Strategy, a Bitcoin treasury firm chaired by Michael Saylor, has reiterated its confidence in its Bitcoin-heavy treasury approach, stating it can service its debt obligations even in an extreme scenario in which Bitcoin falls to $8,000. The statement comes as market volatility continues to test corporate crypto strategies and investor sentiment across the digital asset sector.

Strategy Signals Confidence in Debt Coverage in Extreme BTC Crash Scenario

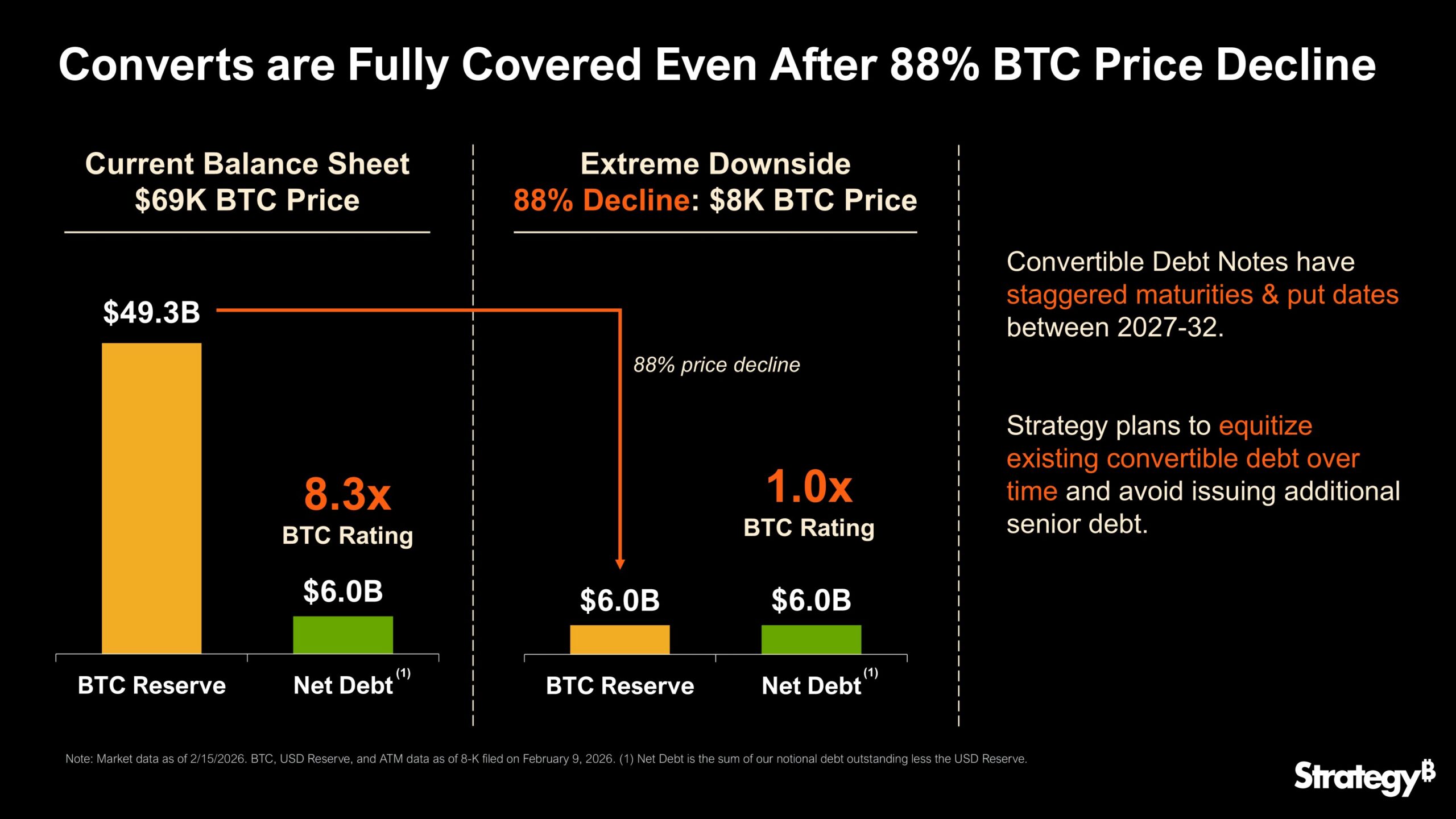

Michael Saylor’s Bitcoin treasury firm, Strategy, in a recent post on X, revealed that it can still comfortably cover its debts even if Bitcoin crashes to $8,000. Strategy, using a supporting chart, highlighted that the firm currently holds roughly $6 billion in net debt. According to the firm’s projections, even if Bitcoin were to crash by about 88%, the value of its Bitcoin reserves would still remain within its total net debt exposure.

Meanwhile, the firm also revealed plans to begin equitizing its convertible debt over the next three to six years. This strategy would effectively reduce the debt burden on its balance sheet while helping prevent the need to issue new senior debt. The move signals a shift toward strengthening long-term financial flexibility while maintaining its core Bitcoin accumulation strategy.

Strategy Maintains BTC Accumulation Despite Volatility and Unrealized Losses

Meanwhile, the firm has maintained its Bitcoin accumulation plan despite ongoing market volatility. On February 9, Strategy purchased an additional 1,142 BTC, worth roughly $90 million. That purchase brought the company’s total Bitcoin holdings to approximately 714,644 BTC, valued at around $54.35 billion.

Michael Saylor’s Strategy Boosts Bitcoin Holdings to 714,644 BTC With $90M Fresh BTC Buy

Interestingly, Saylor also made his regular Bitcoin tracker post yesterday, a move many market watchers interpret as a signal of another potential Bitcoin purchase in the near term. The CEO has built a reputation for posting these tracker updates shortly before announcing new acquisitions.

It is worth noting that Strategy is currently down by more than $5 billion in unrealized losses due to market fluctuations. Despite this, both the firm and its executive chairman remain unwavering in their long-term Bitcoin conviction, viewing price dips as strategic accumulation opportunities rather than warning signs.

BTC Price Outlook Remains Central to Strategy’s Future

In the meantime, Bitcoin price performance remains the single most important factor for Strategy’s long-term outlook. While the firm claims resilience even at $8,000, such a level would likely signal a major systemic event across the digital asset market.

According to CoinMarketCap data, Bitcoin has slipped by roughly 2.3% over the past 24 hours and is currently trading above $68,000. The short-term pullback highlights the ongoing volatility in the crypto market even as prices remain historically elevated compared to previous cycles.

In the near term, analysts remain divided on Bitcoin’s trajectory. Some expect continued volatility driven by global interest rate trends and broader risk asset flows. While others believe increasing institutional participation and long-term supply constraints could help stabilize prices over time and even lead to an explosion to a new all-time high.

Michael Saylor’s Strategy Adds 2,932 BTC as Bitcoin Nearly Erases YTD Gains