XRP is showing signs of a possible structural shift after a significant number of tokens exited Binance in recent days. The large-scale withdrawal comes as the asset navigates a sharp year-to-date decline, fueling speculation that long-term investors may be quietly accumulating at lower levels.

Over 200 Million XRP Withdrawn from Binance

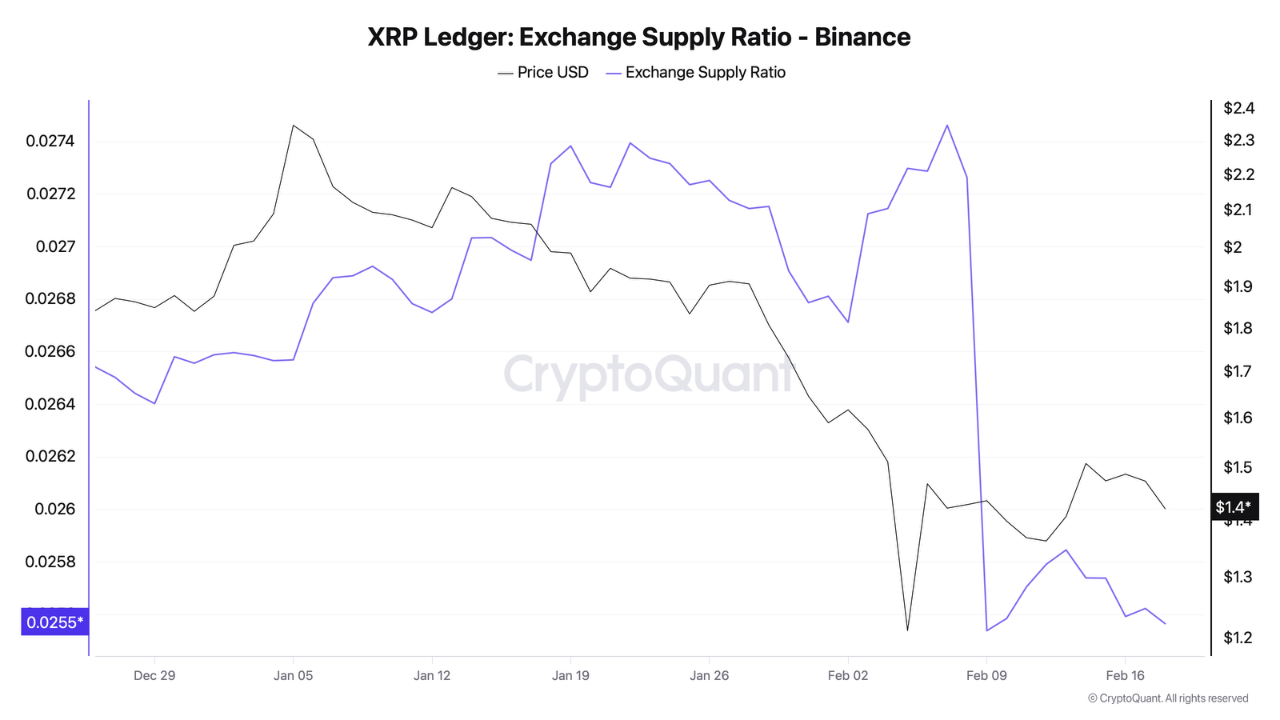

According to CryptoQuant analyst Darkfost, over the past 10 days, more than 200 million XRP tokens have been withdrawn from Binance. The analyst revealed this in a recent blog post, noting that the withdrawals led to a notable decline in XRP’s supply ratio on the exchange, dipping from 0.027 to 0.025.

Darkfost explained that a reduction in asset reserves held on trading platforms often hints at a strong accumulation trend and growing long-term conviction among investors. Typically, when funds are withdrawn from exchanges, they are transferred to private custody solutions, such as cold wallets, rather than kept in an active trading environment. This behavior reduces immediate sell-side liquidity.

In XRP’s case, the analyst suggests that the drop in its exchange supply ratio signals that some investors may view current price levels as attractive for accumulation. Interestingly, the token has undergone a 22% correction since the beginning of the year, a decline that could be strengthening the resolve of investors adopting a longer-term strategy.

XRP Funds See Inflows While Bitcoin and Ethereum Face Outflows

Beyond exchange data, institutional flow trends also appear to favor XRP. A recent report from CoinShares shows that XRP-linked investment funds recorded $33 million in inflows, even as Bitcoin and Ethereum products suffered four consecutive weeks of outflows.

The divergence suggests that institutional capital may be rotating selectively rather than exiting the crypto market entirely. While leading assets faced sustained pressure, XRP-focused products attracted fresh allocations, signaling differentiated investor sentiment.

Further supporting this trend, data from SoSoValue indicates that XRP ETFs registered a modest $4.05 million inflow as of February 19, 2026. Although relatively small compared to broader market volumes, the positive flow contrasts sharply with the sustained withdrawals seen in major Bitcoin and Ethereum funds.

Price Ticks Up 1.2% as Analyst Warns of Potential Downside

Despite the mixed signals, XRP has shown short-term resilience. According to CoinMarketCap, the asset has surged 1.2% in the last 24 hours, trading around $1.43 at the time of writing.

However, not all analysts are convinced that the recent accumulation signals guarantee an immediate recovery. Market expert Ali Martinez recently noted in a post on X that the token may be eyeing further downside following the emergence of a gravestone doji on its weekly chart, a technical pattern often associated with bearish reversals.

According to Martinez, the last time the token formed a similar weekly gravestone doji, the asset declined by 46%, falling to $1.11. While historical patterns do not always repeat, the warning underscores the fragile balance between accumulation optimism and technical caution currently surrounding XRP’s price action. As a result, investors are closely watching whether tightening exchange supply and institutional inflows can outweigh bearish technical signals in the weeks ahead.