaki (@theRealKiyosaki) October 8, 2025

His commentary comes in the wake of growing concerns about the debasement of the dollar due to excessive money printing. Anthony Pompliano, the founder of Professional Capital Management, echoed this stance yesterday, noting that the price of Bitcoin will continue to increase as global governments continue to print more money.

Unlike the U.S. dollar, which has an unlimited supply, Bitcoin is capped at 21 million coins — a feature that allows its value to appreciate over time. By increasing his Bitcoin holdings, Kiyosaki is aligning himself with the growing sentiment that BTC can serve as a hedge against fiat instability.