As Bitcoin matures from a speculative experiment into a globally watched financial asset, attention is already shifting to what lies ahead. With 2024’s halving behind the market and institutional participation steadily growing, analysts are debating where Bitcoin could trade in 2026. While predictions vary widely, several clear themes are shaping expectations for both upside potential and downside risks.

Market Experts Split On Bitcoin Price Prediction For 2026

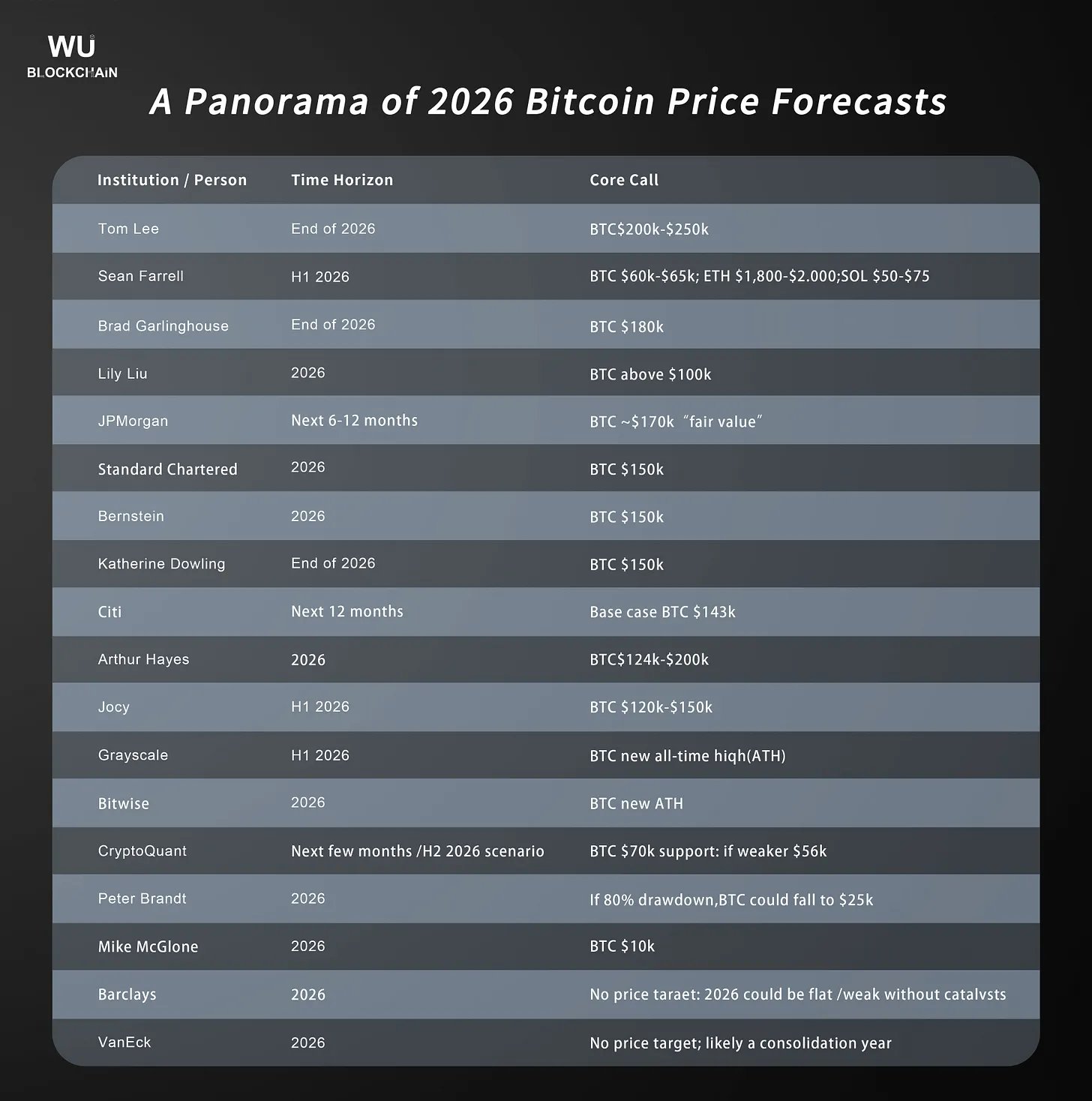

A recent report by Wu Blockchain has revealed the projected outlook for Bitcoin in 2026, with just a few days remaining in 2025. Wu Blockchain noted that institutions and industry stakeholders are this time leaning into scenario analysis and not firm targets for BTC.

This is because most entities’ BTC 2025 trajectory turned out to be a collective miss, as it deviated significantly from the intended path. An example was BitMex boss Arthur Hayes, who had predicted in November that Bitcoin would surge to $200,000 by year’s end. In the meantime, Bitcoin currently trades below its peak of $126,198

However, for 2026, most market experts and institutions are bullish, with only a few calling for a further dip in value.

Bullish Projections and Potential Catalysts

One of the biggest wildcards for Bitcoin’s 2026 outlook is institutional adoption. The approval and expansion of spot Bitcoin ETFs have already reshaped market structure, making BTC more accessible to traditional investors.

By 2026, deeper integration into pension funds, asset managers, and corporate treasuries could provide a stronger price floor than in previous cycles. Thus, Bitmine’s Tom Lee has speculated that BTC could see an upside of around $200,000 to $250,000 by the end of 2026.

Like Lee, Ripple CEO Brad Garlinghouse also expects Bitcoin to spike next year, potentially reaching $180,000. Meanwhile, JPMorgan analysts are also bullish on Bitcoin for next year; however, unlike Lee, they speculate BTC could reach a fair value of about $170,000 based on the BTC-Gold relative valuation theory.

Interestingly, macroeconomic conditions will also play a decisive role. Lower interest rates, weakening fiat currencies, or renewed concerns about inflation could strengthen BTC’s appeal as a hedge.

In such a scenario, BSTR president Katherine Dowling has projected that Bitcoin could rise to $150,000 by the end of 2026. Dowling pinned her prediction on clearer crypto regulatory policies in the US and a more accommodating monetary environment, which, in turn, will lead to increased institutional interest from Wall Street.

Bear Targets

While bullish projections dominate the Bitcoin forecast headlines, some market experts are leaning toward a bearish outlook for 2026.

One such market expert is Sean Farrell, Head of Digital Asset Strategy at Fundstrat Global Advisors. According to Farrell, there will be a significant pullback in the crypto market by early 2026, which will push Bitcoin to the $60,000-$65,000 range.

However, veteran trader Peter Brandt made a steeper projection speculating that Bitcoin could see a massive 85% dip to $25,000 due to a break in its parabolic market structure.

Finally, Bloomberg Intelligence Senior Commodity Strategist Mike McGlone issued a more extreme bearish projection speculating a crash to $10,000 by 2026. According to CoinMarketCap, BTC currently trades around the $87,000 region, representing a 0.8% dip in the past 24 hours and a decline of more than 30% from its all-time high.