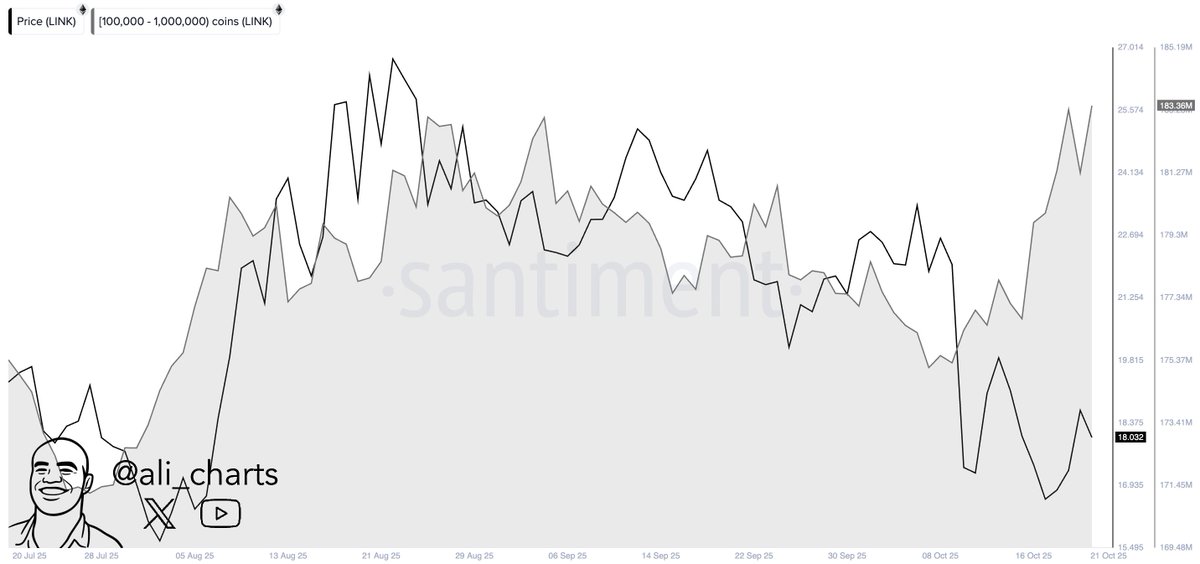

Chainlink (LINK) whales are quietly accumulating millions of tokens, signaling long-term confidence despite the asset facing short-term losses. On-chain analytics firm Santiment reported on October 23 that whales and sharks holding between 100,000 and 1 million LINK have significantly increased their holdings over the past year.

According to Santiment, in the past 12 months, the wallets have accumulated 40 million tokens, representing a 28% increase and 103 new addresses. Accumulation has remained consistent across shorter periods as well.

Over the last six months, whales have purchased 12.9 million LINK, with an additional 2.8 million tokens added in the past month alone. Santiment said this steady buildup could be “a good sign of things to come” for Chainlink, currently the 12th-largest cryptocurrency by market capitalization.

Well-known crypto analyst Ali Martinez confirmed the trend, noting that whales have added 13 million LINK in the past week alone.

Major Whale Withdrawals from Exchanges

On-chain data further reinforces this accumulation trend, with several large wallets moving their LINK holdings off exchanges. Wallet 0xf386 withdrew 62,207 LINK (about $1.07 million) from OKX on October 23, bringing its five-month total to 1.1 million LINK valued near $19 million. Another whale, 0xe8aa, withdrew 66,113 LINK ($1.14 million) from Kraken after accumulating over 307,000 LINK ($5.34 million) in the past month.

Whales keep accumulating $LINK.

Whale 0xf386 withdrew 62,207 $LINK($1.07M) from #OKX 5 hours ago — accumulating a total of 1.1M $LINK($19M) over the past 5 months.

Whale 0xe8aa withdrew 66,113 $LINK($1.14M) from #Kraken 14 hours ago — accumulating a total of 307,684… pic.twitter.com/ioQ9pAOIwA

— Lookonchain (@lookonchain) October 23, 2025

Such large withdrawals typically indicate a long-term investment strategy. By moving tokens off centralized exchanges, whales reduce immediate sell pressure.

Technical Analysis Points to Chainlink Breakout

Despite steady whale buying, LINK’s near-term performance remains muted. At press time, Chainlink is trading at $17.22, down 1.06% on the day, and extending its weekly losses to 7% and its monthly losses to 21%. Notably, the token has traded in a narrow $15.87–$19.02 range over the past week.

Meanwhile, a parallel chart shared by Martinez paints a compelling picture of Chainlink’s long-term structure. After months of consolidation within a tightening symmetrical triangle, LINK appears to be approaching a decisive breakout point.

Technically, the setup indicates that a sustained move above the $25 resistance zone could mark the start of a major bullish phase. If LINK manages to break and hold above that threshold, the next major targets lie near $36, followed by the $52–$74 range.

The long-term projection, as outlined in the chart, envisions a potential run toward $100. As Martinez noted, “The next time Chainlink breaks $25, it could ignite a bull rally to $100.”