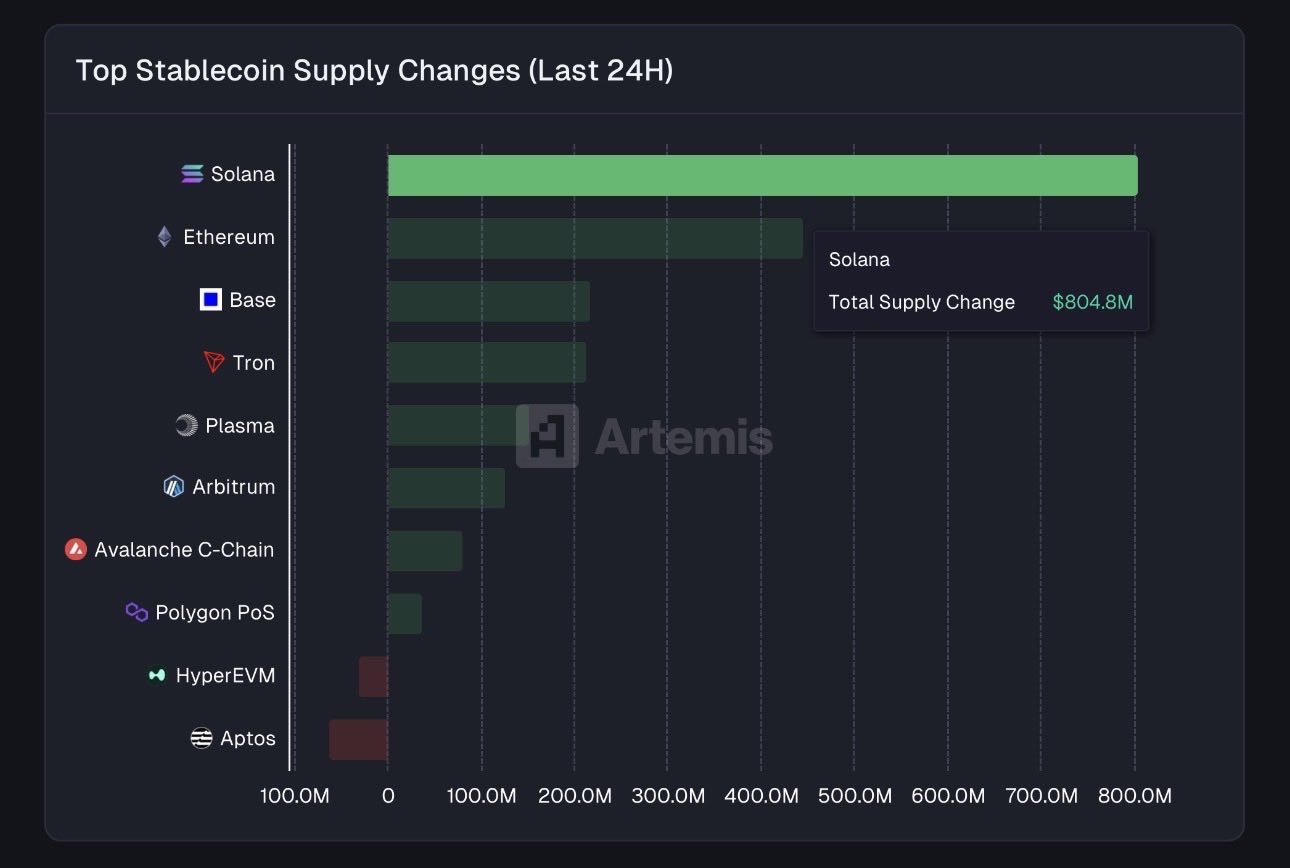

Solana has recorded a historic surge in on-chain liquidity after attracting $800 million in stablecoin inflows within just 24 hours, marking one of the largest single-day inflows seen across any blockchain network this year.

Solana Outpaces Ethereum and Other Networks

The $800 million stablecoin inflow represents a significant milestone for Solana, particularly given the competitive landscape among Layer-1 and Layer-2 networks. While Ethereum continues to dominate in total value locked (TVL), Solana’s ability to attract liquidity at this pace highlights its increasing relevance for active traders and protocols that prioritize speed and cost efficiency.

According to Artemis Analytics, Solana not only led all chains in net stablecoin inflows during the 24-hour window, but did so by a wide margin. The figures for Ethereum, Base, and Tron stood at around $200 million – $250 million, respectively. The influx helped push Solana’s stablecoin supply to more than double its level from a year ago to $14.6 billion, reflecting sustained growth rather than a one-off anomaly.

Stablecoin Growth Signals Rising Network Activity and ETF Inflows

Stablecoins serve as the backbone of on-chain liquidity, enabling trading, lending, and payments without the volatility of native tokens. A rapid increase in stablecoin balances often signals heightened network usage, whether from traders positioning for market moves, DeFi protocols scaling operations, or institutions allocating capital.

Solana’s year-on-year doubling in stablecoin supply suggests that the network is increasingly being used as a primary settlement layer rather than a speculative alternative. This trend has coincided with rising activity across decentralized exchanges, meme coin trading, and consumer-facing applications.

ETF participation also provides a layer of demand. U.S. spot Solana ETFs recorded $8.9 million in net inflows on January 15, highlighting growing institutional interest in SOL exposure through regulated products. While still small compared to Bitcoin and Ethereum ETFs, the steady inflows suggest that Solana is gaining recognition beyond retail and crypto-native investors.

Why Capital Is Flowing Into Solana

Several factors appear to be driving the surge in stablecoin inflows. Solana’s low transaction fees and high throughput continue to make it attractive for traders and developers alike, especially during periods of heightened market activity. Unlike networks that experience congestion and rising costs during demand spikes, Solana has positioned itself as a high-performance alternative.

Beyond infrastructure, Solana has seen renewed momentum in DeFi, an explosion of memecoin activity, and real-world experimentation through initiatives such as Visa’s blockchain pilot programs. Together, these elements have helped transform Solana into a liquidity-driven ecosystem.

SOL Price Outlook and Market Expectations

The influx of stablecoins has fueled optimism around Solana’s price trajectory. SOL is currently trading near $142, with traders watching closely for a potential move toward $170 in the short term. If momentum continues and on-chain liquidity remains elevated, some analysts project more ambitious year-end targets ranging from $250 to as high as $420.

While such projections depend on broader market conditions, the underlying liquidity growth strengthens the case for sustained upside rather than purely speculative rallies.