On-chain analytics platform Lookonchain has drawn market attention to a fresh Ethereum accumulation reportedly linked to BitMine, a crypto mining firm associated with Fundstrat’s Tom Lee.

Transaction Details

According to Lookonchain, BitMine appears to have purchased an additional 30,075 ETH, worth approximately $88.73 million, signaling continued confidence in Ethereum at current price levels.

The accompanying data shows that the transfer originated from FalconX’s hot wallet, a well-known institutional crypto brokerage, to a newly created address believed to be connected to BitMine. Given the size and structure of the transaction, the transfer strongly points to an over-the-counter (OTC) acquisition, a strategy BitMine often uses for its Ethereum accumulation.

Notably, the transaction history reveals that BitMine first sent a small transfer 0.000343 ETH to the same destination address several hours earlier before moving the bulk 30,075 ETH.

Ongoing Accumulation Pattern

Meanwhile, BitMine has continued to source ETH from multiple centralized trading platforms. Just a day earlier, two newly created wallets linked to the firm reportedly received nearly $140 million worth of ETH from FalconX, further reinforcing the accumulation narrative.

TOM LEE JUST BOUGHT ANOTHER $140M ETH

Two fresh wallets just received $140.58M ETH from FalconX. Their acquisition behaviour matches Bitmine’s prior purchase patterns.

Tom Lee continues to buy the dip. pic.twitter.com/arIWirWP63

— Arkham (@arkham) December 17, 2025

In addition, CoinRemark has documented a series of Ethereum purchases by BitMine. Earlier this month, the firm acquired $150 million in ETH, even as the value of its Ethereum holdings had fallen by 81% at the time. It also accumulated approximately 96,798 ETH on December 1, highlighting a consistent buying strategy despite market volatility.

Strategic Timing and Supply Ambitions

The timing of BitMine’s latest purchase is particularly notable. Ethereum continues to face broader market pressure alongside other major digital assets. Despite this, large institutional buyers appear willing to absorb supply during periods of weakness, signaling long-term conviction.

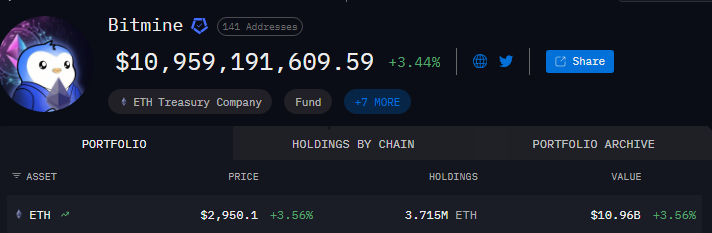

Although some of BitMine’s ETH holdings remain spread across unlabeled wallets, the firm’s official portfolio currently holds 3.715 million ETH, valued at $10.96 billion.

BitMine has previously indicated ambitions to acquire up to 5% of Ethereum’s total supply. Currently, its reported holdings represent approximately 3.07% of Ethereum’s circulating supply, underscoring its growing influence in the ETH market.