The crypto market is facing increased volatility, marked by large liquidations and a troubling trend of long positions being wiped out. As the market navigates uncertain conditions, one trader in particular, an “OG whale,” is sitting on unrealized profits worth $35.8 million from his short positions in Ethereum (ETH) and Bitcoin (BTC).

The market’s volatility comes from heightened broader global events, with new tensions emerging in international trade. Particularly, recent tariff developments between the U.S. and China contributed to this adverse market condition, further putting downward pressure on prices.

Whale Trader’s Bitcoin and Ethereum Short Positions in Focus

The whale in question holds a short position in Ethereum (ETH), with a traded position of 91,036.7854 ETH-USD, valued at approximately $373.45 million. The wallet opened the position at $4,353.9 per ETH, but as the price of ETH declined to $4,102.2, the short trader saw a major unrealized profit amounting to $22.91 million. However, there is still a risk because the liquidation price for this position stands at $4,545.30. This means that if Ethereum’s price, currently trading at $3,970.13, surpasses this level, the trader could face liquidation.

🚨 BREAKING 🚨

OG WHALE WHO SHORTED $BTC AND $ETH IS NOW SITTING ON $35.8 MILLION IN UNREALIZED PROFIT.

THIS GUY DEFINITELY KNEW SOMETHING. pic.twitter.com/VkMKlm0QRE

— Max Crypto (@MaxCryptoxx) October 10, 2025

Similarly, this whale holds a short position in Bitcoin (BTC) with a 10x leverage on a perpetual contract valued at over $735 million. At the time of writing, the price of Bitcoin was trading at $116,583, above the trader’s entry point of $120,883.5.

Crypto Market Liquidation Data Highlights Trends

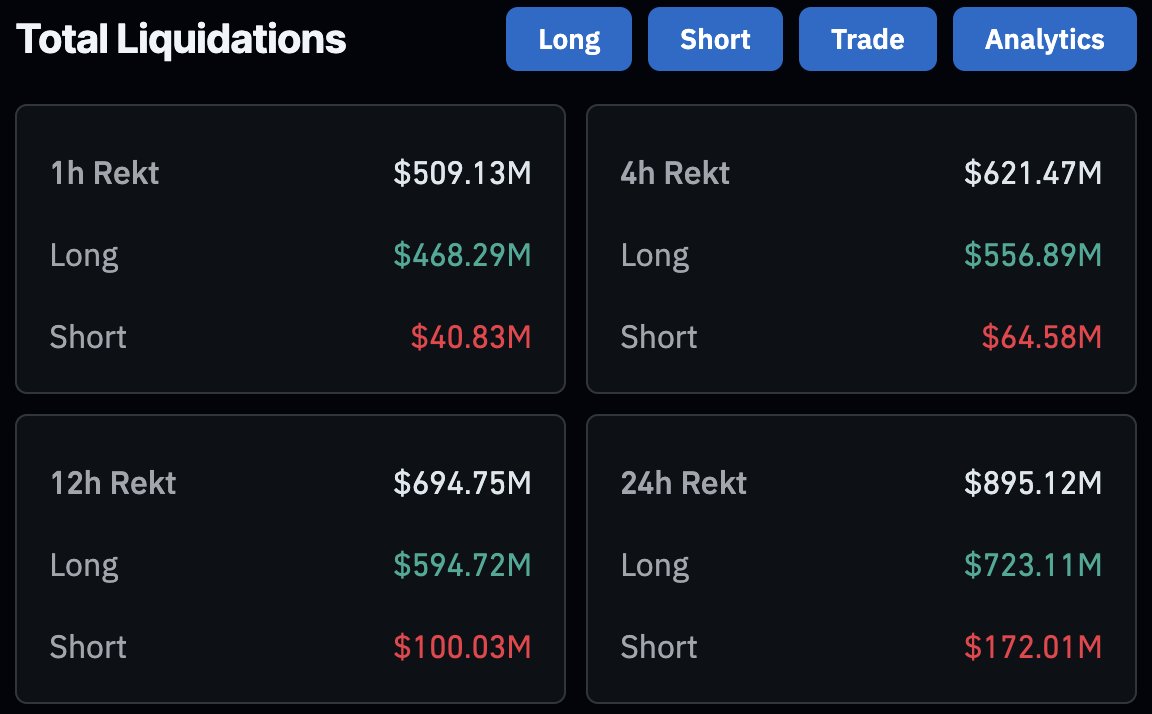

Meanwhile, the broader crypto market has experienced a rise in liquidations, with long positions accounting for the majority of the losses. In the last hour, total liquidations across the market reached $509.13 million, with long positions losing $468.29 million of the total. This trend continues across various intervals, with the last 4 hours showing $621.47 million in liquidations, the 12-hour amount standing at $694.75 million, and a total of $895.12 million in liquidations over the previous 24 hours.

The liquidation pressure affected long positions the most, indicating that market bulls are getting rekt for their positive price outlook.

Global Tariff Tensions Add to the Volatility

The recent surge in market volatility coincides with growing trade tensions between the U.S. and China. A recent directive from China, reported in a Truth Social post, has raised concerns as the country announces plans to impose export controls on a broad range of critical materials, including rare earths. The policy, which could disrupt global supply chains, has drawn immense pushback from countries around the world.

This move could further impact the markets, adding to the existing layer of uncertainty in the crypto market. While the financial world awaits a possible defensive measure, including the imposition of tariffs, these geopolitical issues are likely to continue influencing market sentiment in the short to medium term.