XRP is back in the spotlight after a leading market analyst pointed to a key technical indicator suggesting the asset may be in a full reset phase rather than a bearish cycle. The development comes as the broader crypto market battles heightened volatility, leaving investors closely watching XRP for signs of its next major move.

Key Indicator Suggests XRP Market Reset

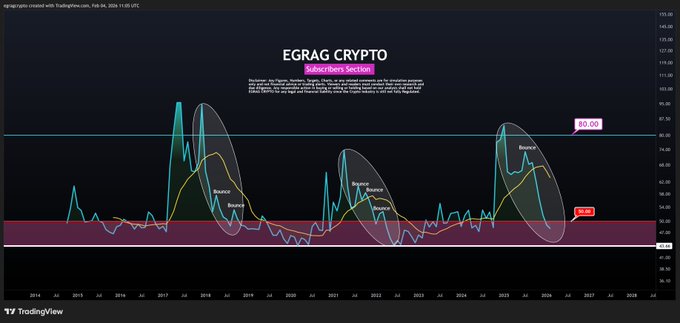

Renowned crypto analyst EGRAG CRYPTO has, in a recent post on X, speculated that contrary to popular opinion, XRP is not currently in a bearish cycle but is instead undergoing a full reset phase. The analyst based this assessment on XRP’s Relative Strength Index (RSI), which is currently sitting around the 45–50 range. According to EGRAG CRYPTO, this level acts as a macro support band for the token across market cycles.

The analyst noted that historically, whenever RSI compresses within this range, XRP tends to experience a violent market shakeout. During these periods, weak hands typically exit positions while overall market momentum resets.

This phase is often followed by substantial price expansion once market structure stabilizes. However, EGRAG CRYPTO cautioned that the token could enter a bearish phase if its RSI drops below 43.

Market Sentiment and Broader Crypto Conditions

The bold speculation comes at a time when the broader crypto market is struggling with intense volatility. Data from asset tracker CoinMarketCap shows that the entire crypto market cap has dropped by roughly 2.5% to around $2.61 trillion.

Bitcoin, the largest crypto asset by market value, recently crashed below its April 2025 low, briefly trading around $73,000 before rebounding. The asset is currently trading around $75,000, reflecting continued instability in market sentiment.

Ethereum has also mirrored this weakness, trading around $2,100. The crypto ETF market has not been spared from the volatility. Bitcoin spot ETFs recorded a steep $272 million outflow as of February 3, 2026, signaling cautious institutional positioning.

Meanwhile, Ethereum ETFs posted a modest inflow of approximately $14.02 million, suggesting selective institutional interest despite broader market weakness.

XRP Price Prediction

Analysts suggest that if the full reset phase theory plays out successfully, XRP could position itself for a major expansion phase that could potentially push the asset toward a new all-time high. Historically, similar reset structures in crypto markets have preceded aggressive bullish cycles once selling pressure is fully absorbed.

Interestingly, Standard Chartered had earlier predicted that XRP could see as much as a 330% upside during the 2026 cycle, with projections placing the token near $8 if bullish market conditions align.

However, downside risks remain. If XRP’s RSI drops below the critical 43 level and the asset enters a confirmed bearish phase, the token could slide toward multi-month lows as selling pressure intensifies and market confidence weakens. Currently, XRP trades around $1.57 and ranks 5th in the crypto market.