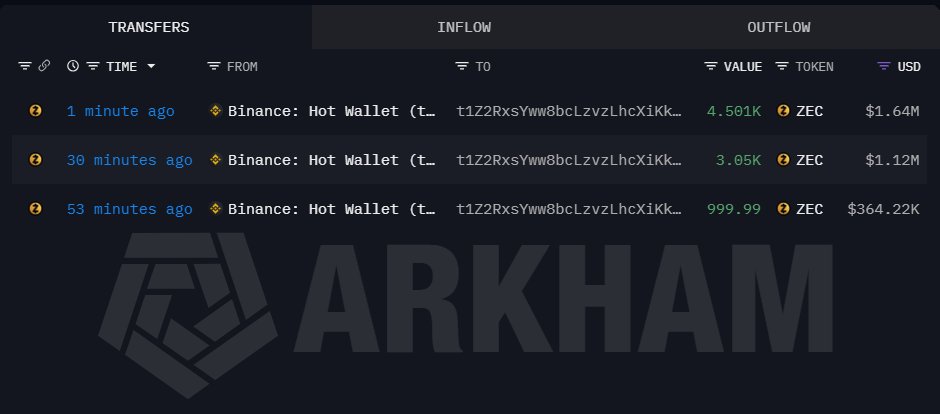

The crypto market is keeping a close eye on unusual on-chain activity involving Zcash (ZEC). Recently, a newly created wallet withdrew 8,551 ZEC from Binance, worth roughly $3.12 million. The size of the transfers, the rapid timing, and the wallet’s lack of prior transaction history immediately drew the attention of traders and analysts, who are keen to understand whether this represents strategic accumulation or a sign of potential market shifts.

What On-Chain Data Shows

On-chain data provides a clear picture of how these withdrawals unfolded. The wallet executed three separate transfers from Binance hot wallets within a very short time frame. The first move involved 4,501 ZEC, valued at approximately $1.64 million. Soon after, the wallet withdrew 3,050 ZEC, worth around $1.12 million, and finally moved 999.99 ZEC, roughly $364,220.

The rapid succession of these withdrawals suggests coordinated action rather than random retail behavior, as the timing and sizes indicate deliberate capital movement. Clustered transactions like these often reflect entities managing large sums efficiently, whether for storage, redeployment, or accumulation.

The fact that these transfers were executed from a newly created wallet makes the story even more significant. Fresh wallets making such substantial withdrawals are often linked to whales, institutional investors, or over-the-counter accumulation strategies, rather than casual retail trading.

Exchange Outflows and Zcash Supply

Moving Zcash off Binance reduces the immediate supply available on the exchange, which in turn decreases potential selling pressure. Wallets exhibiting this type of behavior tend to hold their assets long-term, rather than liquidate them immediately, highlighting a potential non-bearish signal for the market.

Removing significant amounts of Zcash from Binance also has broader implications for supply and market dynamics. The reduction of liquid tokens on the exchange can amplify volatility, particularly if demand spikes unexpectedly.

With fewer tokens readily available for trading, even moderate buy-side pressure can create sharper price movements. This is part of a growing trend in crypto where large holders prefer self-custody and strategic positioning, securing assets off exchanges to maintain control and reduce exposure to short-term market swings.

More ZEC Outflows from Binance Imminent?

Market observers suggest that this wallet could continue withdrawing ZEC in stages. The remaining balances on Binance, combined with the staged nature of this initial activity, align with historical cases in which large holders distribute withdrawals across multiple transactions rather than moving all at once. While this remains a developing story, monitoring these patterns is critical for understanding potential market impacts in the near term.

Traders and analysts are watching several key indicators over the coming days. Subsequent withdrawals from the same wallet, changes in Zcash exchange balances, and price reactions alongside trading volume will provide insight into whether this event is part of a broader accumulation trend or a one-off occurrence. While the motives behind the wallet’s activity are not confirmed, the combination of large, staged withdrawals from a brand-new wallet is a strong on-chain signal worth monitoring.