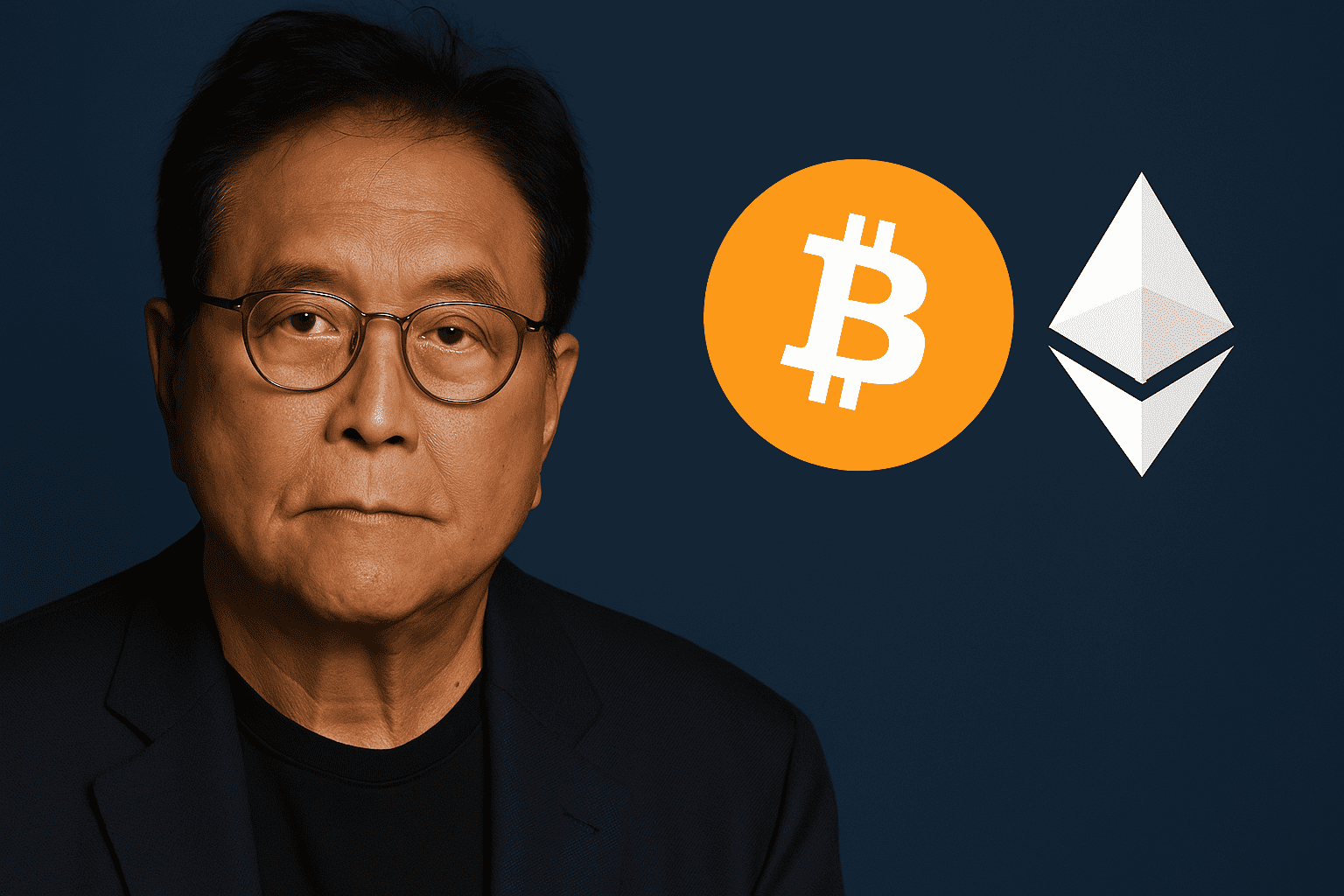

Rich Dad Poor Dad author Robert Kiyosaki has issued another warning about a possible market meltdown, saying “millions will be wiped out.” In a post on X, he cautioned investors to safeguard their wealth by holding assets like precious metals gold and silver, as well as Bitcoin, and Ethereum.

The financial author did not specify when the crash might occur, but suggested that traditional markets are heading toward a deep correction. Kiyosaki’s post read, “MASSIVE CRASH BEGININING: Millions will be wiped out. Protect yourself. Silver, gold, Bitcoin, Ethereum investors will protect you. Take care.”

His comments quickly went viral across online trading and crypto circles, sparking debate over his long-standing predictions of systemic collapse.

History of Repeated Warnings and Market Parallels

Kiyosaki has long argued that excessive debt, loose monetary policy, and asset inflation expose investors to significant risks. His 1997 bestseller popularized the idea of building wealth through tangible assets and entrepreneurship rather than relying on traditional investments. Over the years, he has repeatedly referred to paper assets as “fake” and urged diversification into commodities and cryptocurrencies.

In October, he issued a similar warning after new U.S. tariffs on China led to a sell-off in crypto markets. Bitcoin fell from $122,000, wiping out about $19 billion in leveraged positions within hours. Kiyosaki called the episode proof that global markets remain built on “paper promises.”

Currently, Bitcoin trades around $110,079, up 0.11% over the past day but down 7.1% in the past month. Ethereum exhibits a similar trend, rising 0.64% daily while losing 12% monthly, reflecting the broader volatility in the cryptocurrency sector.

Analysts Split Over Warning’s Credibility

Financial analysts remain divided over Kiyosaki’s latest claim. Market analyst Jonesy observed that the recent Federal Reserve rate cuts resemble the patterns that preceded major crashes in 2000, 2007, and 2020. “Rate cuts have started again,” he said. “This isn’t fearmongering, it’s history repeating itself.”

Been calling this for weeks.

Rate cuts have already started. Just like they did in 2000, 2007, and 2020… right before -49%, -56%, and -35% drawdowns.

Super Trend’s flipping back and forth from red to green with my Signal line diverging.

This isn’t fear mongering. It’s history… pic.twitter.com/LztSenwEK8

— TraderJonesy (@TraderJonesy) November 1, 2025

Investor Avinash Mishra echoed that sentiment, pointing to America’s $35 trillion national debt. “This bubble’s primed to burst,” he said. “I’ve been stacking silver and Bitcoin since 2020 as protection against the fiat trap.”

Meanwhile, some crypto advocates viewed Kiyosaki’s warning more optimistically. Online commentator “Puck” said market turbulence often fuels long-term price growth. “Crashes fuel the next rally,” he wrote, emphasizing that Bitcoin’s resilience above $110,000 underscores continued investor confidence.