Renowned crypto trader Qwatio has again lost millions betting against XRP. This time, a report from Lookonchain shows he lost a staggering $3.6 million in a partial liquidation event on Tuesday, adding to his earlier incurred portfolio drawdown.

Qwatio See Another XRP Short Setback

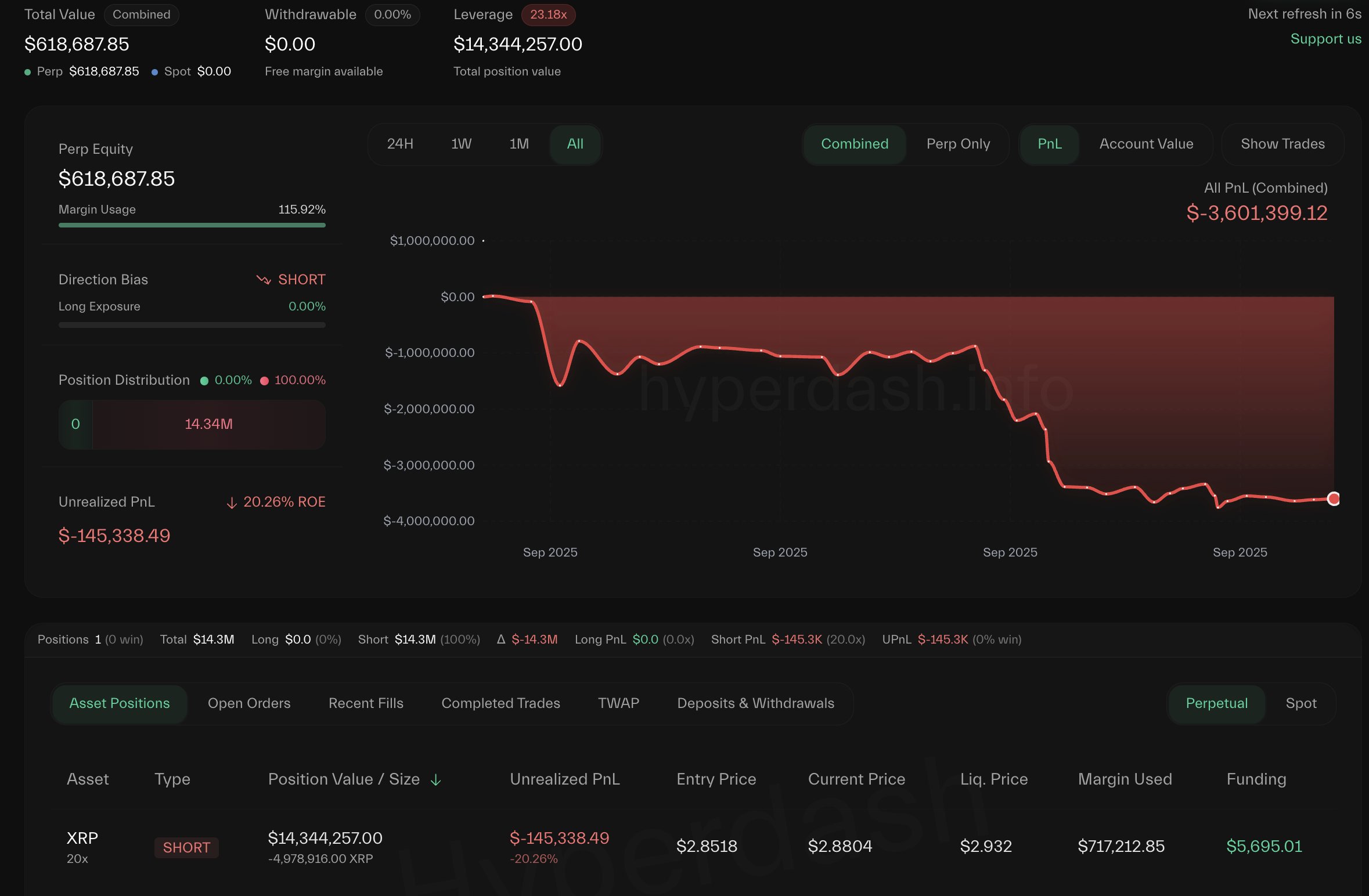

Qwatio originally opened a 20× leveraged short position worth 6.17 million XRP ($17.6 million) at an entry price of $2.8519. The position has a liquidation price set at $2.91, a price XRP fell from last week amid a broader market downtrend.

The trader expected XRP to continue declining below his entry point, but market momentum shifted against him. XRP climbed modestly to $2.92—enough to trigger the partial liquidation. Meanwhile, he closed the trade at $2.9154, resulting in a realized loss of roughly $83,223.

Meanwhile, after that event, Qwatio still holds a residual position of about 4.98 million XRP, valued at around $14.34 million. The remaining trade carries a liquidation threshold of $2,932 with an unrealized loss of approximately $145,338.

Before this latest move, CoinRemark reported that Qwatio realized a loss of $3.4 million from other closed short positions in XRP and Bitcoin. With the new partial liquidation, his cumulative losses now exceed $3.6 million.

However, in a further twist, some reports now indicate that Qwatio’s entire XRP short position may have been liquidated. They noted that after depositing about $4.22 million into the HyperLiquid trading platform, only about $653,000 remained in his account following consecutive losses.

XRP Market & Liquidations

XRP’s recent price action has clearly played a pivotal role. After peaking at around $2.92, XRP pulled back to roughly $2.85, a slight decline over the past 24 hours. The XRPL native token is also down by under 1% over the past week and month, but is up over 37% since the start of the year.

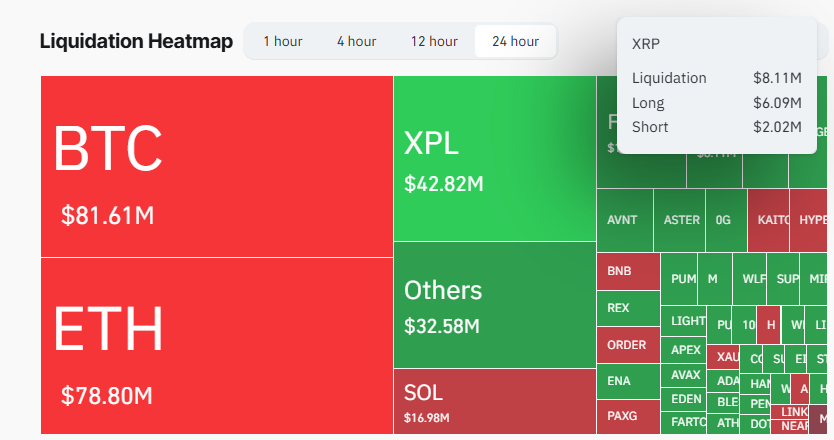

In the broader derivatives markets, XRP leveraged traders have collectively taken a hit. Over the past 24 hours, over $8.11 million worth of XRP positions were liquidated, with bulls losing $6.01 million.

More broadly across the crypto market, recent days have seen multi-hundred-million-dollar waves of leverage unwinds. One of the largest such events in recent memory resulted in $1.68 billion in total positions being liquidated in a single day.